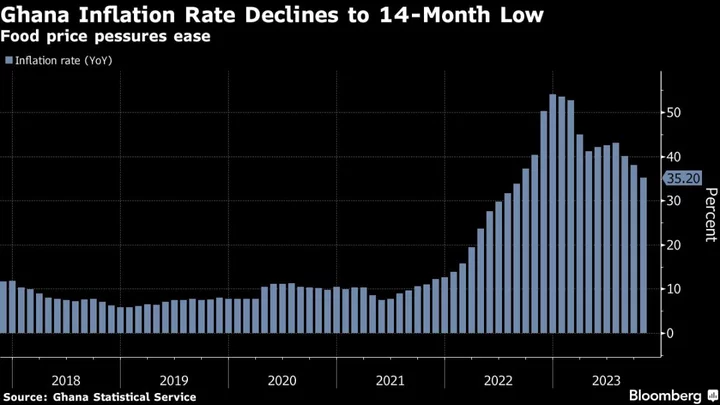

Ghana’s inflation rate fell more-than-anticipated to a 14-month low in October, providing further room to the central bank to keep borrowing costs unchanged when its monetary policy committee meets later this month.

Annual inflation cooled to 35.2% from 38.1% in September, Government Statistician Samuel Kobina Annim said in the capital, Accra, on Tuesday. The data release was brought forward by a day to accommodate the announcement of the 2024 budget by Finance Minister Ken Ofori-Atta on Nov. 15.

The deceleration, driven by the softening in food prices, was faster than the median of seven economists’ estimates in a Bloomberg survey of 36.3%. Food inflation moderated to 44.8% from 49.4% in September and non-food price growth was 27.7% versus 29.3% in the prior month. Prices rose 0.6% in the month.

The cedi was little changed per dollar by 10:08 a.m. in the capital, Accra. The nation’s dollar bonds maturing in 2032 fell slightly to 40.96 cents on the dollar.

The slowdown in inflation, along with additional funding from an International Monetary Fund bailout package later this year that’s expected to boost reserves and support the cedi, may prompt the MPC to hold borrowing costs at 30% for a second straight meeting. The committee is scheduled to announce its latest decision on Nov. 27.

Ofori-Atta’s budget is expected to set out steps taken by the government to meet conditions of the $3 billion IMF program that was approved in May, including progress on an in-principle deal with bilateral lenders to revamp the nation’s debt to unlock further funds.

Read More: Ghana Needs Official Creditors Pact to Unlock IMF’s $600 Million

--With assistance from Simbarashe Gumbo and Alister Bull.