A less-distorted bond market, continued weakness in wages and the threat of an early election are among the reasons the Bank of Japan is expected to keep policy unchanged at this week’s gathering.

Governor Kazuo Ueda has also repeatedly signaled his intention to take time before making any major changes to the central bank’s stimulus.

Bloomberg reported Friday that BOJ officials see little need to change the central bank’s control of yields at the meeting due to improved functioning of the Japanese government bond market, according to people familiar with the matter.

That’s left both market players and economists largely in agreement that the BOJ won’t move in June, though views start to diverge on the trajectory for policy after that. A third of economy watchers polled by Bloomberg see the BOJ moving next month.

“The central bank probably wants to delay any policy change to later this year or even longer, given that there’s no urgency at all in the market, unlike a while ago,” said Jun Kato, chief market analyst at Shinkin Asset Management Co. in Tokyo.

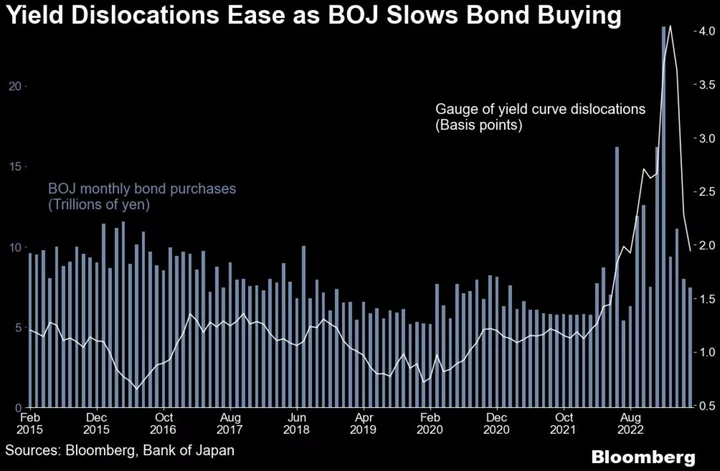

A BOJ survey of banks and investors showed this month that JGB market functioning has improved since hitting a record low in February. A kink in the yield curve and a lack of liquidity were key factors behind the BOJ’s shock decision in December to raise its cap on benchmark yields, a move that triggered a wave of speculation that more change was in the pipeline.

But yields on Japan’s 10-year government debt have stayed below the 0.5% ceiling since March and the BOJ was able to scale back its debt purchases to ¥7.4 trillion ($53.1 billion) last month from a record ¥23.7 trillion in January.

A Bloomberg gauge of the gap in actual yields compared with their estimated values, a measure of market liquidity, has fallen close to its lowest since August. That suggests liquidity is ample enough to limit any market dislocations and takes pressure off the BOJ to act.

Speculation continues to smolder that Prime Minister Fumio Kishida will call an early election to capitalize on a bump in public support following the hosting of Group of Seven leaders and Ukraine President Volodymyr Zelenskiy in Hiroshima last month.

As Kishida’s pick to helm the BOJ, Ueda may be reluctant to consider any tweaks to policy that could disrupt markets and reflect badly on the premier while there is election talk in the air. Still, 40% of polled economists said a snap poll wouldn’t get in the way of policy adjustment.

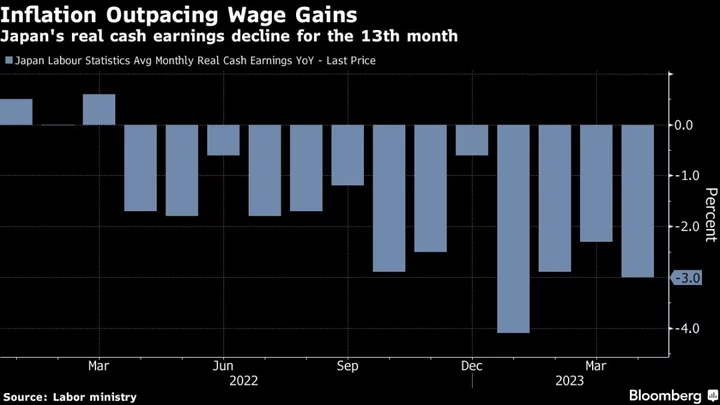

On the economic front, while inflation remains well above 3%, growth in Japanese pay packets continues to lack the strength needed to stop household spending power falling in real terms.

The latest figures released last week showed cash earnings rising just 1% from a year earlier. That trend suggests the BOJ is still some distance from achieving its goal of sustainable wage-driven inflation.

Ueda has warned that moving too quickly presents a greater risk to the chances of securing stable inflation than being behind the curve. He voted against a tightening move that proved premature back in 2000 when he was a BOJ board member during the first years of Japan’s deflationary malaise.

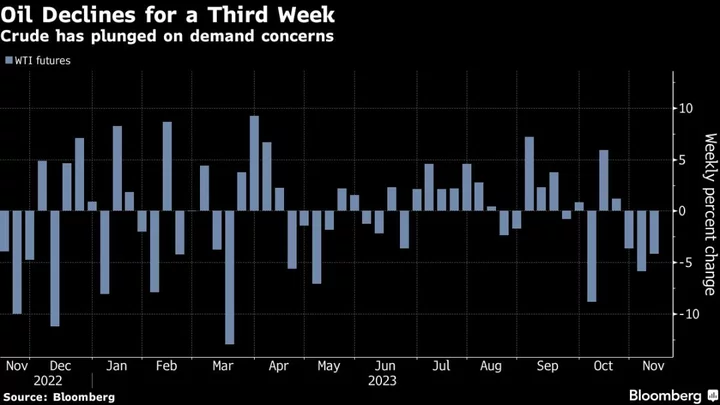

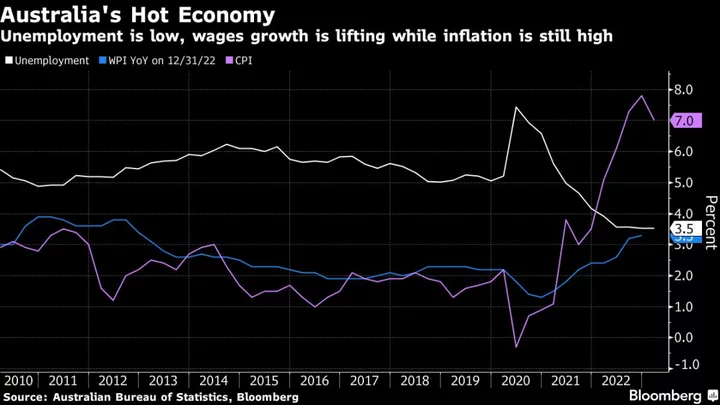

The governor can probably afford to wait in the short-term as pressure on global peers for tighter policy remains data dependent. The unexpected rate hikes by the central banks of Australia and Canada last week show that the tightening cycle isn’t done yet.

Overnight-indexed swaps price in just one and two more rate hikes by the Federal Reserve and European Central Bank respectively for the rest of this year. A surprise hike by the Fed this week would likely nudge the yen down sharply against the dollar, but wouldn’t be enough to move the needle for Ueda on policy yet.

Japan’s futures market shows little sign of a buildup in short-sellers betting on an imminent shift.

“Looking at wages, inflation and other data, it’s unlikely the Bank of Japan will tweak or remove yield-curve control anytime soon,” Shinkin’s Kato said.

Still, not everyone agrees that a hike this summer is out of the question. Among the factors that might nudge Ueda to move sooner outside a resurgence of market pressure would be inflation figures that keep outpacing forecasts.

Economists already see the central bank raising its inflation projections in July given the ongoing strength in prices. That may provide the governor with evidence to justify an initial policy tweak next month before more significant changes later on.

They see an adjustment or an abandonment of yield control as the most likely move if Ueda opts for early action this summer.

“It’s a widely held view that YCC tweaks will be executed without warning,” said Hirofumi Suzuki, chief FX strategist at Sumitomo Mitsui Banking Corp., who says it’s still even possible the BOJ might raise its yield cap again this month. “The BOJ emphasizes it will carefully adjust policy when needed, so it’s not ruling out that possibility altogether.”

Here are the key Asian economic data due this week:

- Monday, June 12: India CPI and industrial production, Japan PPI, New Zealand retail card spending

- Tuesday. June 13: Australia household spending, consumer and business confidence, Japan 2Q BSI large manufacturing

- Wednesday, June 14: New Zealand 1Q BoP current account balance

- Thursday, June 15: Australia employment and consumer inflation expectations, New Zealand 1Q GDP, China 1-yr MTLF, industrial production, retail sales and fixed assets ex-rural, Japan trade balance and core machine orders, Taiwan central bank policy decision, Indonesia trade balance, India trade balance

- Friday, June 16: BOJ policy decision, New Zealand manufacturing PMI, Singapore NODX

--With assistance from David Finnerty.

(Updates with calendar)

Author: Masaki Kondo, Toru Fujioka and Yumi Teso