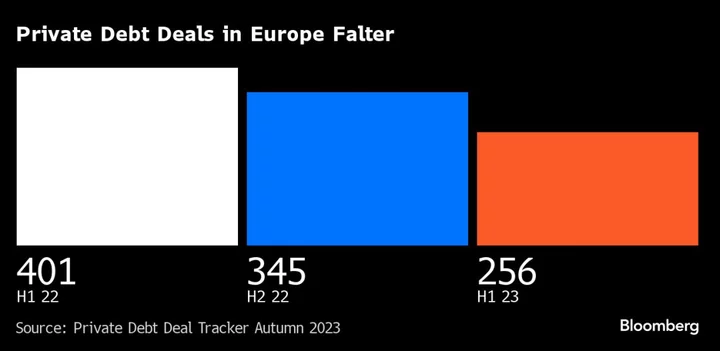

Private credit’s success is creating a $500 billion headache: finding a home for all the money that’s been raised.

Fund managers potentially lost out on more than $7 billion of lending deals in less than 48 hours this week, highlighting the difficulties they face in allocating billions of dollars of dry powder following the industry’s rapid expansion.

A dearth of quality lending opportunities, a revival of competition from banks and a slew of new entrants have resulted in a scarcity of suitable deals to back. That could trigger a race to the bottom between debt funds and banks and result in systemic risks, Moody’s Investors Service warned last month.

Private credit firms, which manage around $1.6 trillion, are already giving up investor protections to secure larger refinancings, leaving them more vulnerable to higher losses if borrowers default. Adding to the problems, the funds have investment periods of three to five years, creating a possibility that providers will sign up to lower quality loans to get money out the door after promising high returns to investors.

“Yield was impressive earlier this year, but this is a fast-moving market and those higher prices are going to get competed out pretty quickly,” said Daniel Bird, the founder of Thornwood Hill LLP, an investor that works on behalf of family offices.

Read More: Private Credit Lenders Giving Up Protections to Win Bigger Deals

The $7 billion plus of deals that risk falling apart this part week show just how hard it is to get deals done. A consortium led by Permira and Blackstone Inc. reportedly reconsidered its pursuit of the European online classifieds company Adevinta ASA, which lenders had hoped to back with more than £3.5 billion ($4.3 billion) of financing. A day later, it was reported that Advent had pulled the sale of CCC Intelligent Solutions Holdings. Private credit funds had offered at least $3 billion of debt to bidders in that deal.

Even as activity in the broadly syndicated market recedes again, new providers are entering the private credit market. Pictet Asset Management and Fidelity International have opened funds and a slew of banks and asset managers are planning to as well.

Still, private credit continues to gain market share over banks and syndications and pricing remains attractive, Ares Capital Corp. Chief Executive Officer Kipp deVeer told analysts in recent days.

The scrum for the best deals follows the collapse in the number of mergers and acquisitions after interest rates rose. Muted supply of new debt is now contributing to spreads narrowing, which could weigh on returns for private lenders and spur them to take more risk. The expectation was that debt for the Adevinta buyout would be priced at 575 basis points over Euribor, a significant tightening from the 650 to 675 basis points over the benchmark that’s been the norm over the past two years.

When spreads narrow, investors often have little choice but to keep putting money to work.

“The last thing you want to do as a manager is stop deploying,” said Floris Hovingh, managing director at Perella Weinberg Partners. “There’s negative sentiment in the market around it and it can make fundraising difficult. It starts a negative spiral that a direct lender should avoid.”

Week in Review

- Chinese developer Country Garden Holdings Co. was deemed to be in default on a dollar bond for the first time, underscoring its fall into distress amid a broader property debt crisis that’s shaken the world’s second-biggest economy.

- China Evergrande Group will face the once-unthinkable possibility of asset liquidation on Oct. 30 when a key court hearing takes place.

- The distressed developer is revising the terms of its proposed restructuring plan and canceled so-called scheme sanction hearings.

- Also on Oct. 30, two units of its peer Logan Group will face a winding-up hearing.

- One of China’s largest retailers, Suning Appliance Group Co., has proposed extending $6.1 billion of unsecured debt by eight years, in its latest effort to deal with a liquidity crunch.

- China Evergrande Group will face the once-unthinkable possibility of asset liquidation on Oct. 30 when a key court hearing takes place.

- A sluggish Chinese economy is causing distress to pop up in unexpected corners of Europe’s junk credit markets, with companies pushed into debt restructurings due to events happening far away.

- Federal Reserve interest-rate hikes have sent the cost of money shooting higher, but the average risk premium for US high-yield debt has remained muted, suggesting investors don’t find junk-rated companies all that risky.

- Banks are taking a cautious approach in the investment-grade bond market amid some of the wildest swings in Treasuries in recent memory.

- Bankers are finding that it’s no longer business as usual when it comes to pricing new corporate bonds now that interest rates have soared to 16-year highs.

- The highest yields in more than a decade have some investors looking harder at buying credit, even as companies have become increasingly reluctant to sell bonds in recent weeks.

- Attendees and panelists at this year’s ABS East conference discussed a range of questions: What are banks doing to manage their capital, what happens to consumer spending and how can one benefit from private credit?

- The $1.3 trillion CLO industry that boomed in the cheap money era now looks particularly vulnerable.

- The pile of collateral pledged against the debt of Europe’s riskiest companies has never been so high as bankruptcies mount and creditors increasingly demand a safety net.

On the Move

- AGL Credit Management LP has recruited David Richman from Carlyle Group Inc. as a managing director in its private credit team led by Taylor Boswell.

- Hayfin Capital Management has hired Peter Swanson to become its new head of US high-yield and syndicated loans.

- Antares Capital hired three executives to its New York-based liquid credit team, namely Rob Davis, Amy Ecker and Jonathan Rogers.

- Aurelien Bonnet has joined Sumitomo Mitsui Financial Group’s US arm as managing director and head of strategic financing solutions.

- Polen Capital has hired Gus Phelps from Summit Partners to help steer the asset-management firm’s direct investments in private middle-market companies.

- Millennium Advisors LLC has hired Dylan Blair as a managing director and global head of US dollar credit trading.

- Jefferies Financial Group Inc. has recruited Morgan Stanley’s Amanda Wu as its Hong Kong-based head of fixed income Asia.