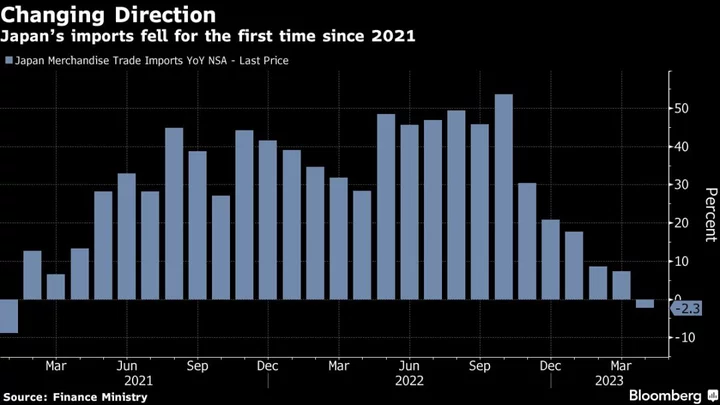

Japan’s imports fell for the first time in more than two years as commodity prices softened, cushioning the impact from a global economic slowdown that is weighing on exports.

The value of imports decreased 2.3% from a year earlier in April, led by a decline in crude oil and liquid natural gas shipments, the finance ministry reported Thursday. The reading turned negative for the first time since January 2021, and was worse than analysts’ forecast of a 0.6% decline.

Exports were up 2.6% from a year ago, driven by car shipments, and was largely in line with analyst expectations. Together they shrank Japan’s ongoing trade deficit.

The decline in imports reflect a fall in commodity prices as the impact from the Russia-Ukraine war on energy costs has lessened over time, following its record price surge last summer.

“Imports dropped largely due to a drop in raw material costs,” said Takeshi Minami, chief economist at Norinchukin Research Institute. “Japan’s economy is holding up so far so that’s not an indication of domestic demand weakening.”

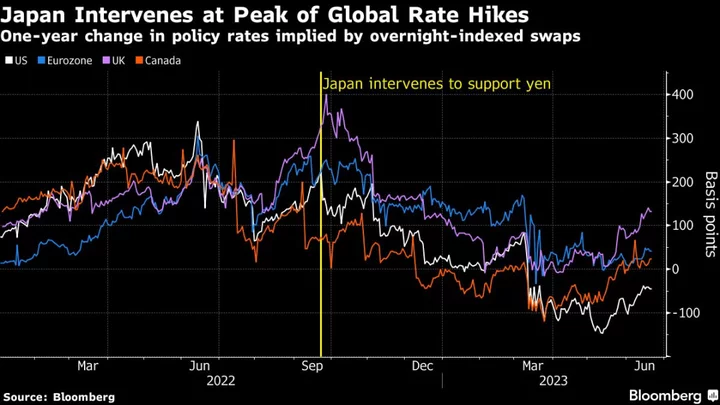

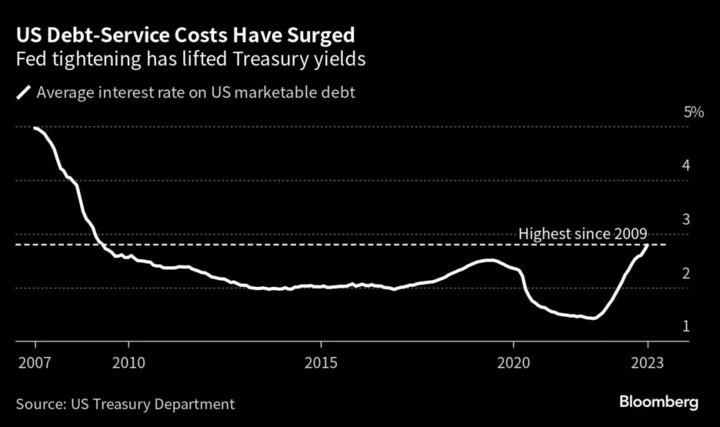

The cheaper import bill will likely help temper the effects of the global economic slowdown amid central banks’ ongoing monetary tightening. While exports continued to grow from a year earlier, they increased at the slowest pace in more than two years. The Bank of Japan’s global peers are continuing to raise interest rates, although there’s an increasing view that the rate hike cycle is heading toward an end.

“Central banks from the Fed to the ECB are coming closer to a terminal interest rate but it’s likely the rates will stay high,” said Minami. “That will cool inflation but at the same time economic growth will be stalled, affecting demand for Japan’s shipments.”

For Thursday’s trade data, the average exchange rate was 132.23 yen against the dollar, 7.6% weaker than a year ago, backing up the view that the decline in imports was commodity prices led.

What Bloomberg Economics Says...

“Continued export gains in April are another positive sign for Japan’s recovery — they suggest external demand is holding up and supply-chain disruptions are easing. Shipments should support 2Q GDP growth via two channels, by boosting the net-export component of demand and by stoking the appetite for capital investment.”

— Taro Kimura, economist

For the full report, click here

The falling import bills also helped cut Japan’s prolonged trade deficit. The trade shortfall shrank to 432.4 billion yen ($3.1 billion) in April, the smallest in over a year.

The shrinking trade deficit could provide further support for Japan’s economy, after consumer spending pushed up growth more than expected last quarter. In the three months ended March, net trade weighed on the overall figures as the shipment of cars and chip-making machinery fell.

The trade report showed exports to the US rose 10.5% compared to a year ago, while those to Europe increased 11.7%. Shipments to China continued to fall, slipping 2.9%.

China’s economic recovery is losing momentum after an initial burst in consumer and business activity early in the year, prompting calls for more policy stimulus to bolster growth.

(Updates with more details from the report, economist comments)