Shares in Asia fluctuate after US stocks ended steady on Thursday, as investors balanced cooling inflation with the prospect interest rates will remain elevated.

Australian equities pared early declines while mainland China and Hong Kong shares whipsawed after the opening bell. US equity futures gained ground after the S&P 500 eroded an early advance to close flat, while the Nasdaq 100 added 0.2%. The Kospi Index in South Korea traded slightly higher.

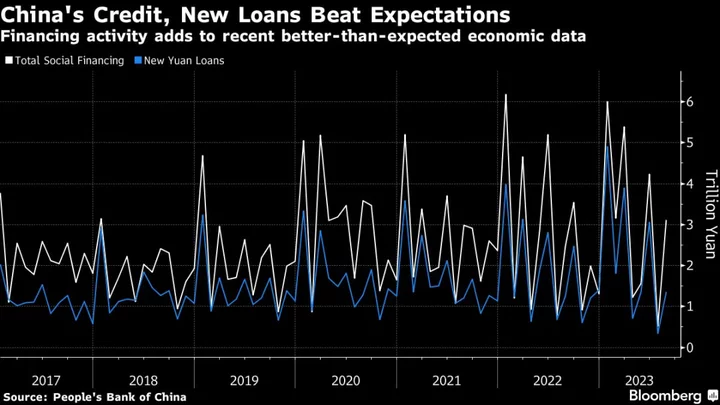

Alibaba Group Holding Ltd shares rallied after the company beat revenue forecasts. A decline for Country Garden Holdings Co. placed the company’s stocks on track for a record close. The Chinese developer expects to report a multibillion-dollar loss for the first half of this year, as it provided more specifics to its recent forecast that helped fuel stock and bond declines.

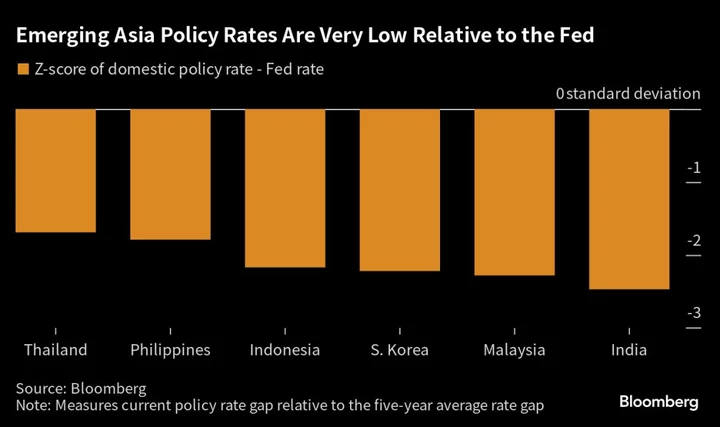

Traders will be keeping a wary eye on the yen and the key 145 level versus the dollar, with a holiday in Tokyo potentially contributing to volatility as volume thins. The persistently wide yield gap between Japan and the US is keeping the yen weak and within sight of levels that triggered intervention by the finance ministry last year.

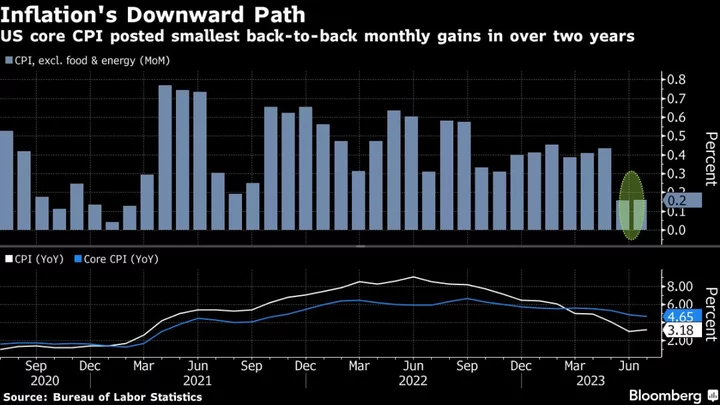

US inflation data released Thursday was broadly in line with expectations. The core measure that excludes food and energy registered the smallest back-to-back increase in more than two years, offering support to risk assets. Despite this, Francisco President Mary Daly told Yahoo! Finance the central bank still has “more work to do” to combat rising prices.

Daly’s comments weighed on Treasuries, further souring sentiment after longer-term US yields rose following a weak 30-year bond auction. The $23 billion auction was awarded the highest rate since 2011.

“The case is building for the Fed to keep policy rates unchanged in September,” said Seema Shah, chief global strategist at Principal Asset Management. “While inflation is moving in the right direction, the still-elevated level suggests that the Fed is some distance from cutting rates.”

In currencies, the Bloomberg Dollar Spot Index was flat after rising Thursday. The greenback is set to extend its weekly gains to four, the longest such streak since February. Meanwhile, the Australian dollar’s continued depreciation is starting to increase fears of inflation.

Two-year yields, which are more sensitive to imminent Fed moves, reversed an earlier slide. Yields on Australian and New Zealand bonds rose in early Asia trading. Trading of cash Treasuries in Asia and Japanese equities will be closed Friday for a national holiday in Japan.

In commodities, oil’s seven-week rally — driven by increasing signs of a tightening market — paused as technical barriers stalled further advances. European natural gas declined following its biggest jump in 17 months, as concerns about potential strikes at major export facilities in Australia affect prices.

Key events this week:

- UK industrial production, GDP, Friday

- US University of Michigan consumer sentiment, PPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 10:49 a.m. Tokyo time. The S&P 500 was little changed

- Nasdaq 100 futures rose 0.4%. The Nasdaq 100 rose 0.2%

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng was little changed

- The Shanghai Composite fell 0.3%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.1% to $1.0995

- The Japanese yen was little changed at 144.65 per dollar

- The offshore yuan was little changed at 7.2362 per dollar

- The Australian dollar rose 0.2% to $0.6531

Cryptocurrencies

- Bitcoin was little changed at $29,428.09

- Ether was little changed at $1,849.92

Bonds

- Australia’s 10-year yield advanced six basis points to 4.10%

Commodities

- West Texas Intermediate crude rose 0.4% to $83.15 a barrel

- Spot gold rose 0.2% to $1,915.47 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rob Verdonck and Brett Miller.