Taiwan’s central bank kept its key rate on hold for the first time since 2021 at its board meeting Thursday, signaling a shift in policymakers’ priorities away from inflation to bolstering the flagging economy.

The monetary authority maintained its benchmark rate at 1.875%, its first pause since December 2021, in line with the forecasts of 20 out of 24 economists surveyed by Bloomberg.

Officials highlighted concerns about the economy as they downgraded their outlook for full-year growth to 1.72% from their previous forecast of 2.21% in Thursday’s statement, citing weak exports and investment.

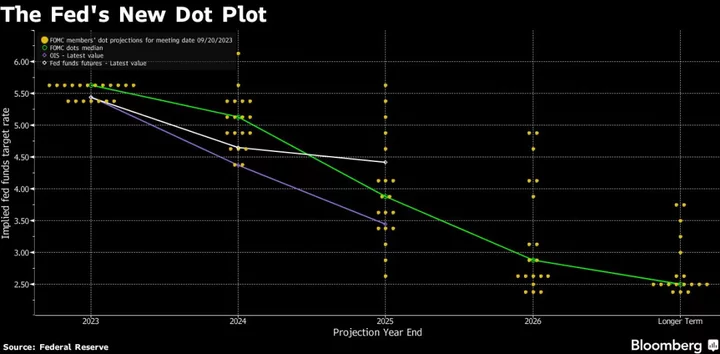

Taiwan policymakers had hiked at their five most recent meetings, but the Federal Reserve’s decision to hold rates unchanged Wednesday and lower-than-expected inflation data for May eased pressure for another rise in borrowing costs.

Taiwan’s economy is also in recession, shrinking 2.9% in the January-to-March period, the worst performance since the global financial crisis, according to data released late May, when the government cut its growth outlook.

Taiwan policymakers would have faced a conundrum if the Fed had hiked its target rate of 5% to 5.25% overnight. That would have potentially increased outflows from the Taiwan dollar to the greenback, pushing up the cost of imports. As it is, the Fed warned there may be more tightening to come.

--With assistance from Samson Ellis.

(Updates with rate decision.)

Author: Jennifer Creery, Chien-Hua Wan and Betty Hou