The stock market is growing more sanguine about US regional banks, but the lenders still face serious pressure.

A credit “contraction is invariably coming,” Soros Fund Management Chief Executive Officer Dawn Fitzpatrick said at this week’s Bloomberg Invest conference, adding that additional banks will fail because “there are more problems under the surface.”

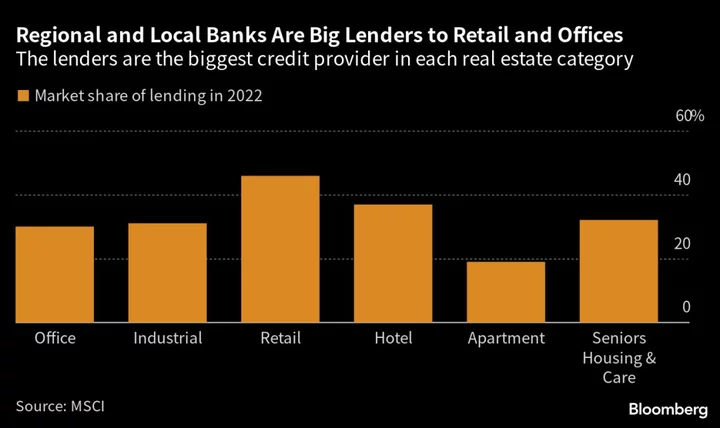

One further source of trouble for the industry will be commercial real estate, an area that in recent years smaller and regional banks have become a bigger force in.

Working from home has cut into office values and almost $1.5 trillion of commercial property debt is due for repayment before the end of 2025. Meanwhile, rising interest rates have made many properties less valuable.

“US banks have become much more vulnerable to a decline in commercial real estate prices,” Torsten Slok, chief economist at Apollo Global Management Inc., wrote in an email to clients this week.

The upshot is that 700 US banks now exceed the Federal Deposit Insurance Corp.’s guidance from 2006 on commercial real estate loan concentration, he calculated. Two years ago, it was less than half that number. There were about 4,700 FDIC insured US banks as of the end of March.

The guidelines were introduced in 2006 to address loan concentration and risk management deficiencies among banks in relation to commercial property loans. Those who exceed them are potentially subject to greater supervisory scrutiny, including higher capital levels and heightened risk management practices.

The FDIC declined to comment. Its chairman Martin Gruenberg said last month that potential problems with property portfolios will be a matter of “ongoing supervisory attention” and that “despite the recent period of stress, the banking industry has proven to be quite resilient.”

Small Minnows

Some banks are already shrinking their exposure to commercial real estate. PacWest Bancorp, one of the US lenders engulfed in the commotion, is selling a $2.6 billion portfolio of real estate construction loans to shore up liquidity.

“The small minnows” have the “lion’s share of the exposure,” Monsur Hussain, head of research for global financial institutions at Fitch Ratings, said on a webinar this week. “They have approximately 14% of their total assets in CRE exposures, but it can be as high as over 40% of their total assets.”

Any further regional bank failures would likely make credit even more difficult to access for property developers and landlords, especially those who are smaller or lower quality.

The headwinds mean office values are now down 27% on average from their recent peak after falling further in the past month, according to Green Street. The average commercial property is down 15%.

“There’s not much transacting these days because buyers and sellers can’t seem to agree on pricing,” Peter Rothemund, co-head of strategic research at the firm, said in a report this week. “These situations eventually resolve themselves, and usually it’s in favor of the buyers.”

The trouble is also beginning to feed through to the commercial mortgage-backed securities market where about $140 billion of the assets are due to mature this year.

In recent years, an increasing portion of the loans that were packaged into CMBS were interest only, according to data compiled by Trepp. More than 4% of office loans packaged into the securities were at least 30 days in arrears as of May, according to a recent report by the real estate data firm. That’s the highest level since 2018.

“We expect commercial real estate more broadly to remain under pressure given the immediacy of the maturity wall at a time where the single-largest lender – regional banks – is experiencing an elevated rate of scrutiny,” Morgan Stanley analysts including Jay Bacow wrote this week.

Elsewhere:

- Billions of dollars of leveraged loans are running short on time to transition away from the scandal-plagued London interbank offered rate before the benchmark is phased out at the end of June.

- A trade group representing the $1.4 trillion leveraged loan market is urging US Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell and other agency heads to back the status quo of excluding loans from securities laws.

- Near-empty office buildings, already a problem plaguing US cities, are becoming a worry for mortgage bondholders as landlords fall behind on repayments at the fastest rate in five years and the difficulty of refinancing the loans grows.

- Floundering companies that seek more money from investors are often only delaying the inevitable. And when they do fail, their final financings might leave everyone worse off.

- Apollo Global Management Inc.’s Co-President Scott Kleinman said private equity firms need to return to old-fashioned bargain hunting as they can no longer rely on debt to juice returns.

- KKR & Co.’s former co-head of private credit, Matthieu Boulanger, is set join $101 billion alternative asset manager HPS Investment Partners as head of Europe.

- Italian confectioner Ferrero SpA raised more than $1 billion in dollar-equivalent high-grade private debt to refinance part of its bank loans, people familiar with the matter said.

- UK firms including supermarket Iceland Foods and poultry producer Boparan Holdings Ltd. have about £14.3 billion ($17.8 billion) of high-yield bonds maturing in 2025. The implied cost of refinancing is about double what they pay to service the debt.

- Companies selling high-grade sterling bonds will have less competition for investor attention after the Bank of England finished its corporate debt sales program.

- A continued pause on interest-rate hikes in India looks set to boost sales of local bonds that are already at a record, while foreign-currency note deals drop to a seven-year low.

- China’s Haitong International Securities Group Ltd. cut its dollar-bond exposure to Chinese developers and is shifting capital to US sovereign and investment grade credit.

- China Merchants Bank sold $400 million of blue bonds, a type of sustainable debt that raises funds for water projects and ocean preservation. It was at least the third blue bond deal in Asia this year.

--With assistance from Katanga Johnson, Lorretta Chen and Dana El Baltaji.