UK house prices fell for a fourth straight month in July as a further rise in mortgage rates curtailed how much buyers could afford, according to Halifax.

The average value of a home declined 0.3% to £285,044 ($362,590), following a 0.1% fall in June, the mortgage lender said in a statement Monday. It left prices 2.4% lower than a year earlier, a slower rate of decline than the 2.6% posted a month earlier.

The findings echo those of rival lender Nationwide Building Society, whose own survey last week showed prices falling 3.8% from a year earlier — the most since 2009. Together, they show how 14 consecutive interest-rate increases from the Bank of England to tame inflation is straining the finances of consumers already struggling with higher food and energy bills.

According to Halifax, prices have fallen 3% since they peaked in August last year following a pandemic-induced boom. Nationwide puts the decline over the same period at 4.5%.

“The continued affordability squeeze will mean constrained market activity persists, and we expect house prices to continue to fall into next year,” said Kim Kinnaird, director at Halifax Mortgages. “Based on our current economic assumptions, we anticipate that being a gradual rather than a precipitous decline. While there have been recent signs of borrowing costs stabilising or even falling, they will likely remain much higher than homeowners have become used to over the last decade.”

Prices have avoided the collapse that appeared possible last autumn, when then-Prime Minister Liz Truss’s ill-fated budget sent borrowing costs soaring. In November, Nationwide warned of a potential 30% drop in prices in a worst-case scenario.

That resilience partly reflects a robust labor market, strong earnings growth and a shortage of homes for sale. Mortgage approvals in June were the strongest since October, according to the BOE.

Economists expect house prices to register a peak-to-trough decline of around 7% to 10%. That tallies with the network of contacts used by the BOE. They expect values to fall no more than 5% in the second half, the central bank said last week.

Activity among first-time buyers in particular was holding up well, Kinnaird said, with many searching for smaller homes to offset higher borrowing costs.

“Conversely the buy-to-let sector appears to be under some pressure, though elevated interest rates are just one factor impacting landlords’ business models, together with considerations of future rental market reforms,” she said. “It remains to be seen how many may choose to exit and what that could mean for the supply of properties available to buy.”

Mortgage rates have surged since the BOE began to raise borrowing costs in December 2021. Those on adjustable-rate loans are already feeling the squeeze, but it has yet to hit millions who are scheduled to refinance over the coming years.

Although mortgage rates have stabilized in recent days, fixed-rate deals are around 3 percentage points higher than at the end of 2021. The BOE meanwhile has signaled its tightening cycle has further to run and that rates could stay elevated through at least next year.

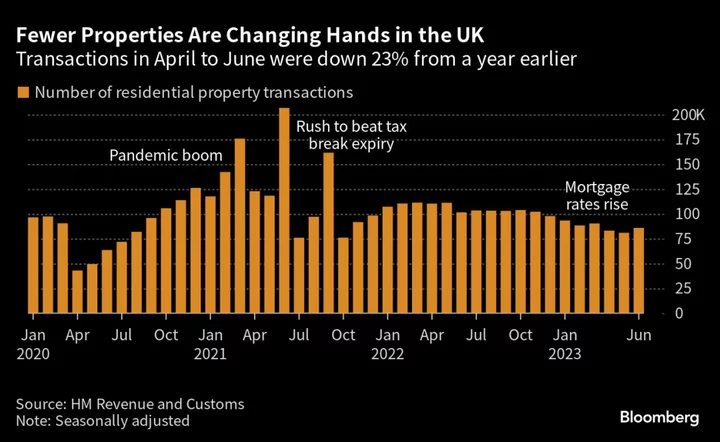

The slowdown in the housing market means fewer properties are changing hands, with knock-on effects for firms from estate agents and furniture retailers to building suppliers and property developers.

Building supplies firm Travis Perkins Plc last week reported lower revenues and a 31% drop in adjusted operating profit, amid “significant weakness” in the housing sector.

House prices fell in all regions of the UK on an annual basis in July except the West Midlands, where they were effectively flat.

The South East, a region preferred by London commuters, has been under the most downward pressure, with prices down 3.9% over the last year to £382,489.

Prices in the capital are also falling — the average home in Greater London now costs £531,141, down 3.5% on the year.

--With assistance from Alex Mortimer.

(Adds chart, regional details)