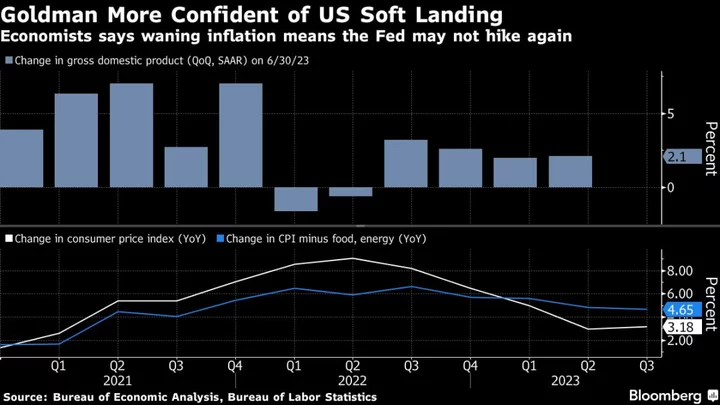

Goldman Sachs Group Inc. now sees a 15% chance the US will slide into recession, down from 20% previously as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates any further.

“First, real disposable income looks set to reaccelerate in 2024 on the back of continued solid job growth and rising real wages,” Jan Hatzius, chief economist at Goldman, said in a research note. “Second, we still strongly disagree with the notion that a growing drag from the ‘long and variable lags’ of monetary policy will push the economy toward recession.”

He sees the drag from policy tightening continuing to diminish “before vanishing entirely by early 2024.”

Hatzius’s 15% recession estimate is well below a Bloomberg consensus of 60%. Goldman is also more optimistic than peers on US economic growth, predicting an average 2% pace through the end of 2024. Hatzius said a September rate rise by the Fed was “off the table” and the hurdle for a November hike is “significant.”

BofA Joins Fed in Reversing Recession Call Amid Growing Optimism

“On net, our confidence that the Fed is done raising rates has grown in the past month,” he said, adding higher unemployment, slowing wage growth and lower core prices should help Fed members remain on hold.

“That said, Fed officials are unlikely to move quickly toward easier policy unless growth slows more than we are forecasting in coming quarters,” Hatzius added. “We therefore expect only very gradual cuts of 25-bps per quarter starting in 2024Q2.”