By Tom Westbrook

SINGAPORE Asian stocks slid on Friday to cap a torrid first week of the quarter for financial markets, with the dollar standing tall and bonds crumbling as the resilience of U.S. jobs data has investors bracing for interest rates to head higher still.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.6%, with Chinese banking stocks down a fourth straight day for a 10% weekly loss on gloom about their outlook as the economy slows.

Japan's Nikkei fell 0.6%. [.T]

Surprisingly strong partial figures on the U.S. labour market, meanwhile, sent selling in bond markets into overdrive.

Two-year Treasury yields burst above 5% and futures pricing started to admit the possibility that the Federal Reserve, as it has projected, will raise rates twice before the year is out.

Ten-year yields steadied in Asia at 4.04% after rising more than 17 basis points in two sessions, but regional markets were under pressure as selling wrapped around the globe, stopping out investors who had positioned for a peak in rates.

"People have been very reticent to accept the idea that central banks are going to take cash rates above 5% and 6% and hold it there," said Andrew Lilley, chief interest rate strategist at investment bank Barrenjoey in Sydney.

"This is a disorderly move towards reality."

Germany's two-year bond yield hit a 15-year high on Thursday. In Britain, where traders are bracing both for recession and for interest rates heading towards 7%, 10-year gilt yields have hit post-2008 highs.

Three-year and 10-year Australian government bond yields each rose a dozen basis points on Thursday and a dozen more on Friday to hit decade highs.

"These were pretty savage moves," said Jack Chambers, senior rates strategist at ANZ in Sydney.

"It suggests some longs have maybe been squeezed out, and people caught," he said.

"Are we starting to price in the idea that there should be a higher term structure of rates? Maybe there has to be some reassessment given the resilience of a lot of economies to higher rates so far."

Even well-anchored Japanese government bond yields rose on Friday.

Private U.S. payrolls jumped 497,000 last month, the ADP National Employment report showed on Thursday, against expectations for a 228,000 increase.

Broader non-farm payrolls data is due at 1230 GMT on Friday. S&P 500 futures were steady in Asia. European futures rose 0.4%.

The buckling bond market gave support to the U.S. dollar, although not too much as yields leapt globally and the fear of intervention has traders too nervous to short the yen.

The euro is down 0.2% on the week at $1.0890. The yen actually rose on Thursday and is hovering at 143.70 to the dollar.

The Australian dollar was last at $0.6641 and eying a small weekly loss, following the Reserve Bank of Australia's decision to pause rate hikes this week. The kiwi was at $0.6174 and eyeing a modest weekly rise.

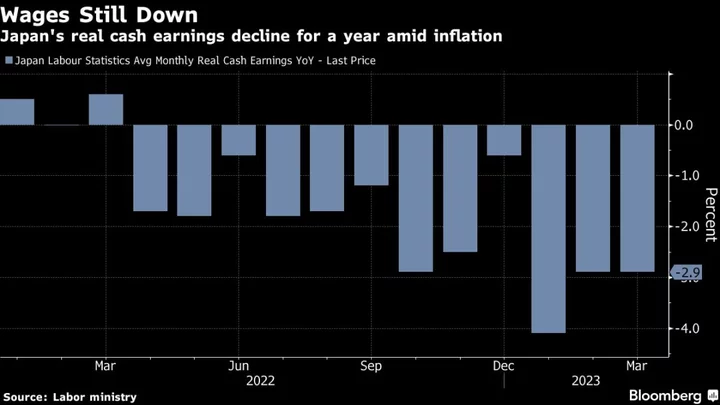

Data on Friday showed Japanese wages rising at their fastest pace in 28 years in May, although it also showed hours worked rising even faster so hourly rates actually dropped.

Elsewhere in markets, Hong Kong banking stocks extended losses and are tracking towards their worst week in more than five years on worries about exposure to Chinese local government debt. Goldman Sachs has downgraded the sector.

The index fell 0.8% on Friday and is down 10% on the week. The Hang Seng fell 0.2% and markets in South Korea and Australia fell more than 1%.

In commodities, Brent crude futures were steady at $76.87 a barrel. Gold, which pays no income, was under pressure from higher yields and flat at $1,914 an ounce.

(Reporting by Tom Westbrook; Editing by Edmund Klamann and Kim Coghill)