Stocks declined after disappointing China services data added to concern over the nation’s fragile economic recovery. Australia’s dollar extended losses after the central bank kept interest rates unchanged.

The MSCI Asia Pacific Index is heading for its first drop in seven days, with Hong Kong shares leading the declines after dipping more than 1%. China’s services sector saw the slowest growth this year in August, an industry survey showed, adding to evidence the economic recovery is losing traction.

“It’s the typical post-party reality check that’s cooling down China’s rally today, as the services PMI notably missed expectations, suggesting further economic downtrend ahead,” said Hebe Chen, an analyst at IG Markets Ltd. in Melbourne.

Futures for European and US stocks fell during Asia trading. South Korean stocks also declined after August inflation accelerated faster than economists forecast on the back of rising energy costs. That supports the case for the central bank to keep the door open to further policy tightening.

Australian equities were little changed and the Aussie dollar continued an earlier loss after the central bank kept rates on hold for a third month in the final meeting under Governor Philip Lowe. While officials said further tightening may be required, they acknowledged inflation has passed its peak. Australia’s bonds pared losses.

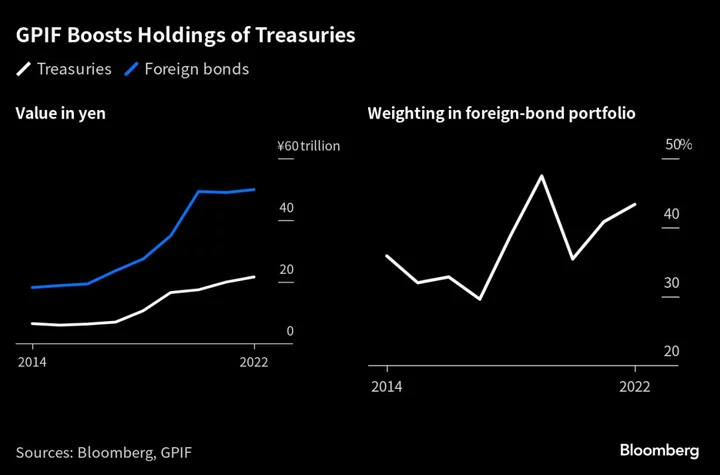

The US dollar strengthened against most of its Group-of-10 peers, while Treasuries slipped as cash trading resumed following a US holiday Monday. The offshore yuan weakened following the PMI data.

Traders will shift focus to August PMI data from the euro area later Tuesday amid stagflation worries in the region. European Central Bank President Christine Lagarde in a speech on Monday avoided signaling whether policymakers will raise or hold interest rates next week.

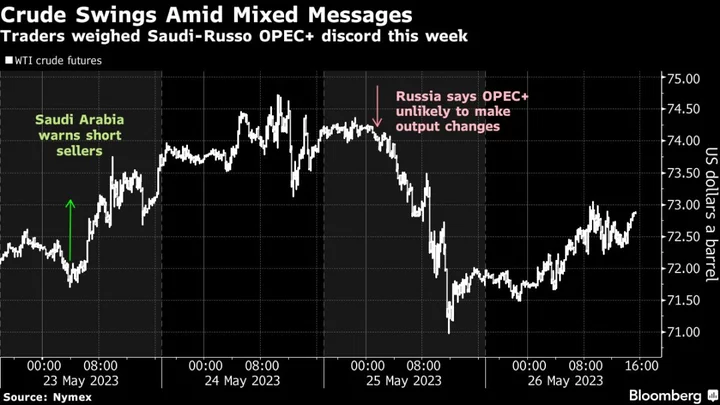

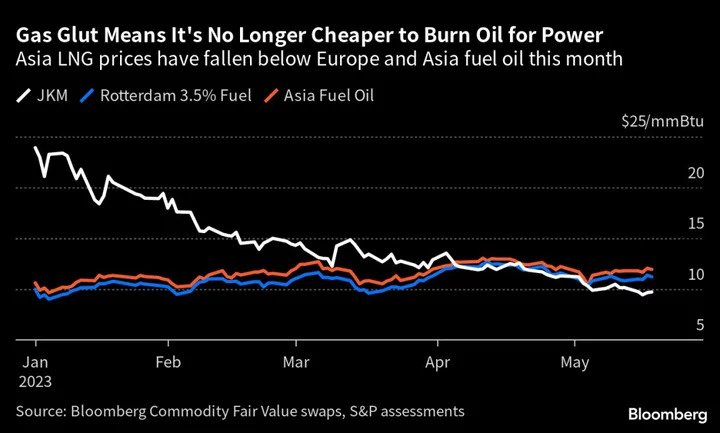

Oil traded near the highest level since November after a surge driven by supply cuts from OPEC+. Gold fell.

In more positive news, Country Garden Holdings Co. told creditors it’s paid coupons of two dollar bonds within the grace periods. The developer is proposing to extend principal payments for eight yuan bonds as well, according to holders who said they were briefed by company advisers.

Meanwhile, Goldman Sachs Group Inc. lowered its estimate of US recession probability. “Continued positive inflation and labor market news has led us to cut our estimated 12-month US recession probability further to 15%, down 5pp from our prior estimate,” Jan Hatzius, its chief economist, wrote in a note.

Key events this week:

- Eurozone S&P Global Eurozone Services PMI, PPI, Tuesday

- US factory orders, Tuesday

- ECB President Christine Lagarde chairs panel focused on central banks and international sanctions at ECB Legal Conference, Tuesday

- Australia GDP, Wednesday

- Eurozone retail sales, Wednesday

- Germany factory orders, Wednesday

- US trade, Wednesday

- Canada rate decision, Wednesday

- Bank of England Governor Andrew Bailey testifies to the UK parliament’s Treasury Select Committee, Wednesday

- Federal Reserve issues Beige Book economic survey, Wednesday

- Boston Fed President Susan Collins speaks on the economy at New England Council, Wednesday

- China trade, forex reserves, Thursday

- Eurozone GDP, Thursday

- US initial jobless claims, Thursday

- Bank of Canada Governor Tiff Macklem to speak on the Economic Progress Report, Thursday

- New York Fed President John Williams participates in moderated discussion at the Bloomberg Market Forum, Thursday

- Atlanta Fed President Raphael Bostic speaks on economic outlook at Broward College, Thursday

- Japan GDP, Friday

- France industrial production, Friday

- Germany CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 6:44 a.m. London time

- Nasdaq 100 futures were little changed

- Euro Stoxx 50 futures fell 0.2%

- Japan’s Topix fell 0.1%

- Australia’s S&P/ASX 200 fell 0.3%

- Hong Kong’s Hang Seng fell 1.3%

- The Shanghai Composite fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.1% to $1.0784

- The Japanese yen fell 0.2% to 146.83 per dollar

- The offshore yuan fell 0.2% to 7.2916 per dollar

- The Australian dollar fell 0.7% to $0.6417

- The British pound was little changed at $1.2619

Cryptocurrencies

- Bitcoin fell 0.5% to $25,704.8

- Ether fell 0.4% to $1,621.12

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.21%

- Japan’s 10-year yield advanced 1.5 basis points to 0.655%

- Australia’s 10-year yield advanced five basis points to 4.14%

Commodities

- West Texas Intermediate crude rose 0.4% to $85.86 a barrel

- Spot gold fell 0.3% to $1,937.12 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Georgina McKay.