Sri Lanka’s central bank signaled it will pause after cutting interest rates for a fourth time this year as the economy gradually recovers from its unprecedented crisis and inflation bottoms out.

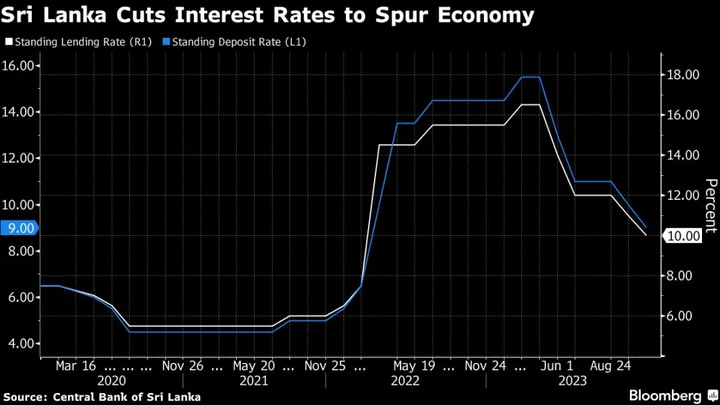

The Central Bank of Sri Lanka lowered the standing lending facility rate by 100 basis points to 10% on Friday, taking its total cuts this year to 650 basis points. “Further monetary policy easing will be paused in the near term” to allow policy steps to work their way through the economy, the bank said.

Sri Lanka is in the process of restructuring its debt after defaulting last year for the first time in its history. Creditors must now submit proposals for the debt plan to the International Monetary Fund in order for the next loan instalment of $330 million to be made.

Inflation has slowed sharply to low-single digits from a peak of 70% last year, giving the central bank scope to ease monetary policy. While there are near-term risks, the central bank said it expects inflation expectations to remain anchored and economic activity to stay “below par” going forward.

“With this reduction of policy interest rates, along with the monetary policy measures carried out since June 2023, sufficient monetary easing has been effected in order to stabilize inflation over the medium term,” it said.

Governor Nandalal Weerasinghe said in an interview last week that once uncertainties of the debt restructuring plan are cleared up, he expects the transmission of monetary policy to the broader economy to speed up, and the gap between policy and market rates to narrow.

--With assistance from Tomoko Sato.

(Updates with comment from central bank.)