Odey Asset Management suspended its flagship hedge fund after being hit by redemption requests from investors fleeing the firm following fresh sexual assault allegations against founder Crispin Odey.

The firm received withdrawal requests amounting to about 19% of the Odey European Inc. hedge fund for its next dealing day on July 3, according to a letter to clients seen by Bloomberg. Odey himself managed the fund until he was removed from the partnership this month, with Freddie Neave taking over from him.

“Given the level of requested redemptions, investor concentration and liquidity profile of the fund, the fund board has determined that it would not be in the best interests of the fund and its shareholders as a whole to continue to permit issues and redemptions of shares,” the firm wrote in the letter.

A spokesperson for London-based Odey Asset Management didn’t immediately respond to a message seeking comment.

The firm also is considering restructuring the fund’s operations, which may allow clients to switch their investments to a new fund, according to the letter.

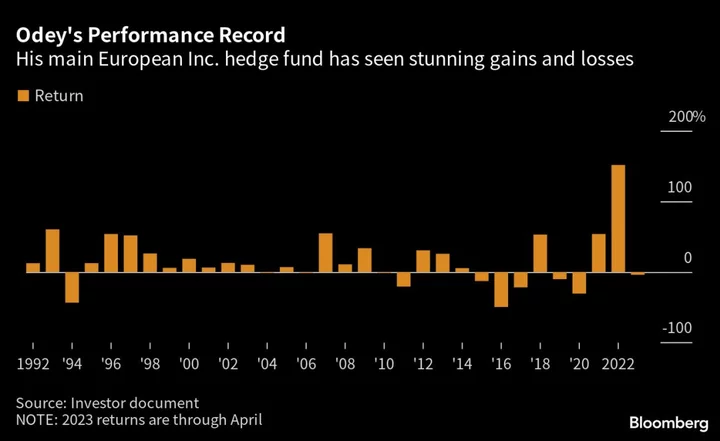

The Odey European fund traces its roots to 1992 as the firm’s main hedge fund offering. The strategy, which managed about $1 billion at the end of April, is known for its wild swings over the years.

In 2022, the fund posted its best-ever performance, returning 152% that was powered mainly by Odey’s highly leveraged short wagers on long-dated UK government bonds as inflation and political turmoil roiled the British economy.

The fund joins four other money pools suspended after an investor exodus from Odey and its affiliate Brook Asset Management since the June 8 Financial Times investigation into Crispin Odey’s alleged treatment of women over a 25-year period.

Odey, 64, disputes the allegations. He hasn’t responded to multiple requests for comment. No criminal proceedings have been brought against him.

The accusations followed similar complaints in the two years since he was acquitted of an assault charge in British courts. Two women came forward to Bloomberg News, another went to the Times of London newspaper. Later, more appeared in a Tortoise Media podcast.

Since then, the asset management firm has ousted its founder from the partnership, shuttered one fund and suspended others. The investment fund said earlier this month the firm was in advanced discussions to transfer its funds and many of its employees to other asset managers.