The US was threatened with the loss of its last top credit rating on Friday, as Moody’s Investors Service signaled it was inclined to downgrade the nation because of wider budget deficits and political polarization.

The rating assessor lowered the outlook from stable while affirming the nation’s rating at Aaa, the highest investment-grade notch. Amid higher interest rates, without measures to reduce spending or boost revenue, fiscal deficits will likely “remain very large, significantly weakening debt affordability,” Moody’s said.

“Downside risks to the US’ fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths,” William Foster, a senior credit officer at Moody’s, said in a statement.

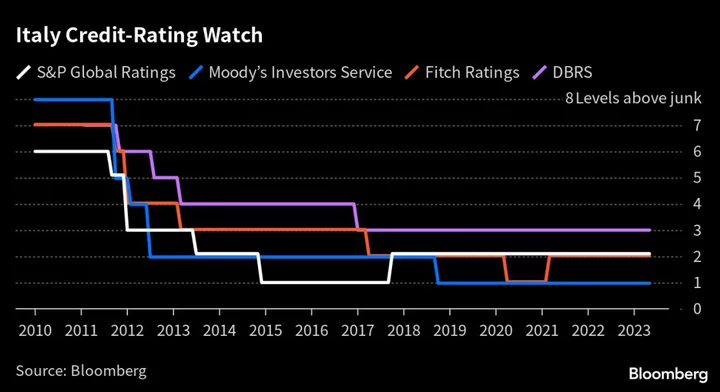

Moody’s is the only of the three main credit companies with a top rating on the US after Fitch Ratings downgraded the US government in August following the latest debt-ceiling battle. S&P Global Ratings stripped the US of its top score in 2011 amid that year’s debt-limit crisis.

Since Fitch’s move, Congress was paralyzed by the ouster of the House speaker and weeks spent by Republicans trying to elect a new one. Also, a government shutdown was averted at the last minute and the possibility of another closure is one week away.

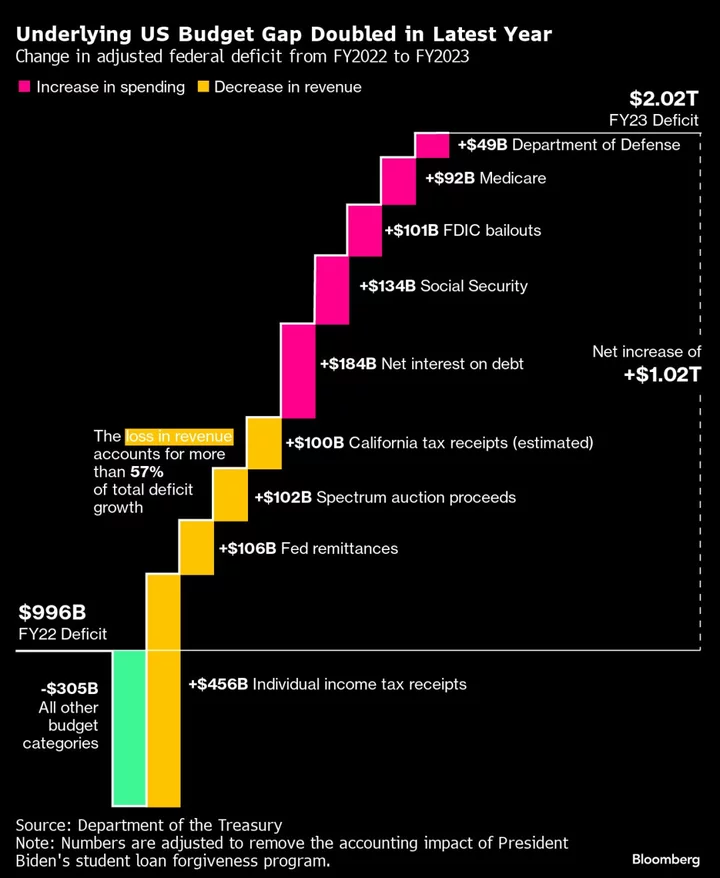

Meanwhile, long-term Treasury yields have jumped to the highest levels in 16 years, which some analysts blamed partly on concern over increasing debt. Data showed the deficit effectively doubled to $2 trillion in the latest fiscal year.

“It is less the aggregate rating and more the constant reminder to markets that fiscal risk is rising,” said Ed Al-Hussainy, a global rates strategist at Columbia Threadneedle Investments.

The Moody’s move also puts the US in an awkward situation as it prepares to host a massive gathering of Pacific Rim leaders, ministers and chief executives in San Francisco, where President Joe Biden and Chinese President Xi Jinping will meet on the sidelines in their first face-to-face contact in a year.

“It’s more embarrassing” than meaningful, said Marc Chandler, chief market strategist at Bannockburn Global. “Moody’s was the odd man out. It’s more about psychology, embarrassing, playing catch-up to the others,” he said, referring to S&P and Fitch.

White House Press Secretary Karine Jean-Pierre said the outlook change was a “consequence of congressional Republican extremism and dysfunction.” Deputy Treasury Secretary Wally Adeyemo, meanwhile, pushed back against the outlook change, saying the economy “remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.”

Ten-year Treasury note futures dropped after the announcement, reaching fresh session lows. The yield on US 10-year Treasuries, meanwhile, extended back through 4.65% and ended matching the session’s earlier highs.

The government’s credit plans have been in further focus after the Treasury last week announced that it would borrow $112 billion in its quarterly refunding — slightly less than anticipated.

The US also faces a government shutdown on Nov. 18 if Congress doesn’t come to an agreement to pass short-term spending bills.

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” according to Moody’s.

--With assistance from Edward Bolingbroke.