Chancellor of the Exchequer Jeremy Hunt defended his package of tax cuts, amid warnings of a looming post-election spending squeeze on public services and as evidence emerged of stronger inflation and signs of strength in the economy that may worry the Bank of England.

Facing criticism from members of the Conservative Party about a tax burden heading for a postwar high — squeezing households ahead of a UK vote expected in 2024 — Hunt said he wants to cut more taxes in future. He announced a two-percentage-point reduction in national insurance, a payroll tax, on Wednesday.

Read more: Hunt Rolls Out Tax Cuts in Bid to Jam Labour Before UK Vote

During the government’s morning broadcast round on Thursday, Hunt acknowledged the reduction wouldn’t come close to offsetting the additional tax paid by households as a result of fiscal drag and higher levies imposed since 2019. The Resolution Foundation think tank said households are forecast to be £1,900 ($2,380) poorer on average over the current Parliament term — the first drop in living standards between two general elections on record.

“It’s a step toward bringing down taxes for families who’ve seen their taxes go up,” Hunt said on LBC Radio. He said he’d prioritized tax cuts that would boost the economy, including making permanent the “full expensing” policy that gives firms 100% tax relief on capital spending.

The government’s shift toward tax cuts as it prepares for an election is coming at the same time as the BOE makes fresh warning sounds about inflationary risks, with BOE officials saying earlier this week they’re still worried about a resurgence in rising prices. Any signs of tension between the direction of UK fiscal and monetary policy may increase a focus on the BOE and whether they’ll have to keep interest rates higher for longer.

The scrutiny on the BOE comes as British companies reported an unexpected increase in output in November, with S&P Global’s purchasing managers’ index edging up to 50.1, the highest reading in four months and above the threshold level of 50 dividing growth and contraction.

Read more: Hunt Tax Cuts to Squeeze UK Public Services Beyond Election

The Office for Budget Responsibility, the UK’s fiscal watchdog, said Wednesday it expects inflation to linger longer than it did in March and that measures set out by Hunt will boost demand more than the supply capacity of the economy. Together, those factors may support the BOE’s case that interest rates will need to remain elevated for some time.

The pound extended gains after the PMI release, jumping as much as 0.6% to $1.2564, the highest since Sept. 6.

The prospect of higher interest rates is partly why the OBR downgraded Britain’s growth forecasts for the coming years, a difficult backdrop for Prime Minister Rishi Sunak as attention shifts toward the election.

Read more: Hunt Doesn’t Rule Out Early Budget, Fueling Talk on May Election

The fact that Hunt didn’t rule out an earlier-than-usual Budget in February, as well as the fast-tracking of the national insurance cut to take effect in January, have fueled speculation about a potential May election.

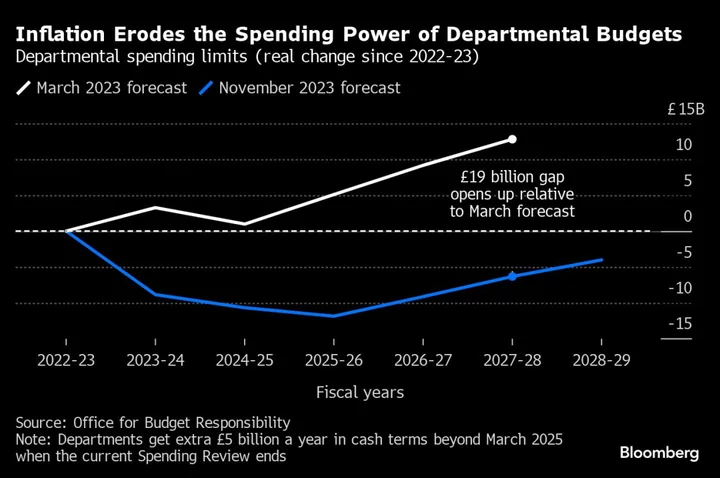

A key feature of Hunt’s current tax-and-spend plan is that it puts a future squeeze on public spending, even as Britain’s public services including the courts and swathes of infrastructure remain underfunded and crumbling.

Hunt defended his decision to use £21 billion to fund his tax cuts rather than divert the money to future spending on public services. He said prioritizing growth would then generate the revenues in future for public services.

“We’re going to show discipline in public spending,” Hunt said. “It’s not going to rise in real-terms as much as people would like.”

Paul Johnson, director of the Institute for Fiscal Studies, warned that the government’s tax cuts may not be sustainable because they are paid for by “questionable, if not plain implausible” spending cuts to public services and government investment.

He said the government wants “to wrestle the size of the state back down toward where it was in 2019” despite rising welfare and debt interest costs.

Health, defense and education have separate settlements but unprotected English departments like Justice, where the prisons are overflowing, face cuts of 3.4% a year through to 2028 – effectively a £20 billion real-terms fall in spending. Johnson compared those cuts to the early 2010s austerity years under former Chancellor of the Exchequer George Osborne.

“That was painful,” Johnson said. “Doing it again will be more painful still. Mr. Osborne made his cuts after a decade of big spending increases. Mr Hunt, or his successor, will have no such luxury.”

The effect of Hunt’s decision is to put a future government in a bind on public spending. That is likely to be a Labour administration, if polls predicting a landslide at the general election prove correct.

But Hunt’s intervention was designed also to breathe some life into the aisling Tories, to build a political narrative around tax cutting that the governing party will use to draw what it sees as a dividing line with Labour.

Still, there is one fact that Hunt acknowledged the Tories won’t reverse ahead of an election: the decline in living standards.

“It’s a disaster for households whose wages are stuck in a totally unprecedented 20-year stagnation,” said Torsten Bell, chief executive of the Resolution Foundation. “Tax-cutting rhetoric clashed with tax rising reality, and positive steps to encourage business investment combined with a growth sapping hit to public investment.”

--With assistance from Aline Oyamada, Philip Aldrick and Ellen Milligan.

Author: Lucy White, Joe Mayes and Tom Rees