China’s property market could take as long as a year to recover, according to a former central bank adviser, who’s urging Beijing to do more to encourage lending to developers to halt the spread of defaults.

Sales in China’s largest cities could return to growth in the next four to six months, but in smaller cities “it will take anything to between six months to one year for a good recovery,” Li Daokui, a former member of the People’s Bank of China monetary policy committee, said in an interview.

Home sales are the main source of income for property developers and the collapse in the market over the past two years has pushed real estate giants like Country Garden Holdings Co. close to default, triggering market panic, and left housing projects unfinished. Bank lending to the sector has also plummeted.

Li proposed Beijing create a mechanism to increase bank lending to property developers in order to reduce financial contagion risks. About 100 billion yuan ($13.7 billion) will be needed to cushion developers through the current downturn, he estimated.

A well-known academic and commentator on China’s economy, Li was an adviser at the PBOC from 2010 to 2012. He’s currently director of the Academic Center for Chinese Economic Practice and Thinking at Tsinghua University in Beijing.

Banks have been curbing lending to the real estate sector given rising financial distress in recent years. Following a brief resurgence at the start of the year, loans for property development have fallen every month since April, registering a 25% on-year decline in August, according to Bloomberg calculations based on data from China’s statistics bureau.

“Some developers are overweight in third and fourth tier cities, so their financial situation won’t be able to improve in the coming six months,” Li said. “In the meantime, increased lending by commercial banks is still extremely important in order to prevent any propagation of liquidity problems. Some policy has to be in place to stop the shrinking of bank lending.”

One possible mechanism is for the central bank, or China’s recently-established National Financial Regulatory Administration, which oversees banks, to form a committee with the nation’s six largest commercial banks and agree to make loans jointly.

“When sales recover the lending of commercial banks will be recovered. We’re talking about liquidity support,” Li said. “I’m not saying all developers should survive. What I’m calling for is to stop the panic in financial markets and stop defaults due to slowing sales.”

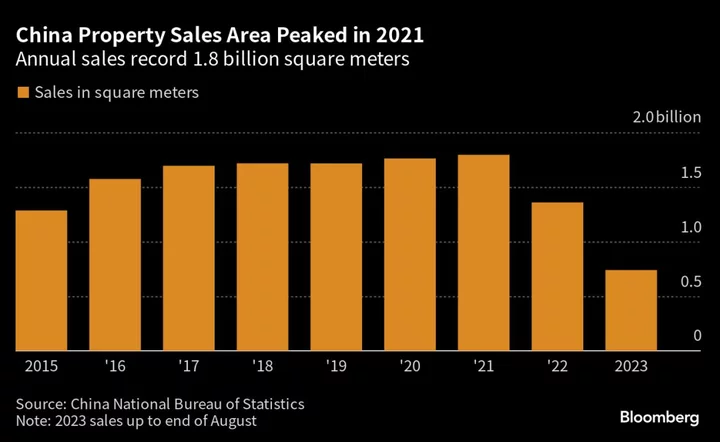

In the longer-term, China’s property sales could stabilize at 1.1-1.2 billion square meters annually compared to a peak of about 1.8 billion square meters in 2021, Li said. Since that is faster than the pace of sales this year, there is room for the market to grow, he added.

“The property market will come back as an important driver for the economy, however the magnitude of the impact of property as a growth engine will be much smaller,” Li said.

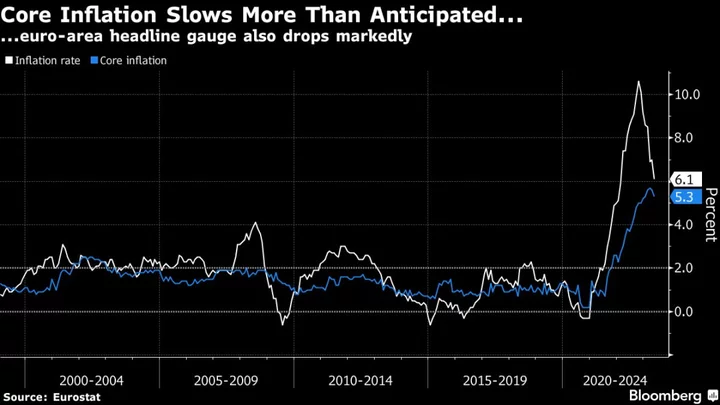

Li said it was possible the PBOC will cut interest rates once more before the end of the year, but he doesn’t expect “numerous or major cuts,” partly because banks profit margins are relatively low.

Policies to boost demand for consumer goods and housing are more effective ways to support the economy than interest rate cuts, he said, because “the major problem of China’s macro-economy and financial system is that demand for loans is not as it used to be.”

Li said he expects more detailed plans for the resolution of local government debt to be released soon. Combined with measures to support the property sector, those policies would be “much more important than cutting the interest rate,” he said.