Stocks in mainland China have emerged as an outlier amid November’s global rally, with the market extending its run of losses owing to persistent investor concerns about the economic recovery.

The CSI 300 Index is down more than 2% in November, the worst performance among benchmarks in the world’s major equity markets. The gauge is heading for a fourth straight month of losses and trading near a 2023 low reached in October. Its dismal performance stands in sharp contrast to the MSCI All-Country World Index’s surge of almost 9% this month, fueled by bets that the Federal Reserve is done raising interest rates.

“Sentiment has been so bad,” said Willer Chen, senior analyst at Forsyth Barr Asia Ltd. “If you look at the macro numbers this month, the only beat probably just comes from retail sales and industrial production. Policy wise, there has been a lot of noise out there this month but nothing concrete or confirmed.”

In fresh signs of economic strains, data Thursday showed China’s manufacturing activity contracted again in November while a gauge of the services sector shrank for the first time this year. The CSI 300 was little changed in afternoon trading after sliding 0.9% on Wednesday. Figures earlier in the week showed profits at industrial companies rose at a much slower pace in October than the prior month as deflationary pressures persisted.

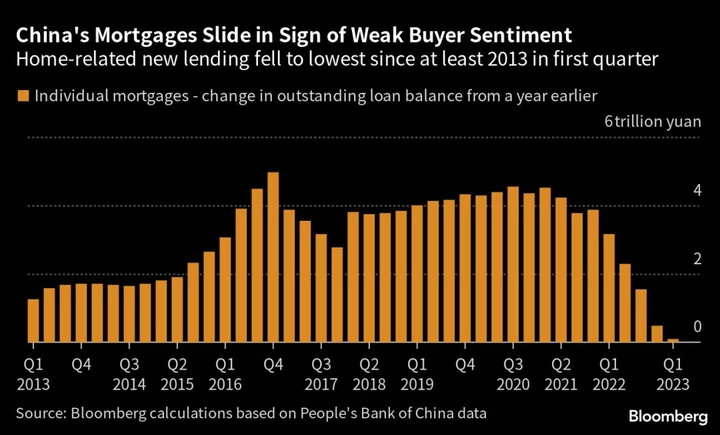

The world’s second-largest stock market has continued to suffer despite signs that Beijing wants to put a floor to the distressed real estate sector. Regulators are drafting a list of 50 developers eligible for a range of financing, Bloomberg News reported Nov. 20. While that helped boost shares of property developers, sentiment in the broader market has remained weak.

Even as expectations for more policy support are building, the real estate sector remains a key threat to growth as falling home sales and property investment have curbed demand for everything from furniture to decorations and home appliances.

Investors also assigned little importance to the progress made in Sino-American relations during the meeting between Chinese President Xi Jinping and US President Joe Biden earlier this month. Further, much-anticipated results from major technology giants such as Meituan have failed to impress, with the food delivery firm’s shares tumbling to the lowest level since March 2020 on Wednesday after it gave soft fourth-quarter guidance.

READ: China Stock Traders Get Little Solace in Pivotal Week for Market

“Investors have been disappointed by China’s economic recovery while third-quarter earnings and the guidance from companies failed to impress,” said Redmond Wong, a strategist at Saxo in Hong Kong.

Down 10% this year, the CSI 300 is on track to for an unprecedented third straight annual loss. Global funds are poised to trim their holdings of mainland shares for a fourth consecutive month.

Still, with the relentless selloff rendering valuations cheap, several global fund managers are starting to bet on a revival. Fidelity International is looking to increase exposure to China in a measured manner, while Invesco Ltd. has said that it’s difficult to have an underweight position on China.

(Updates with additional details.)