Turkey’s Central Bank, under new Governor Hafize Gaye Erkan, is easing its security maintenance rule as its first step to simplifying policies designed to boost Turkish lira savings.

The securities maintenance ratio has been lowered to 5% from 10% effective immediately, according to a decree published in the Official Gazette on Sunday. The ratio was increased twice from 3% to 10% in the last two years in order to support the conversion of foreign currency deposits to lira deposits as a part of the “liraization strategy.”

Under the tweaked rules, if a banks share of lira deposits is below 57%, they will need to increase the securities maintenance ratio by 7 percentage points. The previous threshold was 60%. Banks will get a discounted securities maintenance ratio if the share of lira deposits rises to more than 70%.

The easing comes after Turkey’s Treasury and Finance Minister Mehmet Simsek promised a return to “rational” policies. At Erkan’s first monetary policy meeting last week, the central bank hiked the interest rate by 650 base points to 15% and signaled a “gradual tightening.” Erkan met bankers on Friday, and in her first public appearance since taking the role said they had requested a simplification of rules.

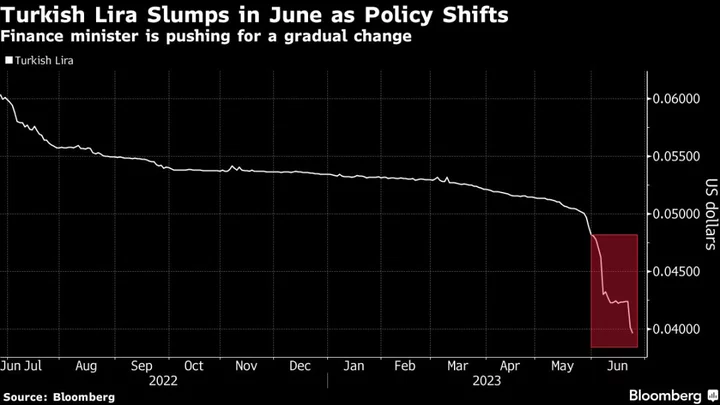

The Turkish lira has depreciated by nearly 18% against the dollar this month, with the slide extending after Simsek emphasized his backing for a gradual shift in economic policies.

“As the lira has depreciated since the second tour election that was held on May 28, the ratio of local currency deposits had automatically fallen and banks have been under pressure to increase securities,” said Cagdas Dogan, research director of Istanbul-based Tera Yatirim. “This tweak helps preventing a very bad potential outcome of the lira’s depreciation rather than a major positive impact for banks. However as the market is more willing to price in the good news, it’s possible we might see a positive effect in banking shares on Monday.”

The securities maintenance regulation was simplified to increase the functionality of market mechanisms and strengthen macro financial stability, the central bank said in a statement published right after the publication of the Official Gazette.

Sahap Kavcioglu, who was the previous central bank governor, lowered the interest rate and followed unconventional economic policies, which fueled the worst inflation crisis in decades and repelled foreign investors that Turkey relies on to plug its perennial current-account deficit.

--With assistance from Robert Fenner.

(Adds the lira’s performance and analyst comment starting in fifth paragraph)