One of Taiwan’s largest lenders is shifting its business and hiring focus to Southeast Asia as its corporate clients in high-tech and textile manufacturing seek to diversify supply chains away from China amid geopolitical tensions.

Cathay United Bank Co. from 2020 to 2022 boosted headcount in Vietnam by 75% and increased hiring by more than a third in Singapore, according to Benny Miao, the head of Southeast Asia for Taiwan’s second-largest lender by assets which is a part of Cathay Financial Group Holding Co.

The lender’s expansion plans have “literally switched positions” with China, Miao said in an interview, pointing to Vietnam, Indonesia and Cambodia as focus countries. “We’re looking at where else our customers are going,” he said. “That’s a large component of what’s going to determine what we want to do and how big of an investment we’re going to make in each of these relative markets.”

The moves come as suppliers in Asia are under pressure to diversify production lines away from China — the “world factory” home to the majority of manufacturing capacity for everything from sneakers to smartphones. The shift emerged during the US-China trade war in 2018, and has intensified in the aftermath of Covid-19 and increased geopolitical wrangling.

“Economically speaking, China is still a market,” Miao said. “But more and more attention now is focused elsewhere.”

Taiwanese companies, traditionally among the biggest investors in China, have also been pulling back because of increased competition and rising labor costs. More recently, manufacturers are moving out because their customers are asking for diversification away from China, which is accelerating the shift, said Miao.

“A lot of their buyers are either European or American, so they’re giving them instructions that say, ‘I need you to do plus one,’” he said, referring to the business strategy of avoiding only investing in China. “I think that’s what’s really driving it.”

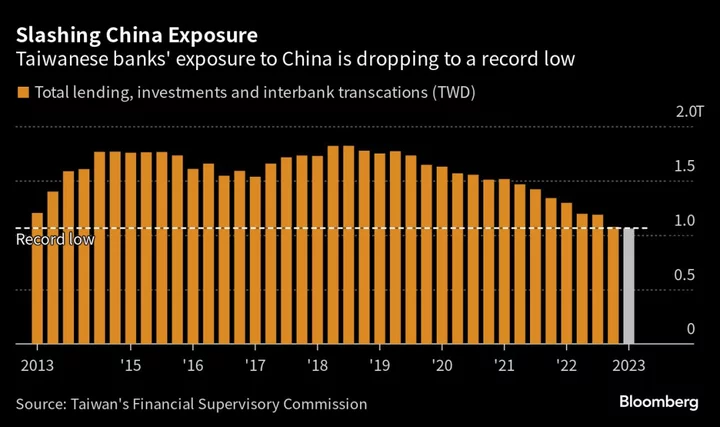

Cathay’s moves are in tandem with a measurable shift away from China by Taiwanese banks, which have slashed their exposure to the world’s second largest economy to the lowest level in at least a decade. Total lending, investments and interbank transactions in China by Taiwanese banks fell 18% in the first quarter of 2023.

More broadly, Taiwan’s companies cut new investments in China by 14% in 2022 from a year earlier. Investments to Southeast Asia, on the other hand, have grown to nearly half of Taiwan’s total foreign investments, according to a report from the Ministry of Economic Affairs.

Cathay Financial, the holding company for Cathay United Bank, reported a drop in first quarter profits due to increased foreign currency hedging costs and lower investment gains, according to a company presentation. Profitability in the banking arm, however, rose 33% to NT$9.2 billion ($294 million) compared to the same period last year.

Most of Cathay’s business in Southeast Asia is focused on corporate banking, according to Miao. For its business clients, the bank provides services such as financial registrations, local government engagement and legal consultation.

Other banks are also trying to take advantage of capital flows between China and Southeast Asia. Singapore’s second-largest lender, Oversea-Chinese Banking Corp., recently released a target to boost revenue from business between Greater China and Southeast Asia.