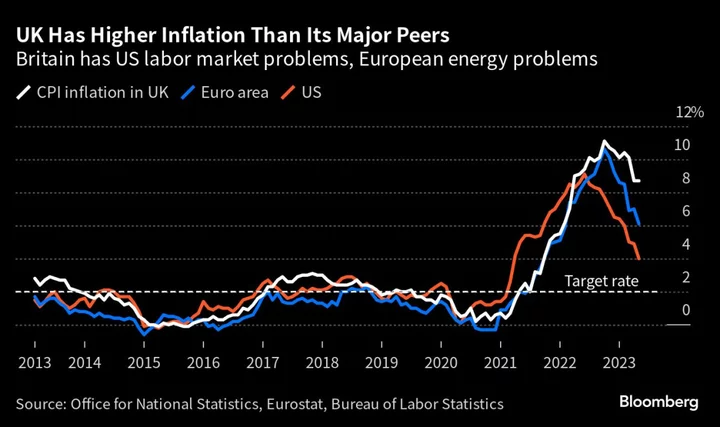

After watching British prices surge faster than expected for four straight months, Prime Minister Rishi Sunak’s team isn’t getting its hopes up about a change in fortunes next week.

Economists surveyed by Bloomberg predict the country’s year-on-year rate of inflation will drop half a percentage point to 8.2% when June data is released on Wednesday. Even a result in line with those expectations would give Sunak a much-needed chance to reclaim the narrative that he’s taming price increases that have plunged the UK into a cost-of-living crisis.

But officials at No. 10 Downing Street and the Treasury are seeking to suppress expectations that Sunak might get a boost from inflation data like the one President Joe Biden got across the Atlantic this week. One dismissed the 8.2% median estimate as optimistic. Two others said the government wasn’t putting much stock in market forecasts after months of misses.

Read More: Sunak Risks Failing on His Five Key UK Pledges at Halfway Point

The issue is critical for Sunak, who has cut a frustrated figure in recent weeks since the UK’s last consumer price index surprise a month ago. While halving the rate of inflation this year is only one of Sunak’s key pledges, it sits at the center of several problems, preventing him boosting growth and making it harder to fund tax cuts and public services.

Turning the economy around is the best chance of overturning the opposition Labour Party’s formidable lead in opinion polls ahead of an election expected to be held in 2024. That looks increasingly difficult to pull off, as forecasts show the economy stagnating through next year and potentially beyond.

It’s not only Sunak showing the strain. Members of his governing Conservative Party have been in a funk as they contemplate losing their seats in Parliament.

One Tory MP said morale in the party was at its lowest ebb after the inflation data and the Bank of England’s subsequent decision to hike interest rates to 5%. Sunak needs the news to turn more favorable, starting next week, the MP said, or else risk a summer of increasingly vocal party criticism.

It’s not only inflation data looming large in Tory thinking. On Thursday, the Conservatives contest three special elections which, if they follow the recent pattern, could further expose the depth of public apathy toward the ruling party.

Yet Tory MPs who gathered in the Downing Street garden for a morale-boosting barbecue encountered a far more upbeat Sunak. The prime minister’s week had begun in the same venue, making small talk with Biden and comparing the blooming roses with those at the White House.

Read More: Sunak Shows Frustration as Torrid June Has UK Cabinet on Edge

Sunak was still talking about America when Conservatives visited the same venue Wednesday for pulled pork sandwiches and a hog roast, according to three people who attended. The prime minister cited fresh news that US inflation had dropped to 3%, saying he expected a similar price-cooling in the UK by year’s end.

Sunak — a Stanford University-educated former Goldman Sachs banker and ex-chancellor of the exchequer — has staked his premiership on his economic record. He has presented himself as a fresh start after Liz Truss’s premiership was derailed by market turmoil.

Echoing Sunak’s comments, Treasury officials, who privately argue that some banks’ forecasts and media coverage of inflation has been too critical, are also confident inflation will drop significantly toward the end of the year.

BlackRock Inc. portfolio manager Rupert Harrison, a Conservative parliamentary candidate and a member of Chancellor Jeremy Hunt’s economic advisory council, said on Twitter this week the “economic context will feel very different by the end of the year” as just like in the US, UK wage growth will outstrip inflation “by quite a large margin.”

Still, people close to the prime minister expect a bumpy political road before things improve. Wednesday’s inflation numbers and the by-elections on Thursday could combine to become a pivotal political moment for Sunak.

Read More: Gloom Descends on Sunak as Johnson Saga and Rate Hikes Persist

A scenario offered by one Sunak ally is that inflation falls and the Tories surpass rock-bottom expectations in votes. Given the low level of national support for the Conservatives, winning one or two of the elections would count as a good result. That, coupled with Sunak’s pitch to end public sector strikes on Thursday, could be taken as a positive momentum shift.

According to Scarlett Maguire, director at pollster JL Partners, the Tories’ best chance is in the Uxbridge and South Ruislip vacated by ex-premier Boris Johnson. His resignation has changed the political winds in that area of northwest London, where the disgraced premier’s slumping popularity has been trumped by a local fight over a new charging zone to cut vehicle emissions.

Polling showed a Labour win in the northern England seat of Selby and Ainsty, Maguire said, and a “likely” Liberal Democrat win in Somerton and Frome in the southwest. Uxbridge is the “biggest unknown of the three,” she said. “As things stand, two look nailed on, one is more on the edge.”

That’s the optimistic scenario. One Tory aide said the party should be prepared to lose all three seats, mirroring the dismal performance in May local elections that laid bare just how difficult it would be to stop Labour from coming back to power. Another disappointing inflation figure would further dampen the mood.

The warning could be an attempt to manage expectations. But it will do little to placate Tory MPs worried about losing their own seats next year.

--With assistance from Kitty Donaldson.