Nigeria’s central bank pledged to restore price stability and steady the country’s battered currency, signaling tighter monetary policy ahead.

“The Central Bank of Nigeria is committed to achieving monetary and price stability,” Governor Olayemi Cardoso said in a sweeping speech to bankers on Friday. “We will tackle institutional deficiencies, restore corporate governance, strengthen regulations and implement prudent policies.”

In his first speech since taking office in September, Cardoso said the central bank will direct banks to bolster capital levels. He also spelled out that policymakers would embrace orthodox central banking practice.

“As part of this new focus, the CBN has just approved the adoption of an explicit inflation-targeting framework to enhance the effectiveness of monetary policy,” he said, adding that the bank was working out the details. “The CBN will provide forward guidance, enhance transparency and maintain effective communication with the public to anchor expectations.”

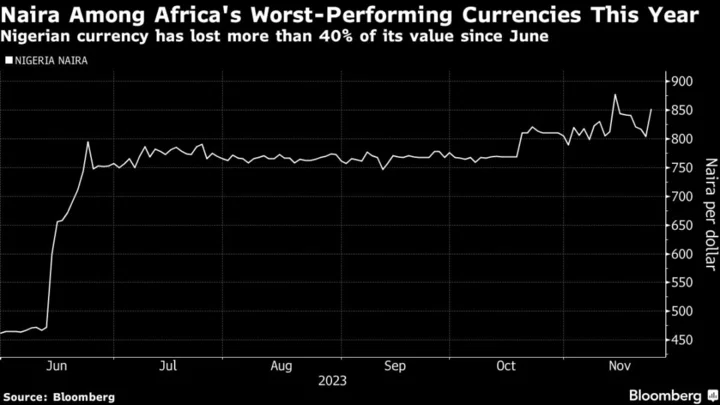

The speech, delivered at the end of an annual banking industry dinner, had been highly anticipated for evidence he has a plan to tackle surging price pressures and currency weakness. The naira has slumped by around 40% against the dollar since June.

The central bank raised its key rate by 25 basis points to 18.75% when it last met in July. Inflation since then has accelerated to an 18-year high of 27.3%.

Cardoso said that inflation will be effectively managed by tightening monetary conditions during the next two quarters.

His stance signals a willingness to defend the autonomy of the central bank. President Bola Tinubu has previously called for lower lending rates to kick-start growth.

But he provided no hints that policymakers was planning to meet soon after a gathering scheduled for earlier this week was canceled at short notice. He did note that the law required the monetary policy committee to meet four times a year and this threshold had already been achieved for 2023.

Since taking office, Cardoso has hinted at a return to orthodox policies at the central bank and he discussed controlling market liquidity in the speech.

The governor also said that the bank was in the process of clearing a backlog of dollar demand that has weighed heavily on the naira.

“We have initiated the payment of unsettled forward foreign-exchange obligations, and these payments will continue until all obligations are cleared,” he said.

Soaring food and gasoline prices have driven Nigerian inflation after Tinubu announced reforms that ended a costly fuel subsidy and eased foreign-exchange controls.

Finance Minister Wale Edun, who spoke before Cardoso at the dinner, said the measures were yielding results and the government would “stay the course.”

(Updates with fresh details throughout.)

Author: Anthony Osae-Brown, Emele Onu, Ruth Olurounbi and Nduka Orjinmo