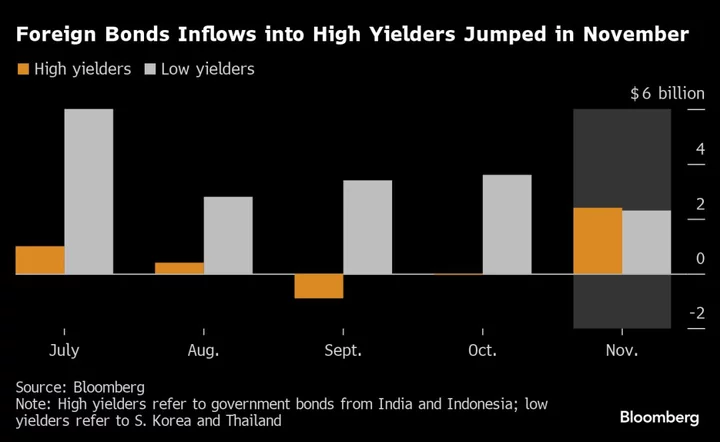

Higher-yielding Asian bonds are drawing more foreign inflows than their lower-yielding counterparts thanks to expectations of a Federal Reserve policy pivot.

Foreign funds poured a combined $2.7 billion into Indonesia and India’s bonds in November, the most since January, while net inflows into South Korea and Thai notes fell to $2.6 billion, the lowest in nine months. That’s after worries about higher-for-longer Fed rates spurred a global investor exodus across the region.

Signs that the Fed may start easing its policy next year are weakening the dollar and burnishing the appeal of Asia’s high yielders as investors are more inclined to purchase them without currency hedging. In comparison, the returns after hedging low-yielding notes have become less alluring.

For instance, dollar-won one-year basis swaps have narrowed to minus 68 basis points in November, the tightest since March, making it less favorable for investors to offer dollars in exchange for the won.

Lower US yields and the easing dollar is encouraging offshore flows into high yielders such as India and Indonesia, according to Kiyong Seong, lead Asia macro strategist at Societe Generale SA in Hong Kong. However “tighter won cross-currency basis would be disadvantageous for foreign bond inflows into Korea, as large chunks tend to be FX-hedged,” he added.

While benchmark rates in Indonesia and India offer an upside of around 50- and 100-basis points over the Fed fund rate, those in South Korea and Thailand are at a discount of 200- and 300-basis points below the key Fed rate. The Bank of Korea held rates at 3.50% on Thursday, while signaling that its highly cautious stance on policy is softening.

Even though the dollar-won basis swap has narrowed, it could shrink further if investors price in a more dovish move from the Fed next year.

Country-specific factors have also been impacting inflows into Indian and Thai bonds.

Foreign funds have made a beeline for Indian bonds after JPMorgan Chase & Co. in September became the first global index provider to include rupee notes into its emerging-market index. Investors are now watching if FTSE Russell, another major index provider, will also include rupee bonds in its emerging market gauge.

In comparison, global funds have only slowly returned to Thai bonds, with net foreign bond inflows of around $903 million in October and November so far, in comparison to the outflow of $1.7 billion in the two previous months, as global investors remain cautious over the government’s cash handout plan which will largely be funded by the nation’s borrowings.

(Updates inflows data in second paragraph and Bank of Korea policy decision in sixth paragraph.)