European stocks gained, erasing an earlier decline, as Anglo American Plc helped lift the gauge while investors digested a slew of earnings reports.

The Stoxx 600 Index gained 0.2% by 1:41 p.m. on Thursday, with the basic resources sector leading gains, while tech stocks lagged after Taiwan Semiconductor Manufacturing Co. cut its outlook.

Anglo American gained after the precious metals miner’s production for the second quarter beat the average analyst estimate. Other miners, such as Glencore Plc and Rio Tinto Plc also rose. Meanwhile, Hikma Pharmaceuticals Plc surged on expectations that it may help fill a production gap after a Pfizer Inc. plant was struck by a tornado, potentially worsening the drug shortage in the US.

ASML Holding NV led the selloff in European tech stocks after TSMC warning showed investors that the global electronics slump may persist for some time despite a boom in AI development. Tech behemoths in the US were also sliding with futures on the Nasdaq 100 down 0.7% after Netflix Inc. and Tesla Inc. earnings.

“There is a risk of consolidation in the tech sector given this year’s performance and there’s probably a shortage of juice for stocks to go higher now,” Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux said in a phone interview.

Among other stocks, Electrolux AB declined the most on record after the Swedish home appliance maker said it plans to offload various non-core brands worth about $1 billion as losses continued to mount. EasyJet Plc shares slipped as investors turned their attention to the remainder of the year after the low-cost airline’s third-quarter results beat estimates.

For the time being, European equities are trading sideways before central bank meetings next week increase volatility again, said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. Markets are digesting mixed earnings, Urbahn added. “The focus will be on the reporting season this week and the central banks next week,” he said.

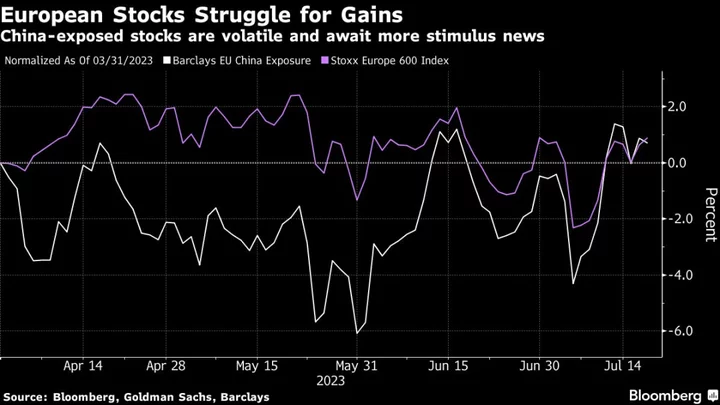

The latest pledges from China to rebuild a shattered private sector fell flat with investors, who said more concrete steps would be needed to boost sentiment.

For more on equity markets:

- Looking to China for Next Leg Higher Carries Risks: Taking Stock

- US Stock Futures Fall as Tesla, Netflix Slide After Earnings

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.