Siemens Energy AG sees a net gain in the coming fiscal year driven by asset sales, as a government-led deal helps secure financing for large-scale contracts to offset ongoing losses at its Gamesa wind business.

The manufacturer expects net income of as much as €1 billion ($1.1 billion) in fiscal 2024, even as it forecasts Gamesa won’t break even until 2026, it said Wednesday. Before special items, the company’s profit margin is expected to be as low as negative 2%.

Siemens Energy announced the outlook together with details of the €15 billion deal with the German government, a consortium of banks and biggest shareholder Siemens AG to shore up its finances with loan guarantees and cash. The guarantees are key to financing bigger orders in its profitable gas-turbine and power-grid businesses.

While the manufacturer has a record order backlog of €112 billion, the problems at Gamesa led to a €4.59 billion loss for the fiscal year through September, the company said. The technical review of problems with Gamesa’s onshore platforms is nearly finished, and the unit is working on a timeline to resume sales with a corrected design.

“Implementing corrective measures into the wind turbine fleet will go on for a couple of years,” Chief Executive Officer Christian Bruch said in a Bloomberg TV interview. “Most of the turbines are operating, but they will obviously need a repair package in the next years.”

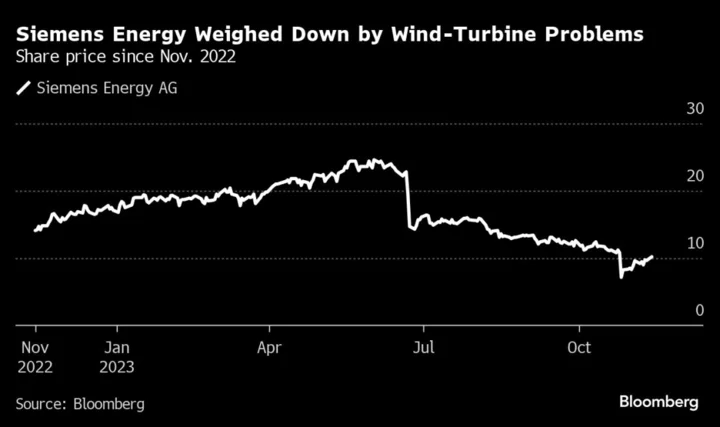

Siemens Energy’s share price has slumped more than 40% this year as problems with the faulty wind turbines mounted. Major components of its onshore wind turbine 5.X can twist over time, making the devices prone to breaking down. Remedial actions have been defined and mitigation and corrective actions are under development, the company said.

Asset disposals of as much as €3 billion will drive next year’s expected net gains, the company said. The majority will come from the partial sale of its stake in a listed Indian affiliate to Siemens for about €2.1 billion as part of the government-led accord.

Under the deal, private banks will provide Siemens Energy with €12 billion in loan guarantees, backed by €7.5 billion in so-called counter-guarantees from the government, which has said the manufacturer is critical for the nation’s transition to renewable energy. Siemens Energy said it will make a “standard market payment” to the federal government for its commitment but didn’t provide an exact amount.

Findings from Gamesa’s technical review, while not yet complete, so far support the company’s previous repair-cost estimate of at least €1.6 billion. Sales of the 5.X platform remain suspended, though the company is ramping up production of offshore platforms, where output has increased from last year.

Bruch said the company doesn’t plan to sell the wind business.

“Completely giving the wind business away, particularly if it is a loss making business, is something I do not see is practical,” Bruch said. “We need to fix certain issues ourselves, but I do see the future of an energy technology company with wind.”

The wind-turbine unit is set to refocus its work on the most profitable markets, Bruch said. The company will provide more details on Gamesa’s progress when it holds its capital markets day Nov. 21.

For the fiscal fourth quarter through September, Siemens Energy posted a 2.5% decrease in revenue to €8.5 billion, falling short of analyst estimates of a €8.68 billion result. Orders fell by 10.6% compared to last year’s quarter.

(Updates CEO interview in fifth, 11th paragraphs.)

Author: Wilfried Eckl-Dorna