The global economy and inflation have so far proved surprisingly resilient to a barrage of interest-rate increases, prompting top central bankers to promise more of the same on Wednesday.

Appearing together in Sintra, Portugal, Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey all said they had a ways to go in reining in too-high inflation.

“Although policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough,” Powell said at an ECB-hosted panel discussion that also included Bank of Japan Governor Kazuo Ueda.

Noting that most Fed policymakers expect to raise rates at least two more times this year, Powell left the door open to the central bank increasing borrowing costs at two consecutive meetings after it took a break from tightening at a gathering earlier this month.

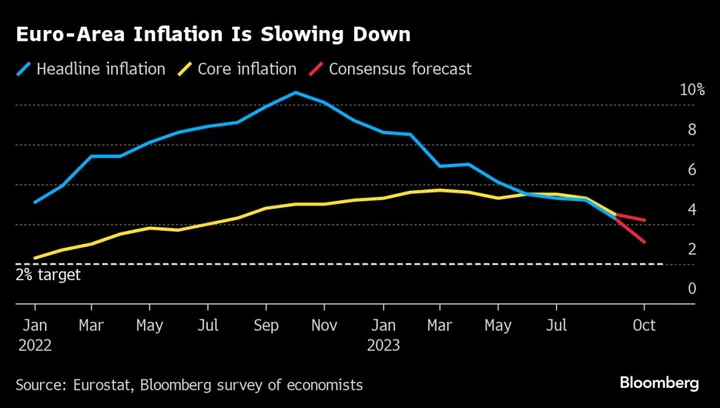

Lagarde, for her part, suggested that an ECB rate increase next month was a virtual certainty, though she was less committal on what policymakers would do at their subsequent meeting in September. Bailey, meanwhile, vowed to do what was necessary to bring inflation back to 2% after the BOE surprised investors by boosting rates a half percentage point this month.

Ueda was the odd man out, emphasizing that Japan’s rates are on hold because underlying inflation remains below 2%. Even so, he outlined the potential for a change if the BOJ becomes more confident that 2% price gains will materialize next year.

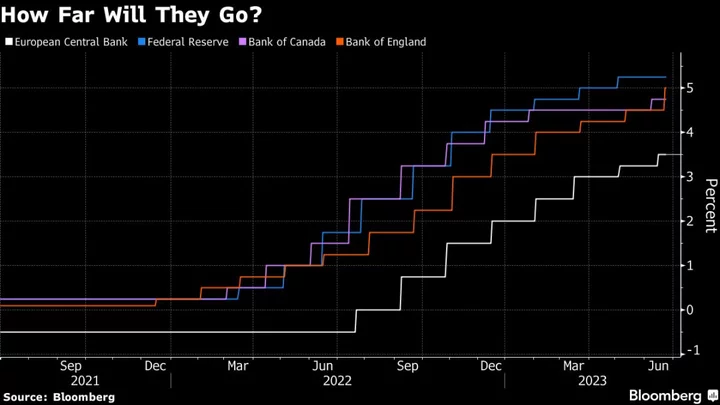

Last year, the Fed, ECB and BOE embarked on their most aggressive credit tightening in decades in a bid to bring inflation back down to their 2% targets.

‘Little Puzzled’

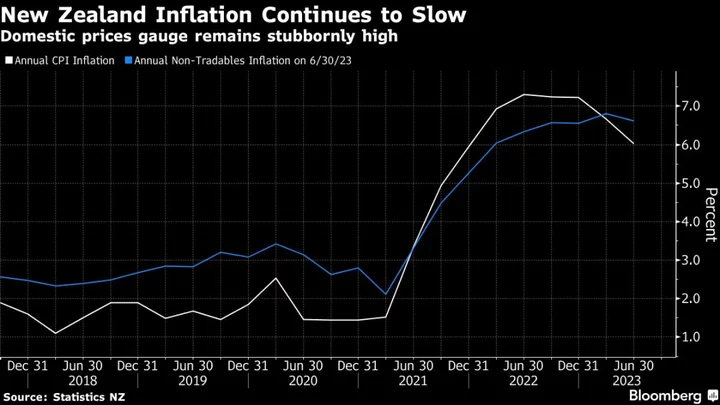

Despite fears that would trigger a global recession, the world economy has so far held up. But underlying inflation has also been persistent.

“Across the board, central bankers were saying, ‘We’re determined,’ but I think they’re a little puzzled that it has had little effect so far,” said Raghuram Rajan, a former Indian central bank governor and ex-IMF chief economist, referring to monetary tightening.

Speaking on Bloomberg Television, Rajan added, “If you look at core inflation, yes, it did come down over the year, but it seems to have stabilized – and that’s the worry.”

What Bloomberg Economics Says...

“The ECB and the Federal Reserve sound like they’re approaching the peak in interest rates and have moved on to talking about the duration of the terminal rate, while the Bank of England is still focusing on how high to go. Lastly, the Bank of Japan is going nowhere anytime soon.”

— David Powell, Anna Wong, Dan Hanson and Taro Kimura

For the full note, click here

Powell and his Fed colleagues will get another reading on inflation on Friday, with the release of May data on the personal consumption expenditures price index.

Headline inflation on that measure is projected by economists to slow to 3.8% from 4.4% in April, in large part due to a decline in gasoline prices. But core inflation – which strips out food and energy costs and which policymakers view as more indicative of the underlying trend — is seen coming in unchanged at 4.7%, according to the median forecasts of economists surveyed by Bloomberg.

Powell’s Outlook

Powell said it won’t be until 2025 that the core measure falls to 2%, and voiced concern that the longer inflation stays high, the greater the risk that it will become entrenched in the economy.

“The passage of time is not our friend here,” he said.

He and Bailey zeroed in on the tightness of their countries’ respective job markets, portraying it both as a source of strength for the economy as a whole but also as a fuel for inflation.

Powell acknowledged that a recession was possible as a result of the Fed’s actions, though that’s not his base case.

Others on the panel were equally cautious. While the BOE is not currently forecasting a recession, “we have to watch it very carefully,” Bailey said.

In the end, the central bankers made clear that their No. 1 aim was taming inflation – even if that meant their economies would have to suffer through some tough times as a result.

“A woman’s got to do what a woman’s got to do,” Lagarde said.

--With assistance from Romaine Bostick.

(Updates with comments from Raghuram Rajan starting in second paragraph after ‘Little Puzzled’ subheadline.)