China’s yuan strengthened beyond its daily reference exchange rate for the first time in four months, getting some respite from months of depreciation pressure as the dollar weakens globally.

The yuan gained 0.4% in both onshore and overseas trading to appreciate past the daily currency fixing set by the People’s Bank of China for the first time since July. Beijing allows the yuan to trade 2% above or below the reference rate in the domestic market.

The yuan is among the worst-performing currencies in Asia this year, even as China has taken a suite of measures to slow its slump amid a patchy economic recovery. The pressure on the currency has eased considerably this month, thanks to the dollar’s retreat as expectations grew for peaking US interest rates and fresh signs of thawing ties between Beijing and Washington.

The PBOC raised its fixing by 0.3%, the most since July, to 7.1406 on Tuesday. That prompted the yuan climbed to climb to a four-month high in both onshore and overseas markets.

“Fixing continues to signal that the policymakers want the yuan to adjust to reflect recent market developments,” said Christopher Wong, strategist at Overseas Chinese Banking. “The strategy of buying time to wait for the dollar’s turn paid off once again.”

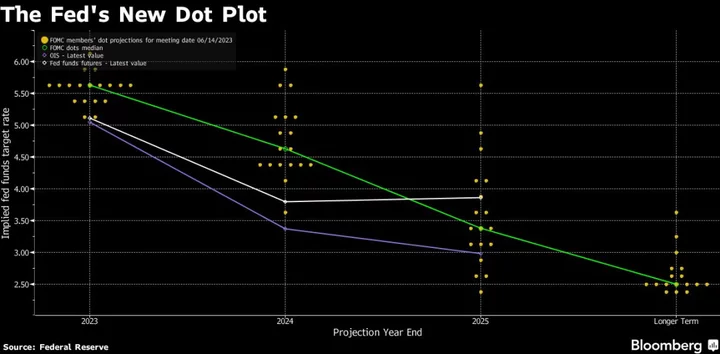

The Bloomberg Dollar Spot Index notched a gain of almost 7% as it rose from a 2023 low in July to a near one-year high in early October as traders weighed the possibility of higher-for-longer interest rates in the US. Those trades are rapidly unwinding as slowing inflation and signs that the labor market is cracking encourage traders to price in Federal Reserve rate cuts next year.

PBOC has been using the daily yuan reference rate as the main tool for managing the currency in recent months. Officials have kept a tight grip on the reference rate by keeping the fixing largely unchanged in October.

“Flattening the fix in recent months actually strengthened the PBOC’s credibility as a price setter and no one would mess with the central bank,” Hao Hong, chief economist at Grow Investment Group said. The yuan could rally past 7.1 per dollar “very soon” as US yields stabilize and the gap between China and US narrows, he added.

(Updates throughout.)