Japan’s economy expanded at a faster pace than expected as a further easing of pandemic regulations boosted consumption, a positive outcome that will likely keep speculation simmering of a possible early election and potential central bank policy change.

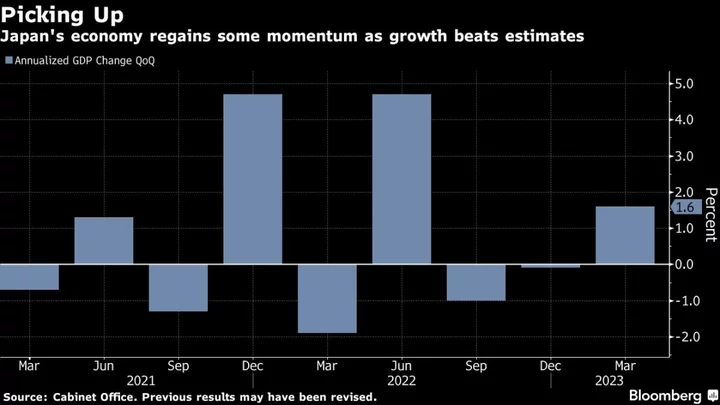

Gross domestic product expanded at an annualized pace of 1.6% in the first three months of the year, exceeding analyst expectations, Cabinet Office data showed Wednesday. A revision of earlier figures also showed Japan went through a technical recession at the end of last year.

Better-than-expected spending by consumers and businesses was the main driver behind last quarter’s growth, while net trade dragged on the overall figures as shipments of cars and chip-making machinery fell.

The stronger-than-forecast reading bodes well for the nation’s economic recovery and could give Prime Minister Fumio Kishida more leeway to consider an early poll. The Japanese leader is hosting Group of Seven leaders in Hiroshima this week and a successful summit could give his support ratings an additional lift.

“Politically this is good timing,” said Hiroaki Muto, economist at Sumitomo Life Insurance Co. “It’s kind of a sweet spot. Overseas economies are still just about holding up while Japan’s economy is recovering on post-Covid revenge spending. It’s a good environment for calling an election.”

An economy growing faster than expected despite a global downturn may also offer some reassurance to the Bank of Japan as freshly installed Governor Kazuo Ueda mulls the sustainability of growth in the economy, wages and prices. Some market players and economists are expecting Ueda to tweak policy before a review he called in April is completed.

“This result is stronger than the level seen by the BOJ and is one step closer to a policy change,” said Atsushi Takeda, chief economist at Itochu Research Institute. “The question is whether the BOJ will revise its price outlook after confirming that the economy will continue to expand beyond April.”

The world’s third largest economy faces both headwinds and tailwinds as it aims to gain more momentum toward a robust post-pandemic recovery. Earlier this month, the government lowered its classification of Covid-19 to be on par with seasonal flu.

At home, stronger wage growth and additional price relief measures by the government are supporting consumption. But it remains to be seen if paychecks can keep up with the pace of inflation that is so far proving stickier than expected.

Downside risks mainly stem from slowdown concerns over the global economy in the wake of higher interest rates to cool inflation. Weaker overseas demand will likely hurt exports from Japan and will be a source of concern for internationally focused companies considering capital investment. Wednesday’s data showed net trade dragged more than estimated on last quarter’s growth as exports fell for the first time in six quarters.

Japan’s economy has been alternating between growth and contraction with its post-pandemic recovery trailing that of its global peers. Since the start of 2021, Japan’s economy has contracted five times out of nine quarters.

Inflation has remained above the BOJ’s 2% goal for a while, but Ueda expects it to fall back below that level later this fiscal year as cost-push factors in energy and commodities fade.

Still, the focus for now will remain on Kishida’s plans following the G-7 summit.

“Japan’s economy is finally recovering, led by domestic demand,” said Hideo Kumano, an economist at Dai-Ichi Life Research Institute. “If growth stays above 1% in the second quarter, that will mean we are heading for an environment where companies can raise wages again next year. That will be a political achievement for Kishida and he may be able to consider an election.”

--With assistance from Yusuke Miyazawa, Ryotaro Nakamaru, Tomoko Sato, Keiko Ujikane and Emi Urabe.

(Updates with more details from the report, economist comments)