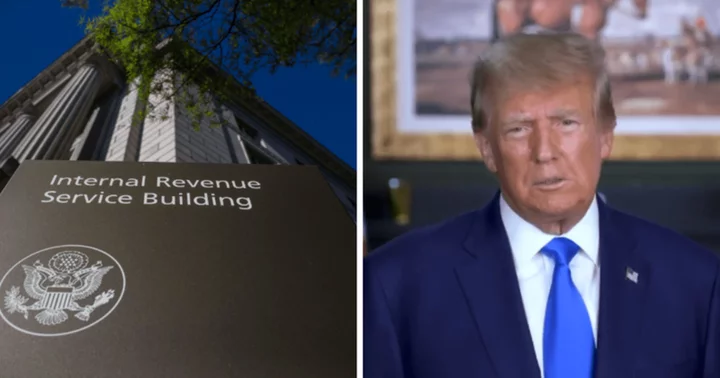

WASHINGTON, DC: Charles Littlejohn, a 38-year-old former contractor from Washington, DC who worked with the Internal Revenue Service until 2021 has been accused of disclosing tax return information of "thousands of the nation's wealthiest people" and a high-ranking government official without authorization.

The court documents of the criminal information filed on September 29 in Washington DC do not identify the government official by name.

However, CBS News claims that a source has confirmed the person to be former President Donald Trump.

What are the charges against Charles Littlejohn?

According to the documents, Littlejohn had allegedly obtained Trump's tax return information and gave it to a news organization.

He has been accused of one count of unauthorized disclosure of tax returns and return information.

In case he is convicted, he may face a maximum sentence of five years in prison.

It has also been alleged that Littlejohn took tax return information belonging to thousands of the wealthiest people in the country and disclosed it to a separate news organization.

The news organizations have published a substantial number of articles based on the information obtained from the accused, stated the prosecutors.

The CBS News source has confirmed the news organizations in question to be The New York Times and Pro Publica.

Response to charges against Charles Littlejohn

The New York Times and Pro Publica have not been accused of any wrongful action.

In a statement to CBS News, Pro Publica said, "We have no comment on today's announcement from the DOJ. As we've said previously, ProPublica doesn't know the identity of the source who provided this trove of information on the taxes paid by the wealthiest Americans."

In 2021, Pro Publica had reported on a trove of tax-return data about the wealthiest Americans. It was discovered that the 25 richest people legally pay a smaller share of their income in taxes than many ordinary workers in the United States.

There has been no comment from The New York Times in this regard. However, in September 2020, when the Times published its extensive reporting on Trump's tax returns, then-editor Dean Baquet wrote, "Some will raise questions about publishing the president's personal tax information. But the Supreme Court has repeatedly ruled that the First Amendment allows the press to publish newsworthy information that was legally obtained by reporters even when those in power fight to keep it hidden. That powerful principle of the First Amendment applies here."

The New York Times report of 2020 revealed that Trump had paid $750 in federal income tax the year he took oath as the President, and no income tax at all some years due to massive losses. Six years of his returns were later released by the then-Democratically controlled House Ways and Means Committee.

No comments have yet been released by the attorney for Littlejohn or the spokesperson for Trump.