The Philippine central bank halted its most aggressive monetary tightening in two decades in a move it calls a “prudent pause” and signaled that the rate will likely be unchanged through the third quarter as growth slows and inflation cools.

The Bangko Sentral ng Pilipinas kept its overnight reverse repurchase rate at 6.25% on Thursday, as seen by 17 of 24 economists in a Bloomberg survey. The rest expected a quarter-point hike.

“A prudent pause also allows monetary authorities to further assess how macroeconomic and financial conditions will evolve in view of tighter global financial conditions,” Governor Felipe Medalla said at a briefing in Manila. “The BSP stands ready to resume monetary tightening as necessitated by emerging data.” Medalla said that a hold was the most likely scenario in the next two to three meetings.

For now, the BSP joins peers in Singapore, Indonesia and India in keeping policy settings unchanged, after domestic inflation cooled for a third month in April and economic growth softened in the first quarter. The central bank’s pause comes after 425 basis points of rate increases in the past year, which lifted the benchmark rate to a 16-year high.

“The pause underlines the notion that policy rates – across several markets - have been hiked to a point that require assessment of the lagging impact of past tightening, before the next decision is made,” said Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp in Singapore.

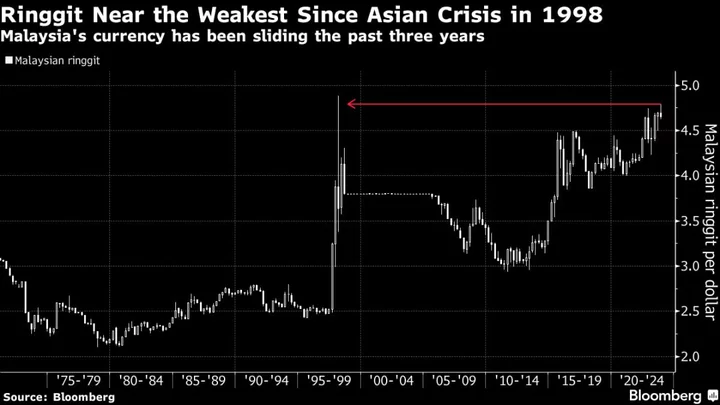

The peso extended gains on Thursday after the decision and closed 0.6% higher to 55.87 against the dollar. Medalla “sounded rather hawkish” which provided support for the local currency, according to Alan Lau, a strategist at Malayan Banking Bhd.

The rate-hike breather also follows a caution from National Economic and Development Authority Secretary Arsenio Balisacan last week that more interest-rate increases may dampen future economic growth. The Philippine economy is expected to expand between 6% and 7% this year.

What Bloomberg Economics Says

The BSP “delivered a hawkish hold, indicating it remains ready to resume tightening if necessary. We don’t think it will be needed. The remaining upside to BSP’s price outlook will dissipate over the remainder of the year as demand-pull pressures from reopening fade.”

—Tamara Mast Henderson, Asean economist

For the full note, click here

“Demand indicators have also pointed to a potential moderation in the recent months,” the central bank said in a statement, referring to economic growth. It said that suggests “that previous policy rate increases by the BSP continue to work their way through the economy.”

Moreover, the BSP’s monetary board decision was supported by the recent mounting of what it called “whole-of-government actions” to ease constraints on food supply. That prompted the central bank to cut its 2023 inflation forecast to 5.5% year-on-year from 6% previously.

The government in recent months has moved to boost food imports, including sugar and onion.

--With assistance from Ditas Lopez, Tomoko Sato, Cecilia Yap, Chester Yung and Karl Lester M. Yap.

(Updates with details throughout.)

Author: Andreo Calonzo and Manolo Serapio Jr.