Major banks are facing one of the biggest regulatory overhauls since the financial crisis, setting up a clash with Wall Street over the amount of capital that they have to set aside to weather a crisis.

The Federal Reserve’s top banking regulator, Michael Barr, said that he wants banks to start using a standardized approach for estimating credit, operational and trading risks, rather than relying on their estimates. He also said that the Fed’s annual stress tests should be re-jiggered to better capture dangers that firms can face.

The plans laid out by Barr on Monday follow a months-long review of capital requirements for banks, a politically sensitive topic that became a lighting rod after several banks collapsed this year. Barr said that his examination found that although the current system overall was sound, several changes were needed that will result in more money that banks need to set aside as a cushion to protect against losses.

“These changes would increase capital requirements overall, but I want to emphasize that they would principally raise capital requirements for the largest, most complex banks,” he said in remarks prepared for a speech at the Bipartisan Policy Center in Washington. “We intend to consider comments carefully and any changes would be implemented with an appropriate phase-in,” he said, adding that most banks already have enough capital to meet the new requirements.

Basel III

Since taking the job last year, Barr has been reviewing bank capital requirements to put in place regulations that align with Basel III. From the beginning, he has signaled that he supports tougher restrictions for bigger, systemically important lenders than smaller institutions.

Barr said that his plans will only take effect if they’re proposed and approved by the Fed, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency. An initial plan could be released as soon as this month, but actual changes would not likely take effect for months or years. Industry will also have a chance to weigh in.

“The proposed rules would end the practice of relying on banks’ own individual estimates of their own risk and instead use a more transparent and consistent approach,” he said.

Under the plan, Barr said that the “enhanced capital rules” should apply to banks and bank holding companies with more than $100 billion in assets. Currently, such restrictions apply to firms that are globally active or have $700 billion or more in assets, he said.

Industry Pushback

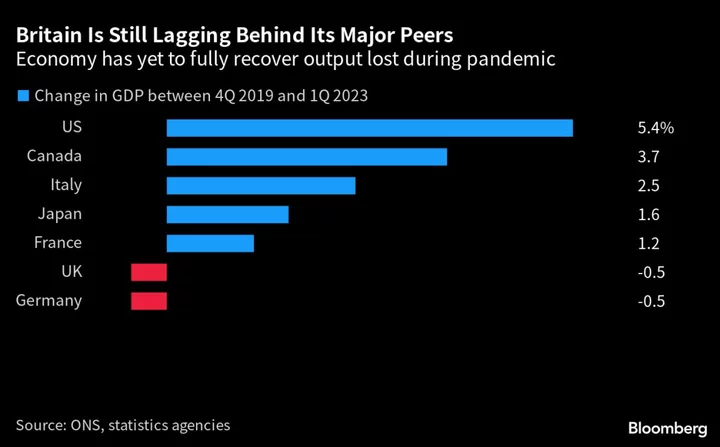

The long-awaited BASEL III reforms to bank capital levels are part of an international overhaul of capital rules that started more than a decade ago in response to the financial crisis of 2008. The issue became more stark — and political — this year with the collapse of several banks. The top US banks are already subject to higher requirements than their European peers, according to the European Central Bank, which oversees lenders in the euro area. Despite that disadvantage, US securities firms were able to win market share from European competitors in previous years.

Barr acknowledged concerns that the changes in capital requirements could lead to banks altering their behavior, as well as the way that financial services are provided. But he said most banks already have sufficient capital today to meet new mandates. As for the rest, he estimates that they would be able to build enough capital through retained earnings in less than two years, “even while maintaining their dividends.” That assumes that they earn money at the same rate as in recent years.