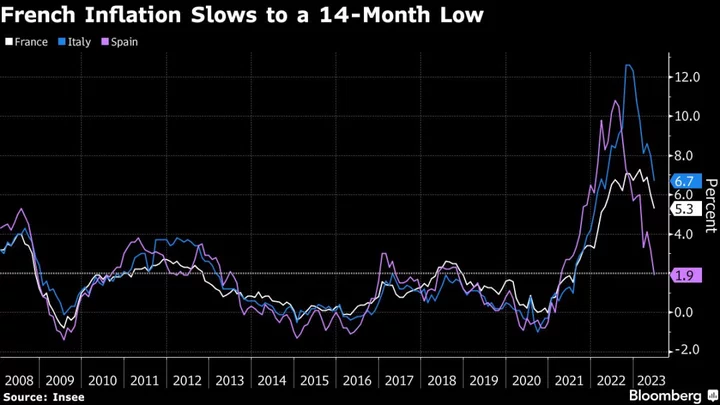

French inflation eased more than anticipated, reaching its lowest level in a year in a boost to those at the European Central Bank who say interest-rate increases can soon end.

The measure of annual consumer-price changes in the euro zone’s second-largest economy softened to 6% in May from 6.9% in April, data Wednesday showed. That’s a sharper slowdown than the 6.4% gain economists surveyed by Bloomberg had estimated.

The result came thanks to a softening of price gains across sectors, particularly in energy. Manufactured goods and services inflation, which are keenly watched by ECB officials, also moderated to 4.1% and 3%, according to the Insee statistics agency.

The data follow a larger-than-expected dip in Spanish inflation in May and are part of a raft of releases from the region’s top economies. Germany will publish its figure for this month later Wednesday, with early regional figures pointing to a similar retreat in price gains. The 20-nation euro area reports on Thursday.

Money-market traders trimmed bets on the path of future rate increases, and are no longer fully pricing another 50 basis points of hikes this year. German bonds rallied, with two- and five-year yields falling as much as 10 basis points. The euro held losses, trading near a two-month low of $1.0673 touched Tuesday.

While the retreat in headline price growth will be welcomed by both the ECB and France’s government, underlying pressures aren’t abating as quickly and continue to be a headache for both.

Bank of France Governor Francois Villeroy de Galhau said last week that core inflation is “showing persistence,” and services will likely become the dominant force driving prices.

Speaking earlier Wednesday, fellow ECB Governing Council member Madis Muller said there’ll probably be more than one more quarter-point rate hike, warning that underlying inflation “unfortunately shows no signs of slowing yet.”

In France, the rising cost of living is proving trickier for President Emmanuel Macron to alleviate than the spike in energy costs was. As part of a campaign to narrow profit margins, the Finance Ministry has pressured large food companies to renegotiate prices and supermarkets.

In a separate release, Insee said consumer spending fell 1% in April as households cut back on food and energy outlays. Economists polled by Bloomberg had expected a 0.3% increase.

--With assistance from Joel Rinneby and Ainhoa Goyeneche.

(Updates with German data, market reaction, ECB’s Muller starting in fourth paragraph.)