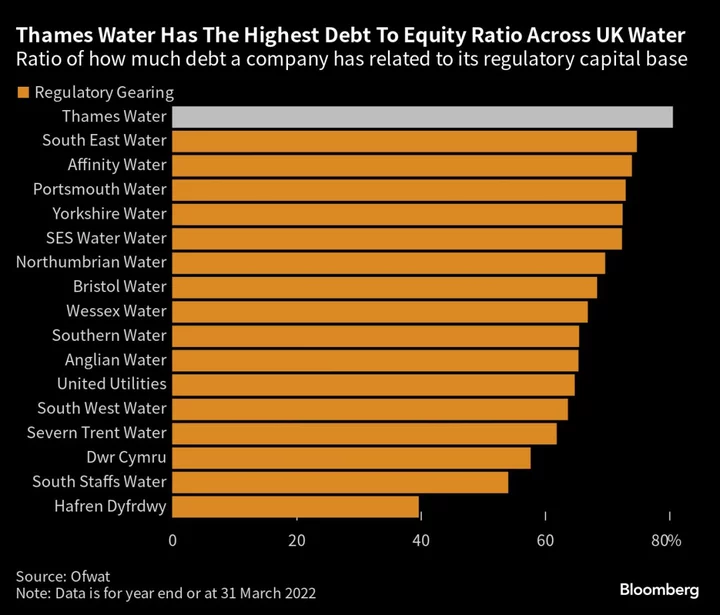

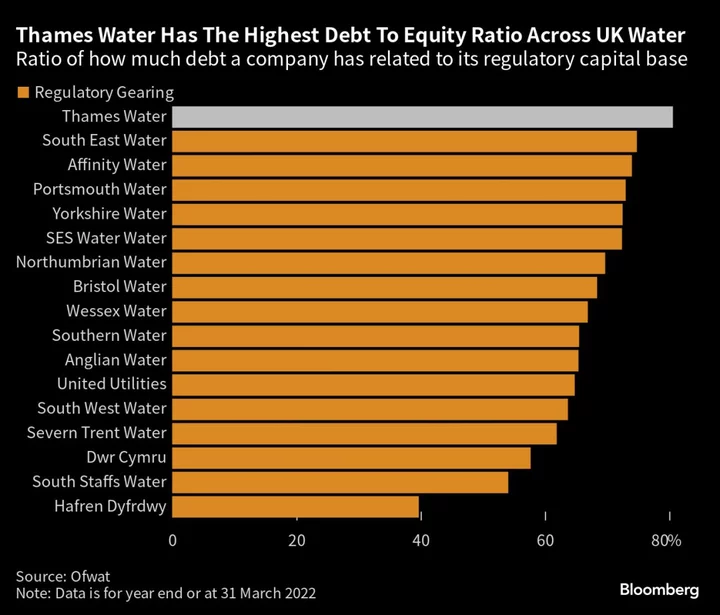

The head of Britain’s water regulator said it shouldn’t have allowed privatized utilities to take on so much debt, as it warned that Thames Water will need more than £1 billion ($1.27 billion) to turn itself around.

Thames, the UK’s largest water company, has held talks with regulators and government officials who have considered nationalizing the utility amid concerns over the rising cost of its debts of more than £13 billion.

David Black, chief executive officer of Ofwat, blamed regulators across various sectors for having a lax approach to debt in the mid 2000s. “We should have stepped in at that point to stop companies gearing up,” he told a House of Lords committee on Tuesday.

He said while other companies also needed to raise funds, the situation at Thames Water was particularly acute as it had “persistent poor performance” combined with “very high gearing.”

Water companies have prompted public anger in the UK due to frequent sewage spills into rivers and along coastlines, as well as huge leaks and rules that prevent people from watering lawns or washing their cars. Bills have risen faster than inflation, and dividends have been paid even as crucial investments have not been made. It’s become a politically toxic issue for the government, and sparked debate on the merits of privatization.

Read More: London Water Crisis Exposes ‘Broken Britain’ Risk for Sunak

Black said Thames was likely to need more than the £1 billion it is seeking from investors, as the company looks ahead to the next cycle of investments. It raised £500 million from shareholders in March. The whole sector is due to come up with business plans in October — including large investments — and the regulator will rein in its debt target to 55% from 60% for the next cycle, Black said.

The Ofwat boss said that placing Thames in the special administration regime, a government system for temporary public ownership, was “not something that would be done lightly.” He said the threat of the SAR was nonetheless “increasing pressure on debt and equity holders to meet their obligations.”

Thames’ chief executive officer, Sarah Bentley, quit the role abruptly last week and has been partly replaced, on an interim basis, by Cathryn Ross — its regulatory affairs director who was previously the head of Ofwat. Thames Water also hired city veteran Adrian Montague as its new chair, last week.

The company’s bonds plummeted following news of talks with government officials and regulators, but gained ground on Monday as some investors bet that fears of a nationalization had been overdone. Ofwat’s Black reiterated on Tuesday that the company had more than £4 billion in liquidity and said the concerns had been “overstated.”

Read More: Thames Water Rocks ESG Funds With Sewage-Tainted Green Bonds

Meanwhile, Thames Water was fined £3.3 million earlier on Tuesday by a court in Sussex, south of London, for causing sewage discharge in breach of its permits.

Black was asked by lawmakers if he personally would swim in the sea, given the sewage flows. He dodged the question.

(adds details on debt)