By Tom Westbrook

SYDNEY The yen gained in volatile trade on Friday and stocks and bonds dropped in Tokyo after the Bank of Japan said it would take a more flexible approach to pinning down long-term yields, while hopes for stimulus had Chinese stocks heading for a weekly gain.

The Bank of Japan maintained its ultra-low interest rates at the end of a two-day meeting but effectively moved its line in the sand on yields, saying its 0.5% cap on 10-year government bond yields is now a "reference" and that it would step in to the market at 1% instead.

The week had already been a defining one for the world's biggest central banks, with hikes in the U.S. and Europe seen ushering in the end of the most aggressive hiking cycle in a generation.

The BOJ's shift was partly flagged in a report in the Nikkei newspaper overnight which dampened some of the immediate reaction, with the yen initially falling in wild trade before driving to its highest for a week at 138.05 to the dollar. The yen was last at 139.14, up 0.25 against the dollar.[FRX/]

Ten-year Japanese government bond yields hit a nine-year high of 0.575% and the Nikkei extended losses to 2%.

An index of Japanese bank stocks surged 4% to an eight-year high on the prospect the tweak could open the way to higher rates eventually and more profitable lending.

"They've changed it (YCC) without committing to too much and want to be more flexible about how they run monetary policy," said Sally Auld, chief investment officer at JB Were in Sydney, referring to the yield curve control policy.

"We're really at the beginning of the end of really extreme monetary accommodation but they still sound very cognisant of the fact that there's still downside risk to the economy and inflation outlook."

The BOJ repeated that inflation is not sustainably at its 2% target and forecast it below that level in 2024 and 2025, even though data showed Tokyo's core consumer price index rose 3% year-on-year in July.

"It is an important step towards eventual disbandment," said Tom Nash, a fixed income portfolio manager at UBS Asset Management in Sydney. "I expect yields will gravitate towards 1% but not get there in a straight line as you're likely to get short covering, domestic buying and the BOJ leaning against it."

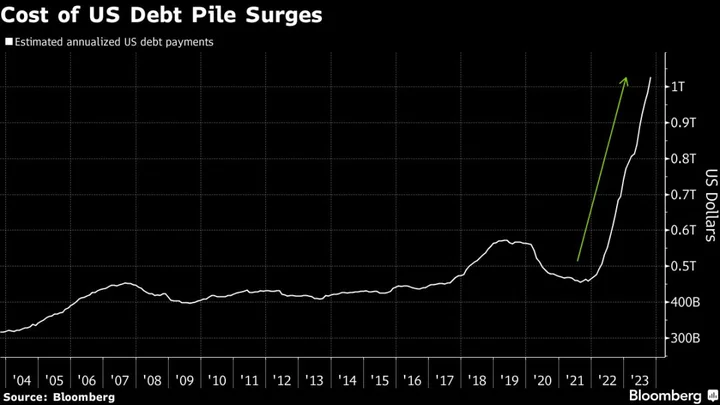

Ten-year U.S. Treasury yields, which had climbed overnight on stronger-than-expected U.S. data and talk of Japan's tweak, extended higher and were last up 3 bps to 4.04%.

Elsewhere in Asia, MSCI's broadest index of Asia-Pacific shares outside Japan was steady but set to notch a weekly gain of 1.8% as investors have cheered promises of stimulus for China's stumbling economy.

The U.S. dollar was broadly stronger, especially against the Australian dollar - down 0.8% to $0.6652 - which was weighed after retail sales suffered their biggest fall of the year in June, suggesting less need for another rate hike.

On Thursday, the European Central Bank raised rates by 25 basis points to a 23-year high, as expected, but President Christine Lagarde sent the euro tumbling with talk of a pause in September.

"Do we have more ground to cover? At this point in time I wouldn't say so," Lagarde told reporters. The euro slid nearly 1% and nursed losses at $1.0980 on Friday.

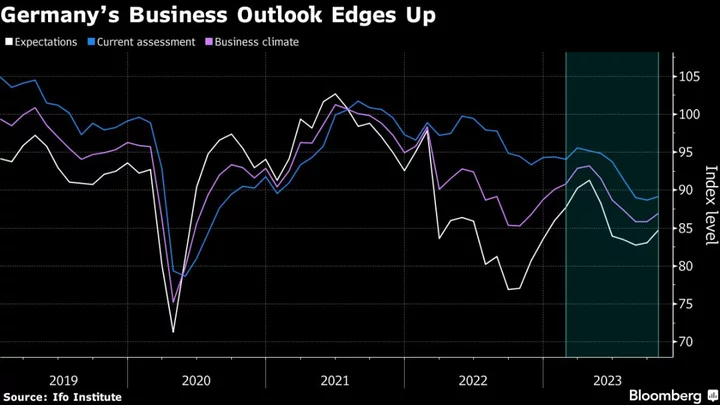

Markets now price even odds that the ECB is done hiking with data, beginning with French and German inflation data due later on Friday, to determine the outlook. Very weak business activity readings earlier in the week showed hikes are starting to bite.

On Wednesday, the Fed had also hiked by 25 bps and investors were cheering a glimpse of the fabled "soft landing" for the economy as the central bank no longer forecasts a recession.

Brent crude oil futures slipped slightly from three-month highs to $83.63 a barrel.

(Editing by Shri Navaratnam, Christian Schmollinger and Kim Coghill)