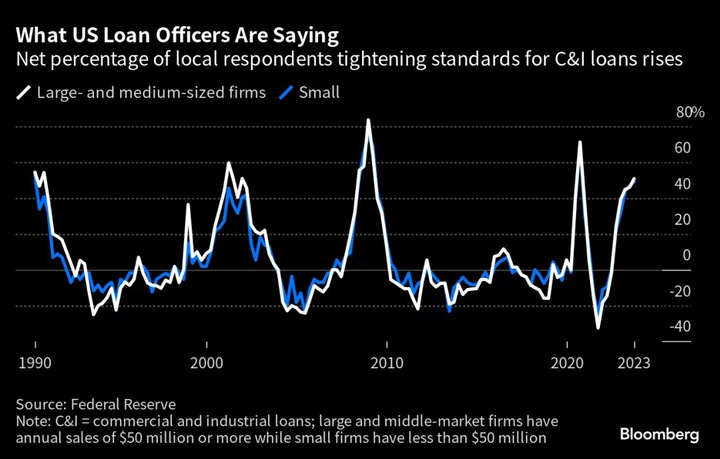

The Federal Reserve said that banks reported tighter standards and continued weak demand for loans in the second quarter, extending a trend that began before recent stresses in the banking sector emerged.

The proportion of US banks tightening terms on commercial and industrial loans for medium and large businesses rose to 50.8%, up from 46% in the first quarter, according to a Fed survey of lending officers released Monday.

The collapse of four US regional banks since March sparked turmoil in the financial sector and increased concerns that lenders would rein in access to credit in a way that could tip the US economy into a recession. Recent data, including last week’s report of greater-than-expected growth, have shown the economy has been resilient in the face of the turmoil.

“The tightening in lending standards generally intensified,” JPMorgan Chase & Co. economist Daniel Silver said in a report. The historically tight data “are not a guarantee of a recession to come, but the tightening evident as of late suggests that the economy should slow.”

Credit Demand

The survey also showed low demand for credit persists despite some improvement. The share of banks reporting weaker demand for commercial and industrial loans among large and mid-sized firms fell to 51.6%, from 55.6% in the first quarter.

The figures in the survey are calculated as net percentages, or the shares of banks reporting tighter conditions or stronger demand minus the proportion of banks reporting easier standards or weaker demand.

The poll — known as the Senior Loan Officer Opinion Survey, or Sloos — showed banks expecting to further tighten standards on all types of loans, citing a less favorable or more uncertain economic outlook and expected deterioration in collateral values and the credit quality of loans as reasons.

There was a particular concern by banks over commercial real estate following struggles by office-building owners in the wake of increased remote work due to Covid-19 and higher interest rates.

The net percentage of banks reporting tighter standards on construction and land development loans was 71.7%. It was 68.3% on nonfarm, nonresidential loans, according to the survey.

Overall, the data in the survey are “at least consistent with the tightening in credit that the Fed has been aiming to achieve with raising rates – although credit was still tightening from easy levels so the overall impact on activity is less clear,” said Veronica Clark, an economist at Citigroup Inc.

The US central bank raised interest rates last week for the 11th time since March 2022, bringing the target on its benchmark rate to 5.25% to 5.5%. The Federal Open Market Committee will make decisions on possible future hikes meeting by meeting, Fed Chair Jerome Powell said in a press conference Wednesday.

In a preview of the Fed survey, Powell said “it’s broadly consistent with what you would expect. You’ve got lending conditions tight and getting a little tighter, you’ve got weak demand, and you know, it gives a picture of a pretty tight credit conditions in the economy.”

“I think it’s really hard to tease out whether how much of that is from this source or that source, but I think what matters is the overall picture is of tight and tightening lending conditions,” he said.

(Updates with comment from economist in fourth paragraph.)