Malaysia’s economic growth accelerated in the third quarter as consumer spending along with the services and construction sectors helped counter the impact of faltering exports.

Gross domestic product expanded 3.3% in the July-September period from a year ago, according to the central bank and the Department of Statistics Malaysia on Friday, in line with the preliminary reading last month and from a 2.9% gain in the second quarter. The economy rose 2.6% quarter-on-quarter.

Relatively low borrowing costs are shielding the economy from the global slowdown, enabling growth in private consumption to quicken to 4.6% last quarter from 4.3% in the prior three-month period. Household spending will remain an anchor of domestic expansion while a rebound in tourism is offsetting the prolonged weakness in exports, the government said.

Growth in services and construction quickened to 5% and 7.2% respectively from a year ago. Manufacturing contracted for the first time in two years on weaker external demand, underscoring the challenges of a slowing global economy for a trade-reliant nation like Malaysia.

Malaysia’s benchmark interest rate is at a record discount relative to the Federal Reserve’s even after 125 basis points in rate increases since May 2022. But the ringgit has become the worst-performing major currency in Southeast Asia this year, prompting former Prime Minister Mahathir Mohamad to suggest pegging the currency to the dollar as he once did in the late 1990s.

The ringgit, which has weakened about 6% this year, was little changed against the dollar at 4.6858 at 1:24 p.m. local time on Friday.

“Growth will continue to be driven by the expansion in domestic demand amid steady employment and income prospects,” Bank Negara Malaysia Governor Abdul Rasheed Ghaffour said at the briefing in Kuala Lumpur. “This growth performance along with other favorable economic developments would provide support to the ringgit,” he said.

Malaysia’s economy is projected to expand by about 4% this year, Abdul Rasheed said as he affirmed the growth forecast range of 4%-5% for next year. Going forward, risks to the growth outlook are weaker-than-expected external demand and prolonged declines in commodity production, he said.

“The third-quarter overall GDP number did not deviate from the advance estimates. Most components were within previous ranges barring government spending which strengthened,” said Sanjay Mathur, an economist with Australia & New Zealand Banking Group Ltd., reiterating the bank’s 2023 GDP forecast of 3.7%.

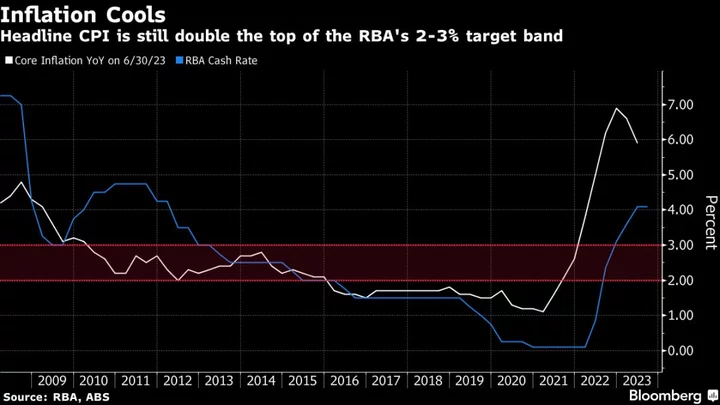

Inflation Outlook

Inflation is estimated to remain modest, averaging 2.5%-3% this year and 2.1%-3.6% in 2024, according to the governor. Upside risks to the outlook include the rationalization of subsidies and price controls, higher global commodity prices from worsening geopolitical conflict, and imported inflation from the ringgit depreciation. Weaker global growth and favorable weather conditions could help tamp down price gains.

The inflation pass-through of the weaker ringgit has been modest so far, Abdul Rasheed said, with every 5% depreciation of the local currency estimated to add just 0.2 percentage points to the headline print.

The ringgit’s performance is expected to be driven by external factors, but should reflect Malaysia’s economic fundamentals in the longer term, the governor said. Global uncertainty spurred 14.1 billion ringgit ($3 billion) in net outflows of portfolio investments in the third quarter, overturning the 8.1 billion ringgit in inflows in the April-June period.

The central bank will remain vigilant to ongoing developments to ensure its policy stance “remains conducive to sustainable economic growth that permits price stability,” Abdul Rasheed said.

--With assistance from Anisah Shukry, Joy Lee, Cecilia Yap, Marcus Wong and Kevin Varley.

(Updates with inflation, policy rate outlook.)