Bond investors are having to regroup after this week’s Federal Reserve meeting dealt a crippling blow to a strategy that many on Wall Street had banked on at the start of the year.

Back then, wagering that short-term yields would decline relative to longer-term ones seemed a sure bet with the Fed expected to finally stop its aggressive hiking cycle and pivot to cuts later in the year. Now, after the central bank upped its projection for interest rates this year by a half-point, the once-popular yield-curve steepening strategy is being abandoned.

“The steepener is a challenging trade,” said Michael de Pass, global head of linear rates at Citadel Securities, adding it’s not the time to put on this trade. “It’s expensive and crowded.”

Policymakers will have ample opportunity to reinforce their message, with officials, including Chair Jerome Powell, scheduled to speak in the coming days. Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin weighed in Friday, saying rates may have to rise further to tame price pressures.

While the Fed paused on Wednesday following 15 months of interest-rate hikes, the median projection in the so-called dot plot showed they expect borrowing costs to rise to 5.6% by year end, up from 5.1% in March. The Fed’s current range is 5% to 5.25%.

That hawkish outlook prompted traders to all but price out rate cuts later this year, with policy-sensitive short-term yields rising faster than longer tenors and further upending the steepening trade.

Now, two-year yields around 4.71% are 95 basis points above the 10-year rate, a level that was last exceeded in early March, before the onset of regional bank turmoil unleashed a bout of steepening. In the futures market this week, large block trades also pointed to investors either unwinding steepeners or adding to new flattener positions.

Late last year, strategists envisioned a much different scenario. In their outlooks released in late 2022, analysts at banks including Citigroup Inc., JPMorgan Chase & Co and Morgan Stanley had all anticipated the yield curve to steepen, betting the labor market would soften, inflation ebb and the Fed end its tightening cycle.

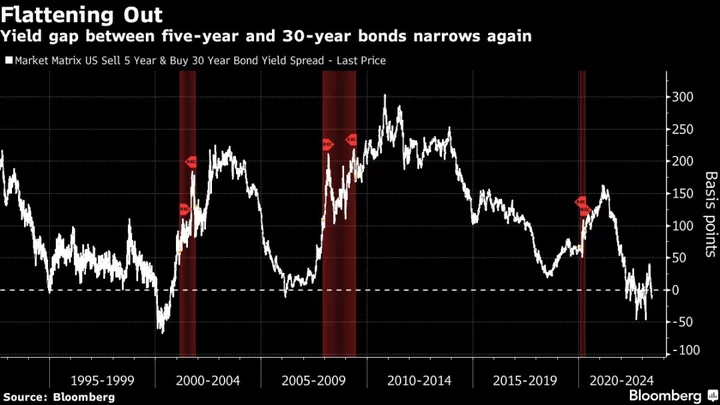

That scenario even looked promising in early March, with the collapse of Silicon Valley Bank prompting traders to bet on rate cuts as early as July. By mid-May, the five-year and 30-year curve — a popular trade — had steepened more than 80 basis points from its most inverted level since the turn of the century.

Unwinding Positions

But since then, stability in the banking sector, a resilient labor market and stubbornly high inflation have put rate hikes back on the table, flattening the five- to 30-year curve by about 55 basis points.

Clients are reducing exposure to interest-rate risk, said Jason Bloom, head of fixed income, alternatives, and ETF strategies at Invesco, noting their confidence in lower borrowing costs is “waning.”

With limited major economic data slated, Fed speakers will be center stage in the upcoming week. On Wednesday, Powell appears before the House Financial Services Committee. Fed governors including Waller and Michelle Bowman will also take the podium, as well as regional Fed presidents including New York’s John Williams and Cleveland’s Loretta Mester.

Ian Lyngen, though, isn’t ready to give up on the steepener. The head of US rates strategy at BMO Capital Markets sees the recent move as an opportunity to add to the position as the economy loses momentum.

“While it may be a resurgent regional banking crisis that offers the impetus, there is no shortage of potential triggers for less aggressive Fed pricing” Lyngen wrote in a note to clients, highlighting the market pricing out cuts in 2023 and two-year yields in outright terms within “striking distance” of the cycle highs.

What to Watch

- Economic data calendar

- June 19: NAHB Housing Market Index

- June 20: Housing starts; Philadelphia Fed non-manufacturing activity index

- June 21: MBA mortgage applications

- June 22: Chicago Fed national activity index; current account balance; jobless claims; existing home sales; leading index; Kansas City Fed manufacturing activity index

- June 23: Preliminary S&P Global US manufacturing and services PMIs; Kansas City Fed services activity

- Federal Reserve calendar

- June 20: St. Louis Fed President Jim Bullard, New York Fed President John Williams and Fed Vice Chair Michael Barr speak

- June 21: Fed Chair Jerome Powell delivers semi-annual congressional testimony before the House Financial Services Committee; Chicago Fed President Austan Goolsbee speaks

- June 22: Powell continues his congressional testimony before Senate Banking Committee; Fed Governor Christopher Waller, Fed Governor Michelle Bowman, Cleveland Fed President Loretta Mester and Richmond Fed President Tom Barkin speak

- June 23: Bullard and Mester speak

- Auction calendar

- June 20: 26- and 13-week bills; 42-day cash management bills;

- June 21: 17-week bills; 20-year bond reopening

- June 22: 4- and 8-week bills; 5-year TIPS reopening

--With assistance from Elizabeth Stanton and Edward Bolingbroke.