US stocks and bonds drifted as more evidence pointed to a slowdown in China’s economy.

The country’s gross domestic product grew at a slower than expected pace of 6.3% in the second quarter, adding to risks for the global economy, reliant on Chinese spending.

The S&P 500 was little changed on Monday, starting the week on a downbeat note following last week’s historic stock-market gains. Oil and gold was also down, while the dollar was stronger against major peers.

“Many countries do depend on strong Chinese growth to promote growth in their own economies, particularly countries in Asia, and slow growth in China can have some negative spillovers for the United States,” Treasury Secretary Janet Yellen said in a Bloomberg Television interview Monday. “Growth has slowed, but our labor market continues to be quite strong. I don’t expect a recession.”

For a time, analysts believed Chinese shoppers coming out of Covid lockdowns would be able to carry the global economy — despite rising US and European interest rates. However, that narrative is looking increasingly shaky.

Yellen said she sees the US on a “good path” to bringing down inflation without a major weakening in the labor market.

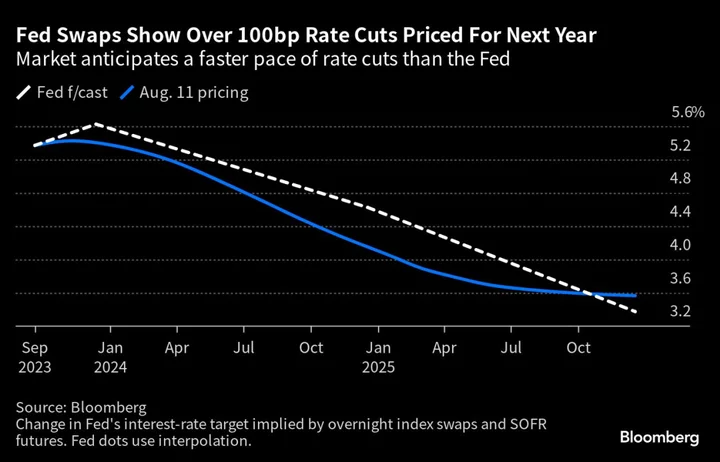

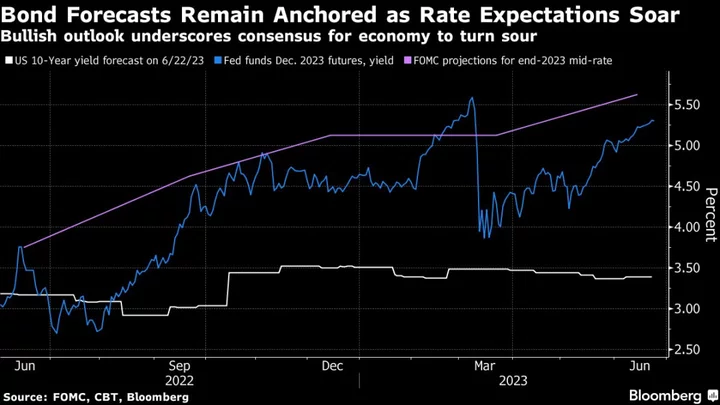

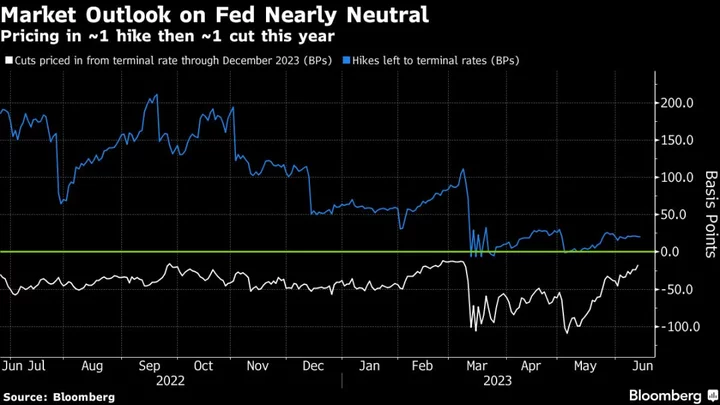

Last week Treasury yields fell and stocks rose as data showing a slowdown the rate of inflation bolstered speculation the Federal Reserve is close to ending its cycle of interest rate hikes.

“The US inflation data announced last week has fueled hopes that we have reached a turning point in the inflation cycle and reinforced expectations for a ‘disinflationary soft landing,’” Joe Little, chief strategist at HSBC Asset Management, wrote. “Bonds have rallied back after last week’s barrage of hawkish Fed rhetoric and stocks have hit 12-month highs. A big question in investment markets currently is: can this ‘Goldilocks’ situation of not-too-hot and not-too-cold data continue?:”

The next pressure point for markets will be earnings, with hundreds of companies reporting over the next few weeks. S&P 500 firms are expected to post a 9% drop in profits in the second quarter, making it the worst season since 2020, according to data compiled by Bloomberg Intelligence. In Europe, it may be even worse, with a projected 12% slump.

Key events this week:

- G-20 finance ministers and central bankers are meeting in India, Monday

- European Central Bank President Christine Lagarde speaks, Monday

- US empire manufacturing, Monday

- US retail sales, industrial production, business inventories, cross-border investment, Tuesday

- Eurozone, UK CPI, Wednesday

- US housing starts, Wednesday

- China loan prime rates, Thursday

- US initial jobless claims, existing home sales, Conf. Board leading index, Thursday

- Japan CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 9:35 a.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average fell 0.1%

- The Stoxx Europe 600 fell 0.7%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.1% to $1.1212

- The British pound fell 0.3% to $1.3060

- The Japanese yen fell 0.4% to 139.34 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $30,216.25

- Ether fell 0.9% to $1,911.62

Bonds

- The yield on 10-year Treasuries was little changed at 3.83%

- Germany’s 10-year yield declined two basis points to 2.49%

- Britain’s 10-year yield was little changed at 4.45%

Commodities

- West Texas Intermediate crude fell 0.9% to $74.76 a barrel

- Gold futures fell 0.7% to $1,950.70 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from John Viljoen and Ksenia Galouchko.