The crisis engulfing the US offshore wind industry escalated as Orsted A/S and BP Plc became the latest developers to take large writedowns on projects, putting President Joe Biden’s ambitious targets for renewable energy generation at risk.

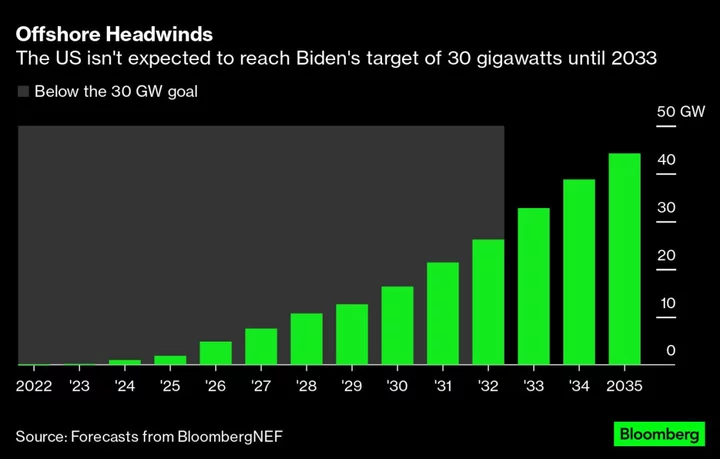

This week alone, energy companies such as Equinor ASA have taken almost $5 billion combined in impairments on turbine farms proposed off New York and New Jersey. The writedowns threaten future investments, potentially jeopardizing Biden’s goal to deploy 30 gigawatts of offshore wind capacity during the next nine years.

The financial hits come as wind developers face a toxic mix of challenges, including higher costs for turbines, supply-chain bottlenecks and difficulties securing financing. Unlike in other countries, offshore wind contracts in the US are not usually linked to inflation, leaving developers with added exposure to fast-rising prices.

“There’s no doubt that the offshore wind industry is finding itself in a perfect storm, where adverse impacts like skyrocketing interest rates are leading to much higher capital costs and supply-chain disruptions,” Orsted Chief Executive Officer Mads Nipper said in a call Wednesday.

The Danish company, which is also the world’s biggest offshore wind builder, said it’s taking $4 billion in impairments after deciding to walk away from the Ocean Wind 1 and 2 projects in New Jersey. Shares tumbled to their lowest level in more than six years.

As part of its review of the US portfolio, Orsted will assess the potential implications of the impairments for the company’s long-term strategy, Nipper said. Still, he says he remains committed to the US wind market.

Meanwhile, BP took a pretax impairment charge of $540 million related to the development of wind parks off New York, with a top executive saying the US offshore wind industry is “fundamentally broken.” Its partner in the project, Equinor, also announced a smaller write-off last week.

“There’s a fundamental reset needed,” Anja-Isabel Dotzenrath, BP’s head of gas and low-carbon energy, said Wednesday at a conference in London.

BP is working with Equinor on “options for their US offshore wind projects to mitigate the effect of inflationary pressures and permitting delays,” she said.

Read More: A 48% Surge in Costs Wrecks Biden’s Much-Lauded Wind-Power Plans

The US is far behind Europe and China in the race to build offshore wind and is targeting a jump to 30 gigawatts by decade’s end from next to nothing now. While the White House has touted its landmark clean-energy subsidy program to kick-start projects, developers must ensure a large chunk of components are US-made to take full advantage of the incentives, and that’s proving hard to achieve.

“While macroeconomic headwinds are creating challenges for some projects, momentum remains on the side of an expanding U.S. offshore wind industry,” White House spokesman Michael Kikukawa said.

The crisis is spreading around the world, as well. In China, top turbine maker Xinjiang Goldwind Science & Technology Co. said last week that third-quarter profit tumbled 98%, while Norwegian energy giant Equinor took a $300 million impairment on East Coast projects.

Read More: World’s Top Renewable Firms Reel Even as Installations Surge

Right now, “it’s impossible to say” how long the headwinds will last, Nipper said.

“It’s not binary when the challenges for the industry will go away,” he said.

--With assistance from Jennifer A. Dlouhy and Will Wade.