Equity markets across Asia were primed to advance following a tech-driven rally Friday on Wall Street, as investors look ahead to crucial US inflation data due Tuesday.

Futures contracts for share benchmarks in Japan, Australia and Hong Kong all gained ground early Monday in Asia. Those advances followed a Friday surge for the tech-heavy Nasdaq 100, which rose 2.3%, helped along by a record high for Microsoft Corp. The S&P 500 rose 1.6%. Markets are closed in Singapore and Malaysia for a holiday.

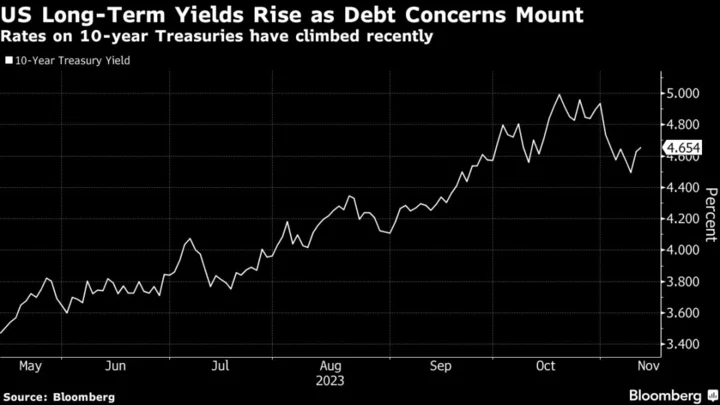

Australian and New Zealand government bonds edged lower after short-dated Treasuries sold off on Friday. Those declines failed to weigh on the long end of the curve. The 30-year yield was left largely unchanged while the 10-year yield rose three basis points.

Currencies held to tight ranges in early Asian trading. The New Zealand and Australian dollars fell slightly against the greenback, while the yen was steady after weakening last week against the dollar.

“We are going to see a change in policy in Japan and that is going to make the yen attractive,” Sonal Desai, chief investment officer for fixed income at Franklin Templeton, said in an interview with Bloomberg Television. “The BOJ will ultimately be pushed towards changing its own interest rate stance which will bring money back.”

In Asia on Monday, Japan will report October producer prices, India will release its latest inflation report and new loan and money supply figures for China could also be released.

In the US, inflation is anticipated to have declined to a year-over-year rate of 3.3% in October, down from 3.7% recorded in the prior month, when the data is released Tuesday. Many bond investors are convinced a sustained rally in Treasuries will fail to occur without a clear economic slowdown. US President Joe Biden and his Chinese counterpart Xi Jinping meet Wednesday.

ANZ Group Holdings Ltd. was among the first to report on in a busy week of earnings results. Profits for the Australian lender were buoyed by higher interest rates, though the bank’s chief executive officer warned of a challenging economic environment ahead.

Other companies set to report Monday include Apple supplier Hon Hai Precision Industry, also known as Foxconn, Chinese tech giants JD.com Inc and Tencent Holdings Ltd., Japanese financial heavyweights Mitsubishi UFJ Financial Group and Mizuho Financial Group, Walmart Inc. and Siemens.

Australia is grappling with the fallout of a cyberattack on port operator DP World Plc as the holiday season approaches. Four ports are expected to face interruptions in the coming days, the government said Sunday.

JD.com and Alibaba Group Holding reported a pickup in sales for Singles’ Day, following steep discounts offered by the e-commerce groups.

Elsewhere, oil advanced Friday, but still notched a third straight weekly drop on growing concerns over global demand. Gold retreated. Bitcoin hovered above $37,000 — around the highest price in 18 months.

Events coming up this week:

- Japan PPI, Monday

- ECB Vice President Luis de Guindos speaks, Monday

- US CPI, Tuesday

- UK jobless claims, Tuesday

- Chicago Fed President Austan Goolsbee speaks, Tuesday

- China retail sales, Wednesday

- UK CPI, Wednesday

- US retail sales, PPI, Wednesday

- China new home prices, Thursday

- US initial jobless claims, Thursday

- New York Fed President John Williams, Thursday

- US housing starts, Friday

- ECB President Christine Lagarde speaks, Friday

- Chicago Fed President Austan Goolsbee, Boston Fed President Susan Collins, San Francisco Fed President Mary Daly all speak, Friday

Some of the main moves in markets:

Stocks

- Nikkei 225 futures rose 1% as of 7:34 a.m. Tokyo time

- Hang Seng futures rose 0.5%

- S&P/ASX 200 futures were up 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0684

- The Japanese yen was little changed at 151.47 per dollar

- The offshore yuan was little changed at 7.3048 per dollar

Cryptocurrencies

- Bitcoin was little changed at $37,187.96

- Ether was little changed at $2,060.21

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.65% on Friday

- Australia’s 10-year yield advanced five basis points to 4.67% on Monday

Commodities

- Spot gold fell 0.9% to $1,940.20 an ounce

This story was produced with the assistance of Bloomberg Automation.