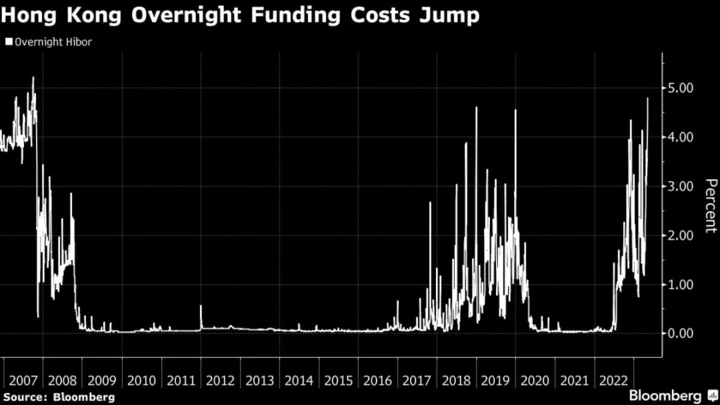

The cost to borrow overnight in Hong Kong jumped to a 16-year high as official efforts to enforce the city’s currency peg with the US dollar cascaded through funding markets.

The overnight Hong Kong interbank offered rate, known as Hibor, climbed 37 basis points to 4.81%, the highest since 2007, on Thursday. While the rise offers support to the local dollar, the size of the move is a likely side effect of the amount of cash the Hong Kong Monetary Authority has drained from the system to push borrowing costs higher.

Repeated currency intervention from authorities — it has spent $6.5 billion since February — has reduced a gauge of interbank liquidity known as the aggregate balance to the lowest since 2008.

The issue for the HKMA started when a surge in US money market rates outpaced their Hong Kong equivalents to levels that attracted return-hungry hedge funds. The gap between the two became wide enough for the funds to borrow the Hong Kong dollar cheaply and buy the higher-yielding greenback.

The popular trading strategy helped push the local currency to the weaker end of its 7.75-7.85 peg with its US counterpart, triggering a need for official intervention. That means the HKMA withdrawing cash from the system until local borrowing costs close the gap with their US counterparts, making the so-called carry trade less lucrative.

One-month Hibor gained for a 16th consecutive day Thursday, sharply narrowing the gap with its US equivalent and helping the Hong Kong dollar pull away from the weak end of its trading band. The city’s currency was little changed at 7.8332 per dollar on Thursday.

Rising demand for the local currency as some firms prepare for dividend payouts during summer is also playing a role in boosting Hibor.

Hong Kong Dollar Pulls Back From Peg Limit as Local Rates Jump

The rising rates will be welcomed by the city’s authorities but the low level of the aggregate balance means Hong Kong watchers expect Hibor to remain volatile. That makes money markets — and the currency —vulnerable to local factors such as large equity offerings and global ones such as shifts in interest rate expectations for the Federal Reserve.

The move “may be a hurdle for USD/HKD to rise back to 7.85 for now,” said Stephen Chiu, chief Asia FX & rates strategist at Bloomberg Intelligence in Hong Kong. “That said, USD/HKD buyers could return if the Fed refrains from cutting rates and Hibors fail to rise beyond their US counterparts.”

Signs of Relief

Still, some pointed to signs that funding pressures are expected to ease further out. For example, three-month Hibor has edged below its one-month counterpart.

“Despite the climb in Hibor overnight, there are some signs of relief in the HKD liquidity squeeze,” said Eddie Cheung, senior emerging market strategist at Credit Agricole in Hong Kong. “While the smaller aggregate balance makes the Hong Kong dollar market more vulnerable to these squeezes, we think that resilient HKD demand in the months ahead will also help to ease outflow pressures.”

(Updates throughout)