US households tapped their credit cards more in the third quarter, when strong spending helped to power blockbuster economic growth. But Millennials and people with student debt and auto loans are falling further behind on payments.

Household debt increased by $228 billion last quarter, bringing the total to $17.3 trillion, the Federal Reserve Bank of New York said in a report on Tuesday. That included a $48 billion rise in credit-card balances to $1.08 trillion, marking the eighth straight quarter of year-over-year increases, the report found.

Credit-card balances are now $154 billion higher than they were a year ago, the largest annual increase since the New York Fed began tracking the data in 1999, researchers said in a blog post.

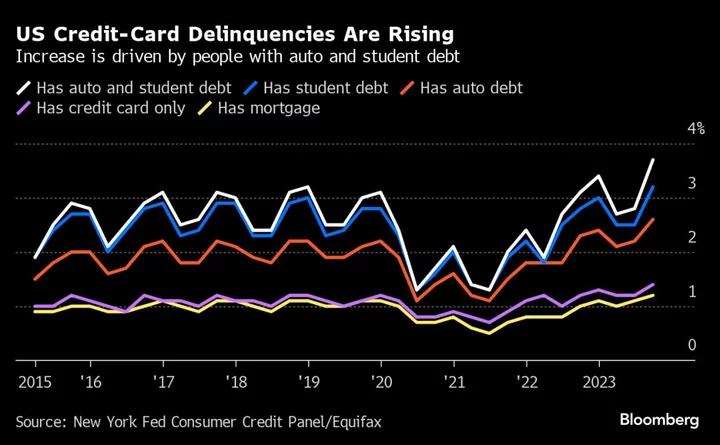

“The increase in balances is consistent with strong nominal spending and real GDP growth over the same time frame,” they said in the post. “But credit card delinquencies continue to rise from their historical lows seen during the pandemic and have now surpassed pre-pandemic levels.”

The percentage of debt balances becoming delinquent dropped to historic lows in 2021 as consumers benefited from pandemic aid and forbearance programs that paused payments on student loans and other debt, the researchers said.

But the share of debt becoming newly delinquent is now rising for most types of debt, the report showed. The main exception is student-loan payments, which only returned last month for federal borrowers.

Whether consumers can keep up with their debt payments and continue spending in the face of higher rates, growing obligations and shrinking savings, is something policymakers and economists are watching closely as they evaluate the strength of the economy.

Read More: Fed to Weigh How Much Fuel Consumers Have Left After Rate Hikes

Delinquency transitions are stabilizing for most auto-loan borrowers, but the rate of credit-card debt becoming newly delinquent rose in the third quarter. The increases were largest for Millennial borrowers, or those born between 1980 and 1994, as well as people who also have auto loans and student debt, the researchers found.

Despite the higher delinquency transition rates, overall delinquency levels are still near or below pre-pandemic levels for most types of debt, the report showed.

--With assistance from Alex Tanzi.