Chinese stocks saw volatile trading as worrying signs mount in all corners of the economy.

The Hang Seng Index, where a majority of the members are mainland firms, was down 0.2% as of 11:35 a.m. in Hong Kong. The gauge had fallen more than 2% earlier, which took losses since a January high to 21%, on course to enter a bear market. A gauge of Chinese tech stocks gained, erasing a 2.5% loss.

The mid-morning bounce was seen as technical by traders, with the market still gripped by fears that the slump in the property sector may snowball into a bigger systemic crisis. Steps to boost the market including an interest-rate cut and authorities asking funds to avoid net selling equities have done little to revive sentiment, as investors see no easy fix to the Chinese economy’s ailments.

“The contagion risks from the real estate sector and trust defaults are a big concern,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “The economy is clearly struggling and it increasingly looks like the government may not have the tools to arrest it.”

READ: China Leaders Vow to Lift Consumption Without Detailing How

The picture emerging from property agents and private data providers suggest the slump in the real estate market may be worse than official reports show. In the latest effort to boost confidence, China’s top leaders pledged to expand domestic consumption and support the private sector in a Wednesday statement, but again lacked details on any new stimulus measures.

Morgan Stanley became the latest investment bank to cut its forecasts for China’s economic growth, citing weaker investment due to the property market slump and local government financial stress. It now sees gross domestic product expanding 4.7% this year, below Beijing’s target.

Analysts pointed to excessive selling in recent days to explain the bounce Thursday morning. The Hang Seng Index saw five sessions of consecutive losses and its relative strength index is around 33, close to the level of 30 that suggests shares are oversold. The gauge is among the year’s worst performers in 92 major indexes tracked by Bloomberg, having lost 8%.

“It’s not unreasonable to think a bounce would happen easily given seller exhaustion,” said Derek Tay, head of investments at Kamet Capital Partners Pte.

Meanwhile, the CSI 300 benchmark fluctuated, falling as much as 0.9% before erasing most of the loss. Foreign investors were on track to offload Chinese shares via links with Hong Kong for a ninth straight session, which would tie a record selling streak.

Some exchange-traded funds, however, have seen inflows despite the broader market weakness. The Huatai-Pinebridge CSI 300 ETF, which tracks the onshore benchmark, has seen positive flows in all but one day this month, according to data compiled by Bloomberg.

“China indexes are at critical levels today which have acted as a floor for much of the year,” said Marvin Chen, a strategist for Bloomberg Intelligence. “A break lower may suggest another significance setback in confidence, which policy rhetoric alone may not be able revive until macro data shows signs of its effectiveness.”

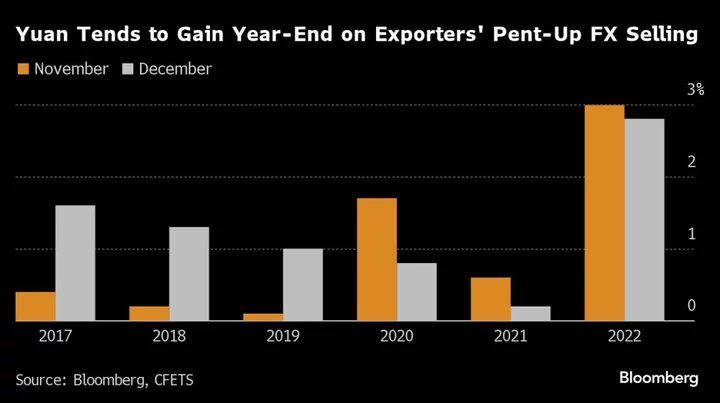

Authorities on Thursday ramped up efforts to stem losses in the currency market by offering the most forceful guidance since October through its daily reference rate for the yuan. The attempted boost for the currency came as broad dollar strength combined with evidence of China’s sluggish economy helped push the onshore yuan toward a 16-year low on Wednesday.

--With assistance from Ishika Mookerjee, Abhishek Vishnoi and Jeanny Yu.