Oil headed for a sixth straight weekly gain, the longest winning streak in more than a year, after OPEC+ heavyweights Saudi Arabia and Russia extended production cuts into next month and US stockpiles sank by a record.

West Texas Intermediate climbed toward $82 a barrel, taking gains over the six-week span to about 18%. Saudi Arabia said Thursday it would extend its unilateral 1 million barrel a day oil output cut into September, and that the move could be prolonged further or even deepened. Russia will also extend its cut into next month, although it tapered the size of the reduction.

The US, meanwhile, posted the largest-ever drawdown of crude inventories last week as holdings contracted by more than 17 million barrels, providing further evidence of a tightening market. That helped WTI’s timespreads to strengthen, with the gap between the two nearest December contracts rising toward $6 a barrel in backwardation from about $3 a month ago.

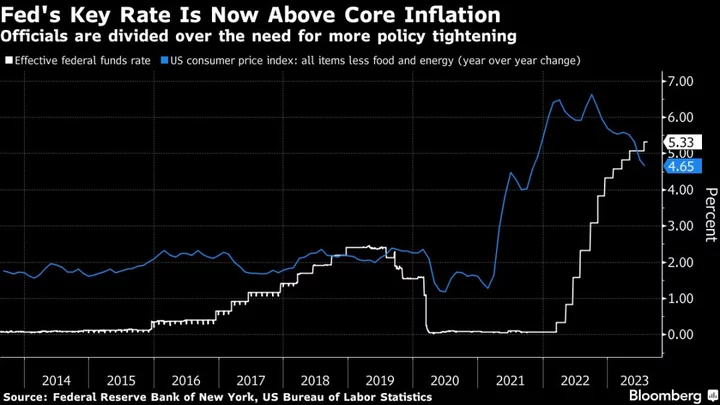

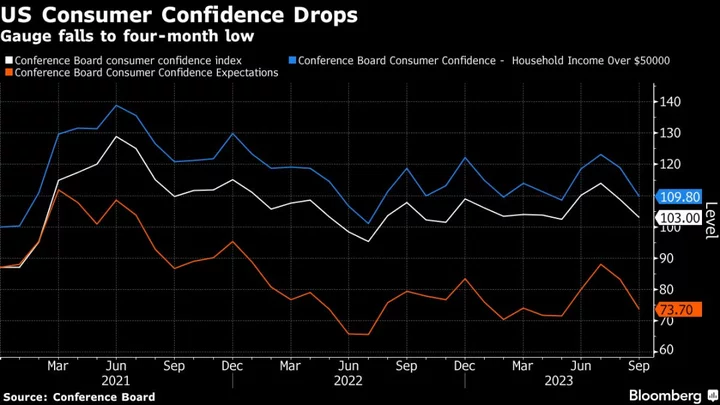

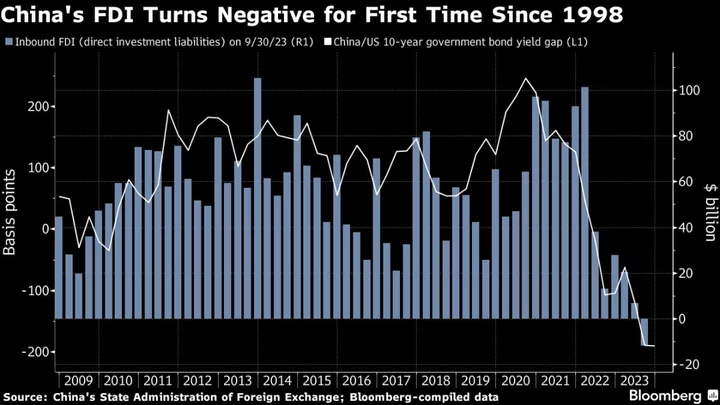

Crude’s rally means futures in New York have now erased all their year-to-date losses amid rising expectations — including from Bank of America Corp. — that the US won’t slide into recession despite the Federal Reserve’s rate-hiking campaign. Still, doubts about China’s lackluster recovery remain a challenge for the outlook despite Beijing’s efforts to revive growth.

To reverse a first-half slump, the Organization of Petroleum Exporting Countries and its allies delivered a collective reduction in supply, which Saudi Arabia and Russia augmented with the additional voluntary cuts that have just been extended. Later Friday, an OPEC+ committee is due to review the market.

“These supply cuts are finally tightening the oil market, especially at the time of peak summer demand,” said Charu Chanana, market strategist at Saxo Capital Markets Pte, referring to the OPEC+ curbs.

Goldman Sachs Group Inc. estimated this week that global oil consumption expanded to a record in July, outpacing supplies and putting the market in a deficit. ANZ Group Holdings Ltd., meanwhile, said supply cuts were tightening up the market and Brent could rally to $100 a barrel by year-end.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.