Russia temporarily banned exports of diesel in a bid to stabilize domestic supplies, driving prices higher in already tight global fuel markets.

So far this year, Russia was the world’s single biggest seaborne exporter of diesel-type fuel, narrowly ahead of the US, according to Vortexa data, compiled by Bloomberg. The country shipped more than 1 million barrels a day during January to mid-September, with Turkey, Brazil and Saudi Arabia being among the main destinations.

The ban, which also applies to gasoline, comes into force on Sept. 21, and doesn’t have the final date, according to the government decree.

Diesel prices in Europe jumped on concern the measure will aggravate global shortages. The world’s oil refiners are struggling to produce enough of the fuel amid curbed crude supplies from Russia and Saudi Arabia, the biggest producers within the Organization of Petroleum Exporting Countries and its allies.

“Despite this being only a temporary ban, the impact is significant as Russia remains a key diesel exporter to global markets,” said Alan Gelder, vice president of refining, chemicals and oil markets at consultancy Wood Mackenzie Ltd. “The global refining system will struggle to replace those lost Russian volumes at a time when global diesel inventories are already at low levels.”

Surging Prices

In northwest Europe, the premium of benchmark diesel futures to crude oil — known as the ICE Gasoil crack — climbed sharply, topping $36 a barrel, according to fair value data compiled by Bloomberg.

Diesel futures for delivery in October also grew more expensive relative to barrels for arrival the following month. The bullish structure, known as backwardation, surpassed $35 per ton.

“Temporary restrictions will help saturate the fuel market, that in turn will reduce prices for consumers” in Russia, the government’s press office said on its website.

Exemptions are made for minor supplies, including deliveries to trade alliance partners from some former Soviet republics, as well as intergovernmental agreements, humanitarian aid and transit, the decree said.

The ban includes all types of diesel, including summer, winter and Arctic blends, as well as heavy distillates including gasoils, according to the decree

Last year, Russia’s seaborne exports of diesel-type fuel were about 0.95 million barrels a day, according to Vortexa data compiled by Bloomberg. That was about 3.4% of total global demand.

“This is a super big deal. We’re talking exports of close to 1 million barrels a day being shut in,” said Eugene Lindell, head of refined products at consultancy FGE. However, Russia won’t be able to keep up a diesel export ban for long, because they’ll soon run out of tank space, he added.

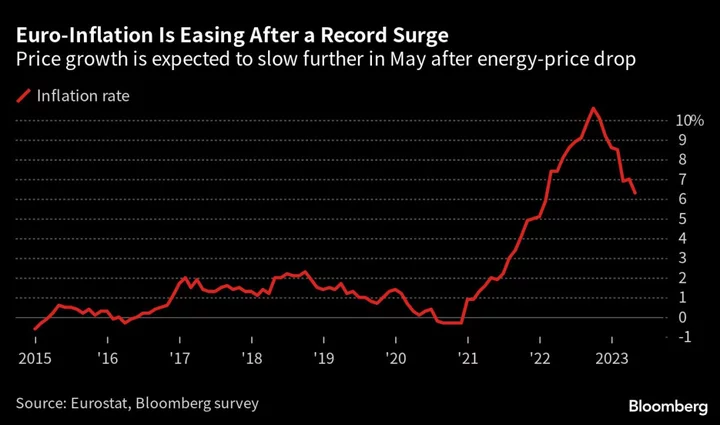

Inflation Battle

Russia’s government has spent weeks in talks with oil producers to decide on measures to rein in rising fuel prices. President Vladimir Putin said last week that officials and companies had agreed on how to act in the future, but the wrangling continued, people familiar with the matter said.

Surging car-fuel prices have been one the biggest contributors to inflation, a potential political headache as the Kremlin prepares for the presidential election in March. Retail gasoline and diesel prices in Russia have climbed 9.4% from the start of the year to Sept. 18 compared with an increase in overall consumer prices of 4%, according to the most recent Federal Statistics Service data.

Political sensitivity to fuel price growth and the impact on farmers spilled into the open earlier this week, when the speaker of the lower house of parliament, Vyacheslav Volodin, a key Putin ally, criticized the Energy Ministry for failing to prevent the jump in domestic fuel prices. The government considered “quite serious measures,” First Deputy Energy Minister Pavel Sorokin told lawmakers who peppered him with questions.

(Updates with Russian diesel exports starting in second paragraph and analyst comment in fifth)