Stocks in Asia rose as China rolled out more stimulus to aid its ailing economy and as traders awaited Friday’s jobs reading to gauge the outlook for Federal Reserve policy.

Mainland China shares climbed after closing the month over 5% lower, with financial and real estate stocks leading the gains. The Hong Kong stock market is shut on what may be the strongest storm to hit the city in at least five years.

The yuan strengthened and led gains among Asian peers against the greenback after China’s central bank reduced the foreign exchange reserve requirement ratio for financial institutions in a bid to support the currency.

“It will support CNY sentiment,” Becky Liu, head of greater China macro strategy at Standard Chartered, said on the move by the People’s Bank of China. “Previous experience suggested that the CNY will be supported briefly by similar measures, but it has not been a step to turn around the direction of USD-CNY in the medium to long term.”

Investors also welcomed moves by the government to allow the nation’s largest cities to cut down payments for home buyers and encouraged lenders to lower rates on existing mortgages as well as on deposits. Bank of China Ltd. and several other major lenders followed through by lowering deposit rates.

Sentiment was further buoyed by an unexpected rise in manufacturing data that advanced to 51 in August, the highest reading since February, according to a Caixin survey.

Meanwhile, Japan’s Topix Index is set for is best weekly advance since October as companies’ profits rose 11.6% on an annual basis in the second quarter. However, data also showed that Japanese businesses cut their spending for the first time in five quarters, an outcome that may prompt a downward revision to second-quarter economic growth data.

Futures for the S&P 500 edged higher after the index closed lower on Thursday to notch its first monthly slide since February.

The 10-year yield had extended its retreat Thursday after recently hitting levels last seen in 2007 while an index of dollar strength had its best month since February. Treasuries steadied during Asian trading, while the dollar ticked lower.

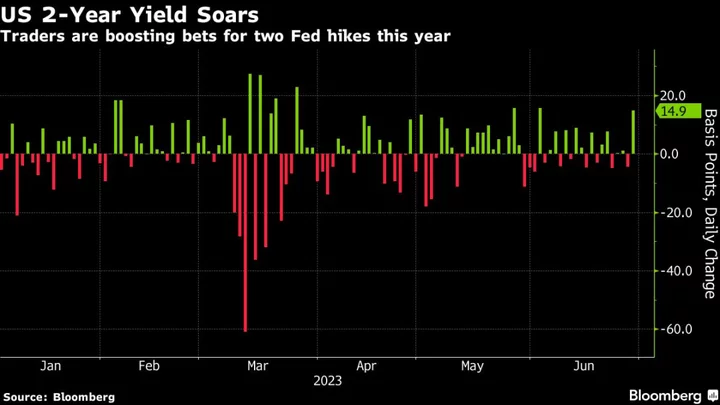

Concerns that the Fed will keep interest rates higher for longer to prevent a flare-up in price pressures has taken the wind out of equity markets around the world, adding to worries about China’s faltering economic growth.

The Fed’s preferred measure of underlying inflation saw the smallest back-to-back increases since late 2020, encouraging consumer spending. Markets took the report in stride, with the numbers illustrating the divergence within the US economy, according to Jeffrey Roach at LPL Financial.

Wall Street is now bracing for Friday’s labor-market data, which will provide further insights on the Fed’s next steps. The report is forecast to show employers boosted their payrolls by nearly 170,000 in August, while the unemployment rate held at a historic low of 3.5%.

Fed Outlook

The Fed may be slower to cut rates than many market participants expect, said Bridgewater Associates Co-Chief Investment Officer Karen Karniol-Tambour.

“When you look at what it takes to get fast rate declines, usually you need the economy collapsing pretty quickly,” she said in an interview for an upcoming episode of Bloomberg Wealth with David Rubenstein. “That’s very far from where we are today.”

Fed Bank of Atlanta President Raphael Bostic said policymakers need to be cautious not to overtighten monetary policy and risk unnecessary harm to the US labor market.

Elsewhere, oil is set for a weekly gain after Russia signaled that it would extend export curbs and US inventories dropped further. Gold headed for the second weekly advance.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday

- US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 11:21 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures rose 0.1% The Nasdaq 100 rose 0.2%

- Japan’s Topix rose 0.9%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng fell 0.5%

- The Shanghai Composite rose 0.7%

- Euro Stoxx 50 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0851

- The Japanese yen rose 0.1% to 145.33 per dollar

- The offshore yuan rose 0.2% to 7.2576 per dollar

- The Australian dollar was little changed at $0.6485

Cryptocurrencies

- Bitcoin was little changed at $26,014.82

- Ether was little changed at $1,650.13

Bonds

- The yield on 10-year Treasuries was little changed at 4.10%

- Australia’s 10-year yield declined five basis points to 3.97%

Commodities

- West Texas Intermediate crude rose 0.2% to $83.80 a barrel

- Spot gold rose 0.1% to $1,942.35 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rob Verdonck, Wenjin Lv and Chester Yung.