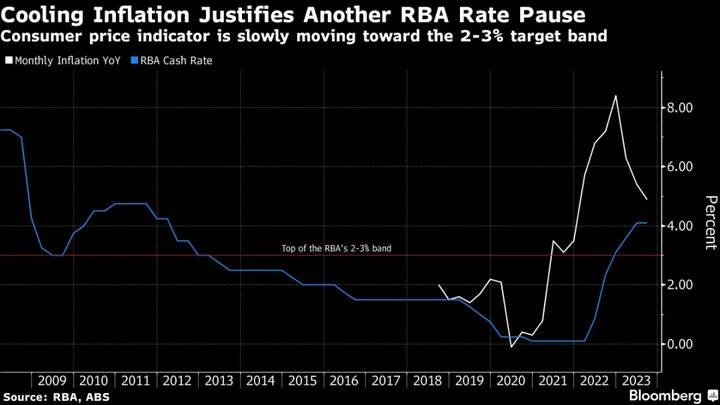

Australia’s central bank kept its key interest rate unchanged and maintained a tightening bias as Governor Philip Lowe wrapped up his final meeting at the helm with inflation in retreat.

The Reserve Bank held its cash rate at 4.1% for a third straight meeting on Tuesday in a decision widely anticipated by markets and economists. The consecutive pauses imply a higher hurdle for any further hikes and suggest a surprise shift in economic data will be needed to prompt additional tightening.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will continue to depend upon the data and the evolving assessment of risks,” Lowe, whose seven-year term ends on Sept. 17, said in his post-meeting statement.

The Australian dollar was little changed after the decision, trading at 64.30 US cents at 2:31 p.m. in Sydney.

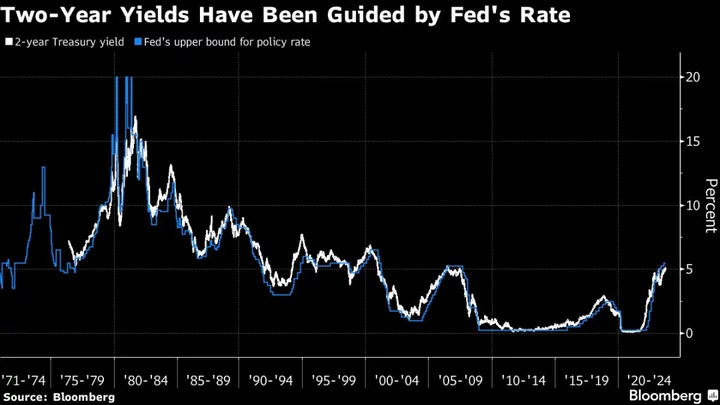

Lowe has moved at a slower pace than most of his major counterparts, reflecting rapid pass-through of hikes to Australian borrowers who are mainly on floating-rate mortgages, as opposed to the typical US 30-year fixed rate. His judgment call of 4 percentage points of hikes compared with the Federal Reserve’s 5.25 appears to be paying off with inflation now steadily cooling.

Figures last week showed a faster-than-expected slowing in monthly inflation even as Australia’s job market — like many in the developed world — shows surprising resilience.

The long and variable lags associated with monetary policy are another reason the RBA is moving cautiously. The ongoing expiry of a batch of home loans fixed at record low rates during the pandemic remains a cloud on the horizon.

Underscoring the need for caution, Australian households remain among the most leveraged in the developed world, with a debt-to-income ratio of 188%.

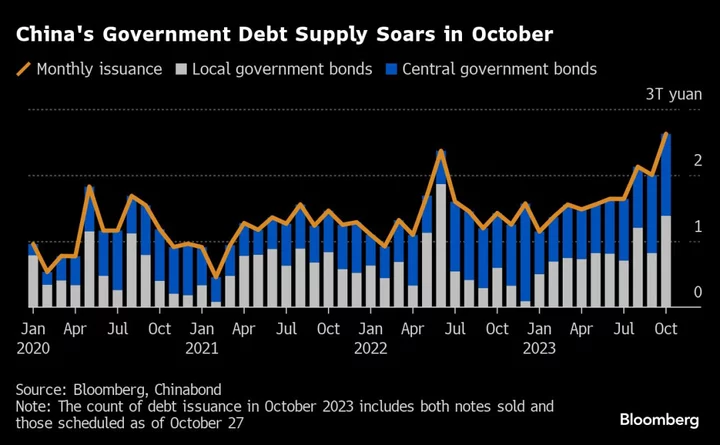

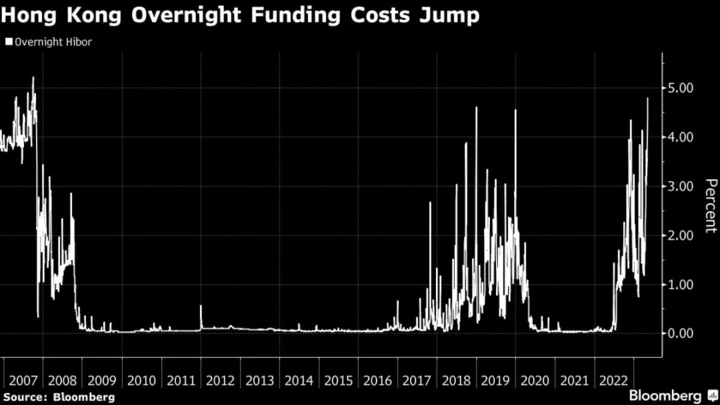

There are also concerns offshore as China, Australia’s biggest trading partner and a key driver of the global economy, is engulfed in a housing crisis. Weaker Chinese demand is flowing through to key commodity prices like iron ore and coal that generate much of Australia’s wealth.

Even so, economists expect the RBA will need to increase borrowing costs at least one more time to 4.35%, pointing to the nation’s ultra-low unemployment rate of 3.7% and still-elevated inflation. CPI is only forecast to return to the RBA’s 2-3% target in late 2025.

Lowe has acknowledged the path to a soft landing is “narrow,” while reiterating that the bank will do what it takes to bring inflation back to target.

Data on Wednesday is expected to show modest economic growth in the second quarter, with activity largely driven by exports.