Bank Indonesia kept its key rate steady at a four-year high to shield the rupiah ahead of an expected US Federal Reserve tightening while offering new incentives to revitalize slowing credit expansion, signaling that it’s keeping a close eye on economic growth.

The central bank held the seven-day reverse repurchase rate at 5.75% on Tuesday, as seen by all 30 economists surveyed by Bloomberg. The key rate has been kept unchanged at that level for six straight months.

“The policy focus is oriented towards strengthening rupiah stability to manage imported inflation and mitigate the contagion effect of global financial market uncertainty,” Governor Perry Warjiyo said in Jakarta. The rupiah gained 0.2% against the dollar as of 2:58 p.m. Jakarta time. The benchmark stock index was up 0.5%.

The central bank unveiled fresh incentives to spur bank lending after growth eased to a 15-month low in June, prompting a downward revision in Warjiyo’s credit expansion forecast this year to a range of 9%-11% from a previous 10%-12%. The latest measures will add an estimated 47 trillion rupiah ($3 billion) in liquidity, enabling banks to lend more to priority sectors including commodity downstreaming, the governor said.

Indonesia’s extended pause while offering liquidity-boosting measures underscores the balancing act that policymakers must manage amid currency weakness, sluggish trade and moderating consumption.

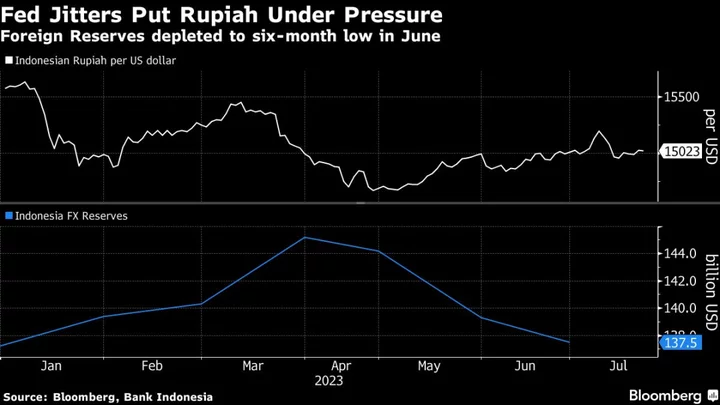

The rupiah has been one of the worst-performers in Asia this month, amid Bank Indonesia’s dollar buffer falling further to a six-month low in June and commodity prices taking a deeper tumble on exports. The BI expects two more quarter-point hikes from the Fed this week, and again in September.

What Bloomberg Economics Says...

Bank Indonesia signaled a rate cut is unlikely in the near-term. It said its focus remains on managing the rupiah. With more tightening in the pipeline from the Federal Reserve, we don’t see the case for a rate cut becoming compelling until closer to year-end, if not later.

—Tamara Mast Henderson, Asean economist

For the full note, click here

Still, the exchange rate remains manageable in line with the bank’s stabilization measures, Warjiyo said. The rupiah is poised to strengthen as global market uncertainty eases and investors weigh Indonesia’s stable inflation and steady growth. The new rule requiring natural-resource exporters to keep part of their earnings onshore starting in August should also add support, he added.

Warjiyo and his board have repeatedly said that currency stability is key to keeping consumer prices in check. The BI is confident that headline inflation, which has returned within the bank’s 2%-4% target for two consecutive months, will stay in the band for the rest of 2023. Price gains are forecast to average 1.5%-3.5% in 2024.

A rate cut doesn’t look imminent, with the central bank expecting the economy to do better in the second-quarter than it did in the previous three months. Despite global headwinds and slowing credit growth at home, Bank Indonesia retained its 2023 growth forecast at 4.5%-5.3%.

“Bank Indonesia will come in to cut rates when the economy is faltering but we are not really seeing very strong evidence of that right now,” said Mingze Wu, a foreign exchange trader at StoneX Group in Singapore. “Compared to China where PBOC is actively easing, Indonesia’s situation is much healthier in comparison.”

--With assistance from Norman Harsono, Tomoko Sato, Marcus Wong, Soraya Permatasari, Yudith Ho and Nurin Sofia.

(Updates throughout with more details from briefing.)