Thailand plans to ease foreign exchange rules for domestic companies and individuals to help them shore up their risk management as the central bank said the baht will continue to remain volatile due to a host of external factors.

The Bank of Thailand plans to promote the use of local currency among local businesses and cut their reliance on dollars by transacting more in currencies such as yuan, yen, ringgit and rupiah, Alisara Mahasandana, assistant governor for financial markets operations group, told reporters in Bangkok on Tuesday.

The central bank will raise the limit on grant money transfer — without underlying transactions — to $200,000 from $50,000 currently, Alisara said. It will also double the threshold on direct overseas investment in equities for individuals to $10 million annually from $5 million, she said.

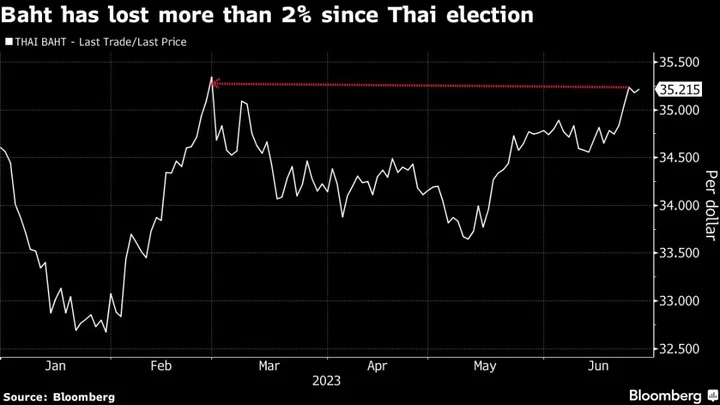

The baht, which is down more than 1.7% this year against the dollar to trade near a four-month low, will remain volatile, the BOT said, adding it will monitor a host of external factors including monetary policies of major economies, inflation trend and the political uncertainty following the general election in Thailand.

BOT will also relax the rules for Thai units of foreign companies to send money as notional pooling to founders and expand the scope of activities for companies under the nonresident qualified company, Alisara said.

The new foreign exchange rules may take effect from the third quarter, Alisara said.