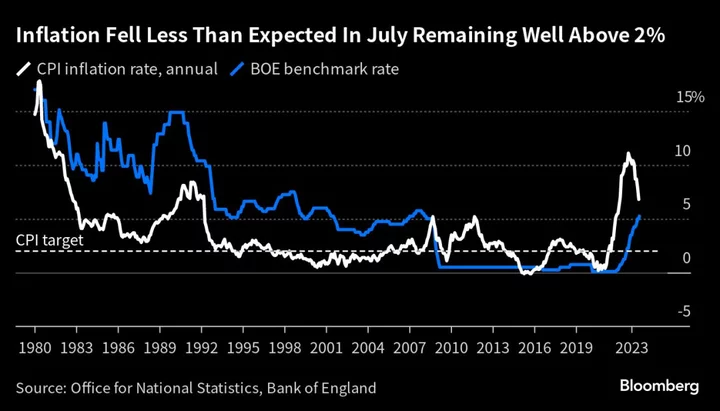

UK inflation remained higher than expected last month as the cost of travel and holidays climbed, adding to the case for the Bank of England to raise interest rates again.

The Consumer Prices Index rose 6.8% in July, exceeding the 6.7% rate expected by economists, the Office for National Statistics said Wednesday. It was the fifth time in six months the figures surprised on the upside.

While falling energy and food price inflation brought the headline rate down from 7.9% in June, the cost of services accelerated by 0.2 percentage points to 7.4%, matching highs touched in May and in 1992. The price of airline tickets and hotels increased rapidly. There also was a 1.7% increase in the cost of renting property — mainly from state-supported housing.

Coupled with a record surge in wages reported on Tuesday and surprisingly strong growth, the figures strengthen the sense that Britain is suffering the worst inflationary spiral in the Group of Seven nations. Investors have revived speculation the BOE will deliver a quarter point rate hike or more next month.

Neil Birrell, chief investment officer at Premier Miton Investors, said the data showed the BOE had “no room for complacency.”

“We are not yet at the stage in the UK that we can say that we are winning the battle on inflation, there are too many pressures,” he said.

The pound extended gains after the release, rising 0.2% to $1.2731. Investor bets on interest rates held steady, pricing in further increases to 6% early next year from 5.25% currently.

Britain has suffered the worst inflation in the Group of Seven since the start of the pandemic. The latest inflation figures were 5.3% in the euro area, 3.2% in the US and 3.3% in Japan.

Prime Minister Rishi Sunak’s government has made fighting inflation a priority ahead of the election that’s widely expected next year.

“While price rises are slowing, we’re not at the finish line,” Chancellor of the Exchequer Jeremy Hunt said. “We must stick to our plan to halve inflation this year and get it back to the 2% target as soon as possible.”

The core rate of inflation, excluding food and energy prices, held at 6.9% in July instead of ticking down as economists had expected.

For low-income households that tend to spend more of their income on food bills, there was some good news as the rate of food inflation slowed. Though still high at 14.9%, it was the slowest growth rate since September 2022.

Basics such as milk, breakfast cereals, bread and crumpets drove the fall, and 10 of the 11 detailed food classes saw a fall in inflation. Three of those ten classes saw prices fall between June and July.

Inflationary pressures subsided in the manufacturing sector. Raw materials costs continued to decline, raising the prospect of a further falls in inflation in the coming months.

Prices charged for goods leaving the factory gate fell 0.8% in the year to July – the first negative reading since December 2020 and the lowest since October 2020.

--With assistance from Alex Mortimer.

(Updates with details from the report from the third paragraph.)

Author: Lucy White, Philip Aldrick and Eamon Akil Farhat