Egypt unexpectedly resumed its cycle of monetary tightening, seeking to tame inflation that’s running at an all-time high.

The central bank’s Monetary Policy Committee raised the deposit interest rate by 100 basis points to 19.25% and the lending rate to 20.25%, according to a statement Thursday. Rates are now the highest since at least 2006, and above the previous peak reached during the currency crisis of 2016-2017.

Of 11 economists surveyed by Bloomberg, only BNP Paribas SA correctly predicted the hike, with the rest seeing no change.

The increase comes after inflation in the Middle East’s most populous nation hit an annual 35.7% in June. Still, the decision was a surprise because most analysts expected there’d be no further hikes until Egypt built up its foreign-currency buffers enough to manage another currency devaluation.

The rate move is still unlikely to “be followed by an immediate FX adjustment,” according to Morgan Stanley.

“We think that the authorities will likely wait until they see more FX inflows related to the announced IPOs and a strong tourism season before letting the currency adjust,” Morgan Stanley economists including Alina Slyusarchuk said in a report. “This reflects an aim to contain the size of the potential FX adjustment and spillovers to inflation and fiscal accounts.”

Read More: Egypt Can’t Stand More Price Hikes After Pound Float, Sisi Says

Consumer costs in the North African nation are bearing the brunt of three devaluations of the pound since early 2022. The central bank targets inflation of 5%-9% by the fourth quarter of next year, and the government has said tackling soaring costs is a top priority.

Containing Pressures

“Given the balance of risks surrounding the inflation outlook, the MPC judges that a policy rate hike of 100 basis points is warranted in order to contain the inflationary pressures and anchor inflation expectations around the CBE’s targets,” the central bank said in its statement.

The regulator has now raised rates a combined 11 percentage points since March 2022.

The MPC “judges that inflation rates are likely to peak in the second half of 2023 before beginning a disinflation path towards the CBE’s pre-announced targets afterwards, supported by the cumulative monetary policy tightening to date,” it said.

All the same, central bank Governor Hassan Abdalla’s April comments that tighter policy could do little to contain price growth stemming from supply issues also suggested a raise was unlikely.

President Abdel-Fattah El-Sisi warned in June about the impact of currency devaluations on rising prices, saying the nation of over 100 million won’t be able to tolerate much more weakening of the pound.

The currency has been allowed to lose half its value since early last year, helping Egypt secure a $3 billion International Monetary Fund rescue package. But despite a pledge to shift to a flexible exchange rate, it has been trading at around 30.9 per dollar at local banks for months, significantly lower than its black-market value of 38.

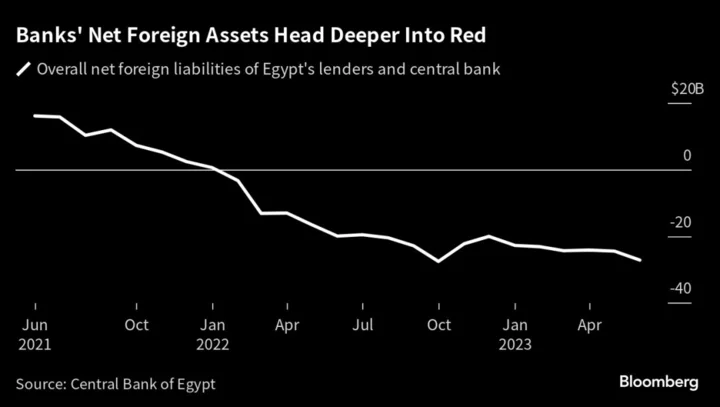

Read More: Egypt Currency Squeeze Sinks Bank Foreign Buffers to New Low

The approach has come at a cost, draining the economy of foreign exchange. Net foreign liabilities of commercial banks hit an all-time high in June.

Egypt is now focusing on securing new foreign-currency inflows vital for an economy in the throes of its worst crisis in years.

Authorities target finalizing $1.9 billion of previously announced state-asset sales with local firms and Abu Dhabi wealth fund ADQ this month and receiving the proceeds by September, CNN Arabic reported July 28, citing an unidentified official.

The IMF has said authorities should “use the monetary policy instruments” at their disposal — especially interest rates — to rein in prices. There could be a “high social cost” if inflation stays high, the fund said in April.

--With assistance from Harumi Ichikura and Abdel Latif Wahba.

(Updates with economist comment starting in fifth paragraph.)